Polymarket Launches Stock and Index “Up/Down” Markets in Finance Expansion

Prediction platform Polymarket is broadening its reach into traditional finance with a new feature that lets users bet on stock and index movements. The move highlights the platform’s growing ambition to connect crypto-native speculation with mainstream financial markets, as investor interest in event-based trading continues to accelerate.

In brief

- Polymarket adds “up/down” markets for stocks and indices, letting users bet on price direction without a brokerage account.

- The new Finance section covers Equities, Commodities, IPOs, and more, with data verified by WSJ and Nasdaq sources.

- ICE backs Polymarket with a $2B investment, valuing it at $9B as the platform expands beyond politics and macro topics.

- MetaMask integration and 4% yield rewards strengthen Polymarket’s appeal amid rising institutional trading interest.

Prediction Market Polymarket Steps Into Equities With New Directional Bets

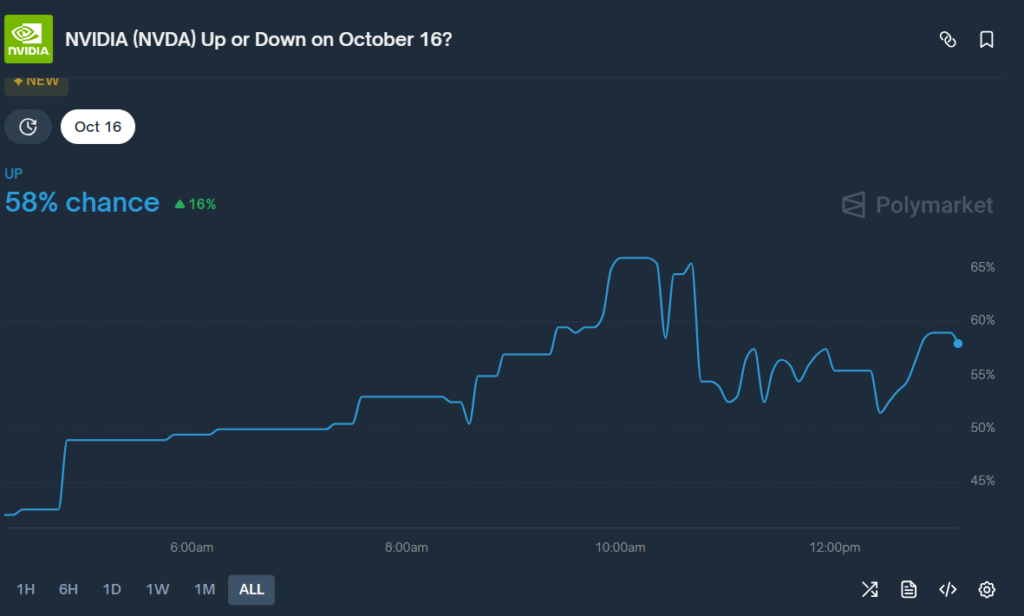

Polymarket is introducing “up/down” equity and index markets, allowing users to wager on whether individual stocks or benchmarks will end higher or lower by a set time, the Intercontinental Exchange (ICE)-backed prediction platform announced on Wednesday.

The feature appears within a new Finance section that groups markets into categories such as Equities, Earnings, Indices, Commodities, Acquisitions, IPOs, Fed Rates, Business, and Treasuries. Resolution sources include The Wall Street Journal and Nasdaq, ensuring transparency in results.

The launch advances Polymarket’s push into mainstream financial events. It follows last month’s debut of company earnings markets, part of the platform’s reintroduction in the United States. That rollout shifted the platform’s focus beyond politics and macroeconomic topics toward single-company outcomes.

By offering direction-based contracts on individual stocks, Polymarket enables users to speculate on market movements without requiring a brokerage account or margin trading. The addition marks another step toward linking prediction markets to traditional finance, a goal tied to the platform’s effort to attract deeper liquidity and a broader user base.

Prediction Platforms Expand Into Finance With Wallet Integrations and Yield Rewards

Recent months have brought solid growth across the prediction market sector. Polymarket recently added Donald Trump Jr. to its advisory board , signaling plans to strengthen its presence in U.S. politics and finance. Together with rival Kalshi, the two platforms processed about $1.4 billion in trading volume last month, as institutional interest continued to climb.

Support from major financial players continues to build. ICE, the parent company of the New York Stock Exchange, has agreed to invest up to $2 billion in Polymarket, valuing it at $9 billion.

MetaMask also integrated Polymarket, enabling users to place bets directly within the wallet. In addition, Polymarket now offers up to 4% annualized returns on eligible open positions—among the most competitive rewards in the industry.

Even so, CFTC-regulated Kalshi remains Polymarket’s strongest competitor , leading in trading volume and recently raising $300 million in funding at a $5 billion valuation from investors including Sequoia Capital and Andreessen Horowitz—highlighting the sector’s intensifying race for market share.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?

Bitcoin rejects at key $93.5K as Fed rate-cut bets meet 'strong' bear case

Bitcoin price action, investor sentiment point to bullish December

Ether outpaces Bitcoin’s trend change: Is ETH on track for a 20% rally?