Ethereum Price’s Rise To $5,000 Could Be Blocked By These Holders Selling

Ethereum’s path to $5,000 may be blocked by long-term holders selling. A move above $4,222 could revive bullish momentum, while a drop below $4,000 risks deeper losses.

Ethereum (ETH) has shown a steady recovery over the past few days, fueled by improving sentiment across the broader crypto market.

The world’s second-largest cryptocurrency is trading near multi-month highs, but its path to reclaiming the $5,000 mark could face resistance due to weak investor accumulation.

Ethereum Accumulation Is Recovering

The Holder Accumulation Ratio for Ethereum currently sits at 30%, well below the 50% threshold that typically signals strong accumulation behavior. A ratio above this mark often suggests that long-term investors are actively buying ETH, reflecting confidence in sustained growth

Historically, Ethereum’s accumulation ratio has tended to rise between 40% and 45% during periods of steady price increases. The recent uptick, while modest, does hint at gradually improving sentiment.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Ethereum Holder Accumulation Ratio. Source:

Glassnode

Ethereum Holder Accumulation Ratio. Source:

Glassnode

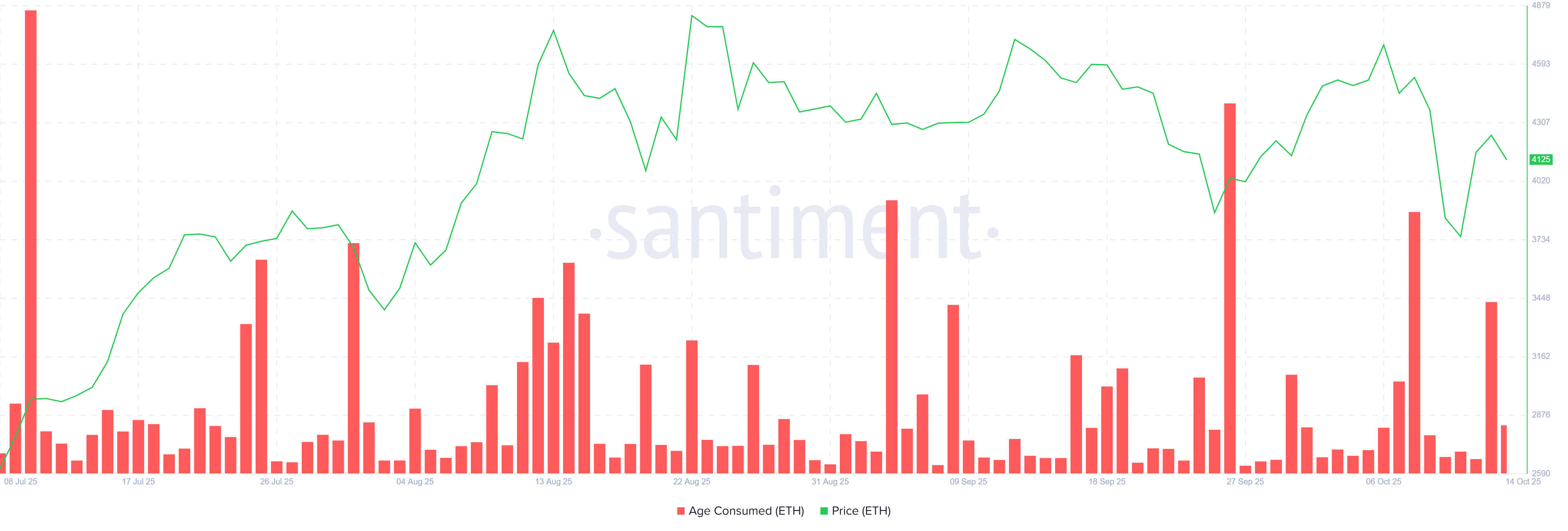

Ethereum’s “Age Consumed” metric has spiked twice this month, indicating a notable increase in long-term holder activity. This on-chain metric measures when previously dormant coins begin moving again, often signaling that older holders are selling. Repeated spikes suggest that confidence among long-term investors may be weakening.

Consistent selling from long-term holders typically precedes short-term price corrections, as it introduces new supply into the market. If these spikes persist, Ethereum could face mounting resistance on its climb toward new highs.

Ethereum Age Consumed. Source:

Santiment

Ethereum Age Consumed. Source:

Santiment

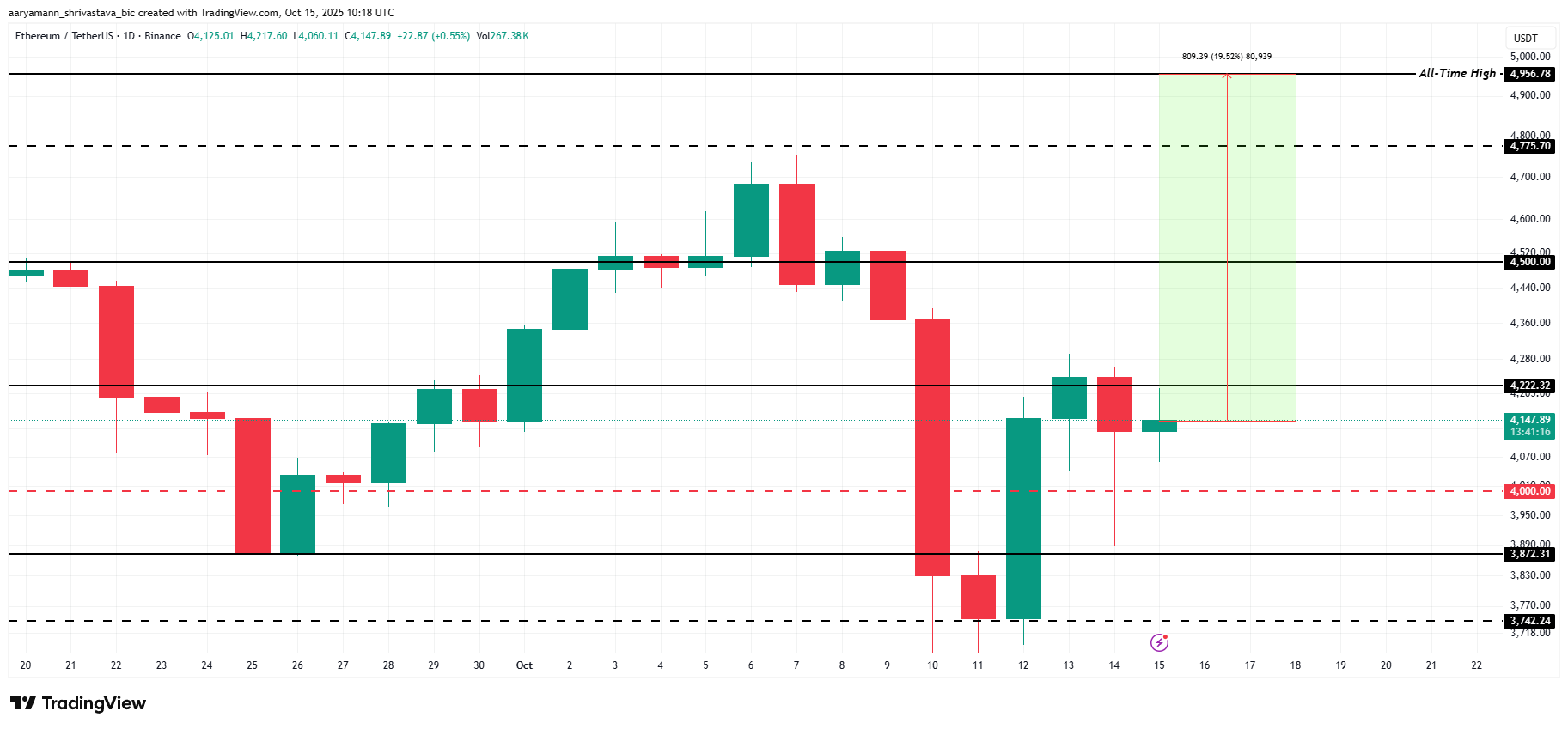

ETH Price Is Struggling To Rise

Ethereum is currently priced at $4,147, trading just below the key $4,222 resistance level. A successful breach of this barrier could enable ETH to climb toward $4,500. This would attract stronger inflows from institutional and retail investors alike.

If accumulation strengthens and confidence returns, Ethereum could advance toward $4,956 — its previous all-time high — and potentially touch $5,000. This would represent a decisive signal of market recovery and renewed bullish momentum.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

However, if bearish sentiment grows or long-term holders continue offloading their holdings, Ethereum could slip below $4,000. A deeper correction could pull the price down to $3,872 or lower, invalidating the bullish thesis and signaling renewed selling pressure in the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.