Aave freezes PYUSD markets after unprecedented 300T mint and burn

Blockchain data showed stablecoin issuer Paxos both minted and burned about $300 trillion worth of the PayPal USD stablecoin within 30 minutes, leaving many crypto users scratching their heads.

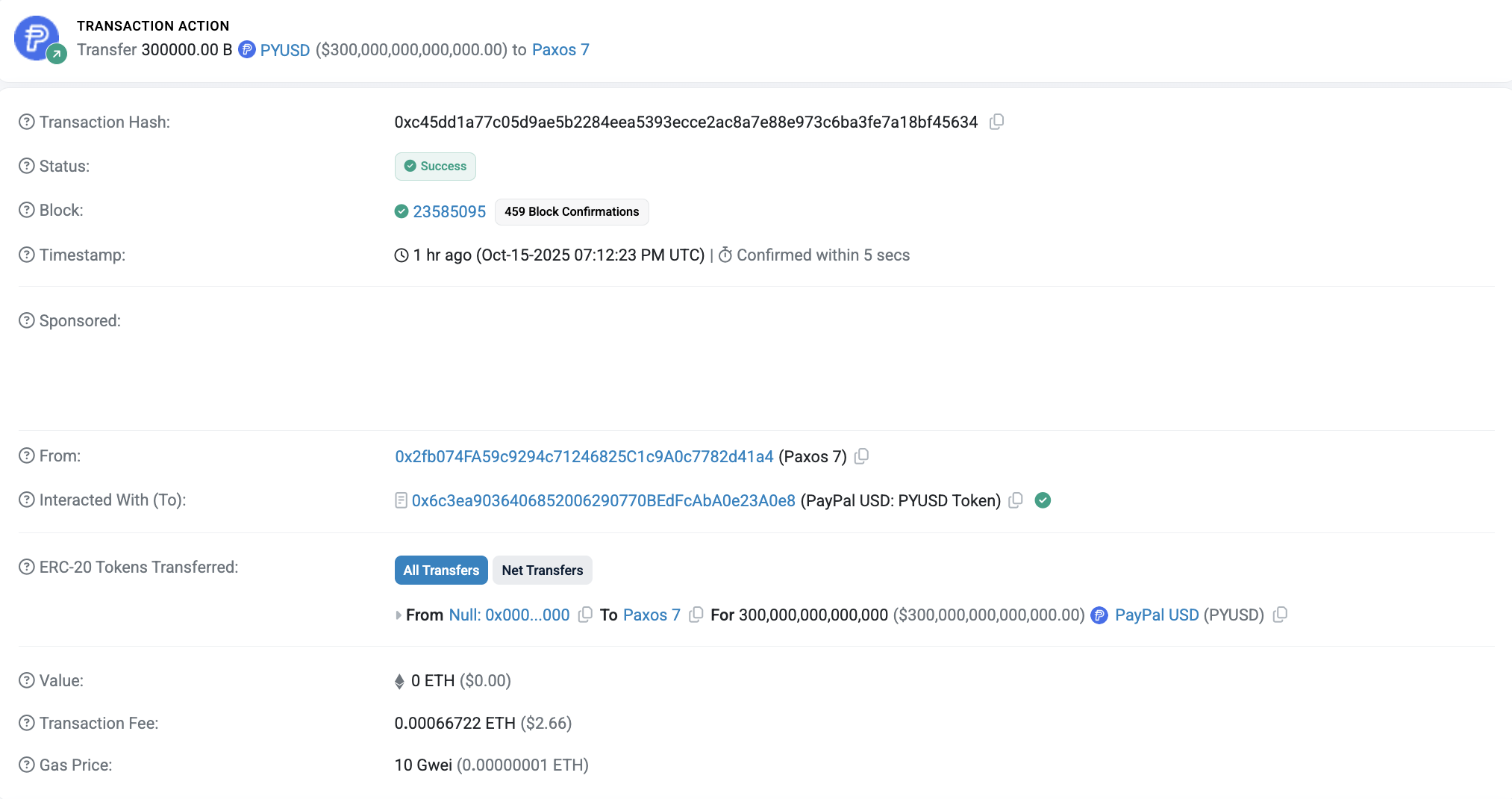

In a Wednesday X post following the mint and burn, Chaos Labs founder Omer Goldberg said Aave would be temporarily freezing trades for PayPal USD (PYUSD) after an “unexpected high-magnitude transaction” of minting and burning the stablecoin. Ethereum blockchain data showed Paxos minting 300 trillion of the US dollar-pegged stablecoin at 7:12 pm UTC and then burning the entire amount 22 minutes later by sending it to an inaccessible wallet.

Reporting from The Defiant suggested that it had been an “accidental mint” given the timing. Others online have speculated that such a large mint and burn may have been some kind of test or simulation authorized by Paxos.

Cointelegraph reached out to the stablecoin issuer for comment but had not received a response at the time of publication, nor had Paxos or PayPal publicly commented on the move.

$300 trillion is more than twice the Gross Domestic Product for every country on earth, according to data from the International Monetary Fund.

This is a developing story, and further information will be added as it becomes available.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Increasing Economic Strain of Alzheimer’s Disease and Its Effects on Healthcare Systems and Long-Term Care Industries

- Alzheimer's disease's global economic burden is projected to surge from $1.6 trillion in 2023 to $14.5 trillion by 2050, straining healthcare systems and public infrastructure. - The Alzheimer's therapeutics market is growing at 23.4% CAGR, driven by disease-modifying therapies and tech innovations like AI-driven care platforms. - Strategic investments in dementia infrastructure include $3.9B U.S. NIH funding and startups like Isaac Health securing $10.5M for in-home memory clinics. - Public-private part

Building Robust Investment Portfolios: Insights Gained from Economic Crises and Policy Actions

Hyperliquid (HYPE) Price Rally: The Role of DeFi Advancements and Investor Sentiment in Driving Recent Market Fluctuations

- Hyperliquid (HYPE) surged to $59.39 in 2025 before retreating, driven by DeFi innovations and volatile market sentiment. - Technical advancements like HyperBFT consensus and USDH stablecoin attracted 73% of decentralized trading volume, while institutional partnerships stabilized the ecosystem. - Despite short-term volatility near $36, bullish RSI patterns and $3 trillion trading volume suggest potential for a $59 rebound, though sustained momentum above $43 is critical. - Analysts project HYPE could rea

The Driving Forces Behind Economic Growth in Webster, NY

- Webster , NY, transformed a 300-acre Xerox brownfield into a high-tech industrial hub via a $9.8M FAST NY grant, boosting industrial and real estate growth. - Public-private partnerships enabled infrastructure upgrades, attracting $650M fairlife® dairy projects and 250 high-paying jobs by 2025. - Industrial vacancy rates dropped to 2%, while residential values rose 10.1% annually, highlighting synergies between infrastructure and economic development. - The model underscores secondary markets' potential