Alibaba Subsidiary Drives Attention to its Ethereum Layer 2 Blockchain

Jovay Network, an Ethereum Layer 2 (L2) network backed by Ant Digital, a subsidiary of Alibaba, is catching eyes today after it proclaimed its alignment with Ethereum on social media.

Despite many investors being surprised by the news, Jovay was originally revealed as an Ethereum L2 in April at the RWA Real Up conference in Dubai.

Jovay touts itself as financial-grade blockchain infrastructure, focused on global real-world asset (RWA) tokenization via its “modular Layer2 infrastructure that bridges Web2 and Web3.”

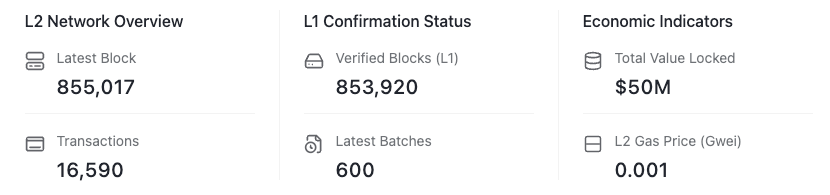

According to the chain’s block explorer, the network currently hosts $50 million in total value locked, but has only finalized 16,600 total transactions.

Alibaba Group ($BABA) is the 30th-largest company in the world by market capitalization, with a $385 billion valuation, making it the second-largest company in China.

The company first began exploring blockchain via Ant in 2019 with Alibaba Cloud, its blockchain-as-a-service (BaaS) platform for supply chain management tasks such as product traceability.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Evaluating the Increasing Need for Expertise in AI and Computational Fields: Discovering Investment Prospects in Educational and Training Platforms

- Farmingdale State College (FSC) expands computing programs and partners with Tesla/Amazon to address AI/data science demand. - Edtech firms like Century Tech use AI for personalized STEM learning, aligning with FSC’s need to scale enrollment while maintaining rigor. - Global AI education market projected to reach $12.8B by 2028 (33.5% CAGR), driven by corporate/university collaborations like SUNY-NY Creates TII. - Investors face risks in regulatory scrutiny and curriculum obsolescence but gain opportunit

Magic Eden to expand $ME buybacks in 2026 using revenue from Swaps, Lucky Buy, and Packs

The Emergence of Hyperliquid (HYPE): Analyzing the Latest Market Rally

- Hyperliquid (HYPE) dominates 73% of decentralized derivatives market in 2025 via liquidity innovations and hybrid trading structures. - HIP-3 protocol and two-tier architecture drive $3.5B TVL, enabling EVM compatibility and 90% fee cuts to attract DeFi projects. - Platform's 71% perpetual trading share reflects strategic buybacks ($645M in 2025) and 78% user growth amid shifting capital toward on-chain infrastructure. - Hybrid model challenges CEX dominance while facing aggregator risks, but institution

The Emergence of Tokens Supported by MMT and Their Influence on Financial Systems in Developing Markets

- MMT-backed tokens leverage blockchain to tokenize sovereign debt, real estate , and carbon credits, reshaping emerging market fiscal strategies. - Tokenized bonds enable local-currency issuance with smaller denominations, as demonstrated by Hong Kong's 2025 digital green bonds and OCBC's commercial paper program. - Central banks integrate blockchain tools for real-time liquidity adjustments, while programmable features like inflation-linked coupons enhance fiscal flexibility in volatile economies. - Chal