Stablecoin Market Surges to $15.6 Trillion in Transfers and $300B Supply in Q3 2025

The third quarter of 2025 marked a major milestone for the stablecoin market, reflecting growing global adoption and institutional use. Fueled by record DeFi activity and greater regulatory clarity, stablecoins reached historic highs in both supply and transaction volume, solidifying their role as a core pillar of the digital asset economy.

In brief

- Stablecoin transfer volume hit $15.6T in Q3 2025, the strongest quarter on record for digital assets.

- Total stablecoin supply expanded by $45B, pushing the market above $300B for the first time in history.

- Ethereum reclaimed dominance with 69% of new issuances, while Tron’s supply saw a rare decline.

- USDT led DEX trading with over $100B monthly volume as stablecoins power global DeFi and payments.

Ethereum Reclaims Dominance as Tron Sees Rare Supply Dip

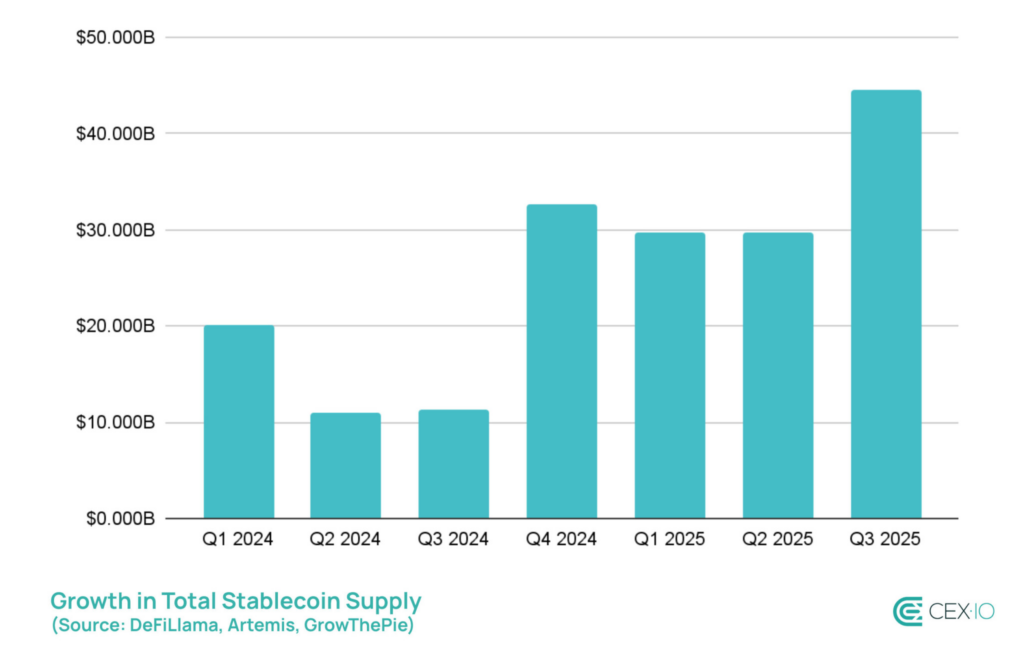

Stablecoins recorded their strongest quarter on record in Q3 2025, with transfer volumes exceeding $15.6 trillion and total supply expanding by $45 billion. The 18% quarterly growth pushed the stablecoin market above $300 billion , according to a report by CEX.IO.

USDT, USDC, and USDe drove most of the growth, making up 84% of all new stablecoin issuance. Even with U.S. limits on yield-bearing tokens under the Genius Act, USDe and PayPal’s PYUSD saw the fastest expansion, jumping 173% and 152%. The surge was fueled by strong DeFi activity and growing use across cross-chain platforms like LayerZero’s Stargate Hydra.

On-chain activity also reached new highs, with several notable developments:

- Total stablecoin transfers in Q3 2025 exceeded $15.6 trillion , marking a new record.

- Automated bots accounted for 71% of all on-chain transactions.

- Retail activity strengthened, with sub-$250 transfers reaching all-time highs in September.

- Small-value transactions are projected to exceed $60 billion by the end of 2025.

- Ethereum regained market dominance, hosting 69% of new stablecoin issuances, while Tron experienced a rare supply decline.

Layer 2 networks such as Arbitrum also gained traction, driven by demand from perpetual trading platforms and liquidity migration. As a result, USDC’s market share on Arbitrum rose from 44% to 58%, strengthening the network’s role as a hub for trading and DeFi activity.

Stablecoin Ecosystem Reaches New Heights as Final Quarter Kicks Off

Trading volumes across all stablecoins soared to $10.3 trillion, the highest level since 2021. USDT extended its dominance, surpassing $100 billion in monthly decentralized exchange (DEX) volume for the first time.

It overtook USDC as the most used trading pair on decentralized exchanges, boosted by rapid growth in activity on Binance Smart Chain (BSC). By the end of Q3, USDT’s share of total trading volume rose from 77.2% to 82.5%, while USDC declined to 10.5%. Other stablecoins collectively fell to a combined 7% share of the market.

Stablecoins cemented their central role in digital asset markets during the third quarter of 2025. Once viewed mainly as liquidity tools, they are now essential for settlement , payments, and retail adoption. With stablecoin usage historically rising in Q4, the sector may be poised for another strong quarter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Privacy First: Buterin Backs Messaging’s Fundamental Transformation

- Vitalik Buterin donates 128 ETH ($390K) to Session and SimpleX to advance metadata privacy and permissionless design. - Platforms use decentralized infrastructure and cryptographic IDs to protect communication metadata, resisting censorship and AI surveillance risks. - Donation counters regulatory threats like EU's Chat Control while promoting privacy-focused innovation in encrypted communication. - Experts emphasize permissionless account creation as critical for digital freedom, despite trade-offs like

Bitcoin News Update: Growing Optimism Faces ETF Withdrawals: The Delicate Balance of Crypto Stability

- Crypto markets show fragile stabilization as Fear & Greed Index rises to 20, but Bitcoin remains 30% below October peaks amid $3.5B ETF outflows. - Stablecoin market cap drops $4.6B and on-chain volumes fall below $25B/day, weakening Bitcoin's liquidity absorption capacity. - Select altcoins like Kaspa (22%) and Ethena (16%) gain traction while BlackRock's IBIT returns $3.2B profits, signaling mixed institutional confidence. - Technical indicators suggest tentative support at $100,937 for Bitcoin, but So

BCH Rises 0.09% as Momentum Fuels Outperformance

- BCH rose 0.09% in 24 hours but fell 4.22% in seven days, yet gained 22.72% annually. - It outperformed its Zacks Banks - Foreign sector with 0.66% weekly gains vs. -2.46% industry decline. - Earnings estimates rose twice in two months, boosting consensus from $2.54 to $2.56. - With a Zacks Rank #2 (Buy) and Momentum Score B, BCH shows strong momentum potential. - Annual 63.46% gains and positive revisions solidify its position as a top momentum stock.

DOGE drops 1.36% as Bitwise ETF debuts

- Bitwise launched the first Dogecoin ETF (BWOW) on NYSE, offering institutional-grade exposure to the memecoin. - DOGE fell 1.36% in 24 hours but rose 7.34% weekly, reflecting mixed short-term market sentiment. - The ETF aligns with growing institutional adoption and regulatory momentum for altcoins, despite a 52.35% annual decline. - Similar products like Bonk’s ETP and Ethereum upgrades highlight maturing crypto infrastructure and investor demand.