Stablecoin Surge Signals Renewed Crypto Market Momentum

Quick Breakdown

- Tether and Circle record a combined $74 billion inflow, signaling renewed strength in crypto liquidity.

- Stablecoin growth defies market volatility, reinforcing investor confidence in digital assets .

- Rising demand for stablecoins reflects accelerating de-dollarization and shifting global liquidity trends.

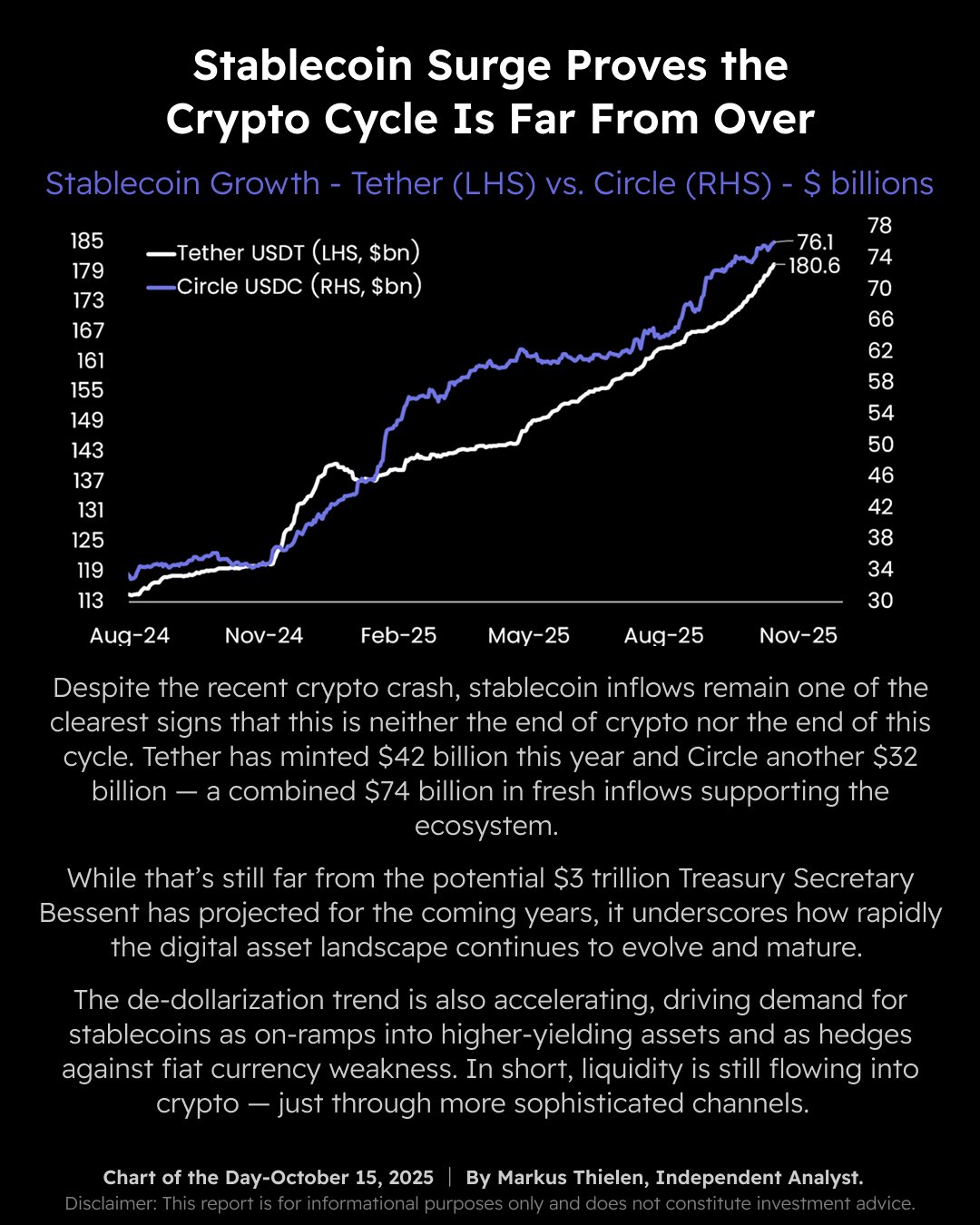

Stablecoin growth is reigniting optimism across the crypto market, defying predictions of a prolonged downturn. According to data from independent market strategist Markus Thielen, combined inflows into Tether (USDT) and Circle (USDC) have surpassed $74 billion in 2025, underscoring stablecoins’ pivotal role as the primary liquidity engines of the digital asset ecosystem.

Stablecoin Surge Signals Renewed Crypto Market Momentum. Source: Matrixport

Stablecoin Surge Signals Renewed Crypto Market Momentum. Source: Matrixport

Despite market volatility, liquidity remains robust

Tether has issued roughly $42 billion in new USDT this year, while Circle added another $32 billion in USDC circulation. Their total supplies now stand at $180.6 billion and $76.1 billion, respectively — representing one of the fastest expansion phases since 2021.

Thielen noted that even amid this year’s market correction, “liquidity is still flowing into crypto — just through more sophisticated channels.” The data suggests investors are not exiting digital markets, but rather repositioning capital through stablecoins, which are increasingly viewed as low-risk, yield-bearing assets during volatile periods.

Stablecoins reflect global economic shifts

Analysts say the surge in stablecoin usage highlights a wider macroeconomic transformation, as investors seek stability amid currency weakness and fluctuating traditional markets. Stablecoins are now being used not only as hedging tools but also as gateways to yield-generating digital assets.

This trend is also driving a gradual de-dollarization of the global economy. By offering borderless, 24/7 financial access without reliance on banks, stablecoins are rapidly gaining traction in Asia and Latin America, where they’re used for remittances, cross-border trade, and DeFi participation.

While the digital asset market has yet to reach the projected $3 trillion capitalization forecasted by U.S. Treasury Secretary Janet Bessent, the sustained expansion of stablecoins points to deepening institutional confidence and a more mature crypto financial system.

In a related development, the Solana Foundation has partnered with Korea’s Wavebridge Inc. to build a Korean won-pegged (KRW) stablecoin and institutional-grade tokenization products, further advancing the real-world adoption of blockchain-based finance.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Clearer Regulations Propel XRP ETFs to $628M as the Asset Earns Greater Legitimacy

- Canary Capital's XRPC ETF dominates XRP ETF market with $250M inflows, outpacing all competitors combined. - Grayscale's GXRP and Franklin Templeton's XRPZ drove $164M debut inflows, boosting total XRP ETF AUM to $628M. - 2025 SEC ruling cleared XRP's secondary sales as non-securities, enabling institutional adoption and $2.19 price rebound. - XRPC's 0.2% fee waiver and institutional focus fueled $6B+ ETF trading volumes, reversing prior outflows. - Analysts project $6.7B XRP ETF growth within 12 months

Bitcoin Updates: Anxiety Sweeps Crypto Market, Yet ETFs Ignite Optimism for Recovery

- Crypto Fear & Greed Index hits 20, signaling extreme fear as BTC/altcoins face renewed volatility amid Tether's "weak" stablecoin downgrade. - Tether CEO defends USDt stability with $215B Q3 assets, while Bitcoin-focused firms adopt defensive stances against mNAV risks. - Altcoin Season Index at 25/100 shows modest rebound, with Zcash surging 1,000% and Grayscale filing first U.S. Zcash ETF. - Upcoming spot altcoin ETF launches and potential Fed rate cuts (80% priced) spark optimism despite fragile on-ch

The Impact of Artificial Intelligence on Transforming Business Efficiency and Entrepreneurial Expansion

- AI-driven tools are becoming essential for SMEs and startups to enhance productivity and operational efficiency amid competitive pressures. - McKinsey reports 71% of organizations now use generative AI in 2025, but SMEs lag behind large enterprises in scaling AI adoption. - AI adoption delivers measurable ROI, with case studies showing 15-140% productivity gains in sectors like legal, sales, and customer service. - Investors are prioritizing AI-enhanced SaaS platforms that address SME pain points, enabli

The Federal Reserve's Policy Change and Its Effects on Solana (SOL): How Infrastructure Funding and Clearer Regulations Are Speeding Up Blockchain Adoption in 2025

- Fed's 2025 policy clarity and liquidity injections accelerated Solana's institutional adoption in blockchain finance. - Regulatory frameworks like OCC Letter 1186 and GENIUS Act enabled banks to engage with Solana's stablecoin and DeFi infrastructure. - Solana's Alpenglow upgrades (100ms finality) and $508M funding fueled partnerships with Visa , Western Union , and Coinbase . - $2B ETF inflows and $1T DEX volume highlight Solana's role in reshaping cross-border payments and DeFi ecosystems.