MORPHO Drops 167.01% Over the Past Year Despite Recent 7-Day Surge and Market Fluctuations

- MORPHO's price plummeted 522.88% in 24 hours, then surged 3842.76% in 7 days. - The asset later fell 167.01% over both 1-month and 1-year periods, showing extreme volatility. - Technical indicators suggest bearish momentum persists despite short-term spikes. - Traders analyze -10%+ drops to assess potential rebounds or continued declines.

As of OCT 15 2025,

MORPHO’s price has shown significant volatility lately, with a steep 24-hour drop of 522.88% marking its most notable recent movement. This sharp decline came after a rapid 7-day surge of 3842.76%, highlighting the asset’s vulnerability to swift changes in market mood and conditions. Such volatility has created considerable uncertainty for both traders and investors, as both short- and long-term price directions remain unpredictable.

Market activity around MORPHO has also included a 167.01% decrease over the past month and the same percentage loss over the last year. These numbers point to a persistent downward trend over the longer term, despite the explosive rally seen in the previous week. As a result, traders are paying close attention to technical signals and overall sentiment to assess whether the recent surge is a brief anomaly or signals a turning point for the asset.

Technical analysis indicates that bearish momentum is likely to persist. Important support levels have been challenged multiple times, while resistance remains out of reach. Both the relative strength index and moving averages suggest weak upward momentum, prompting traders to remain cautious until more definitive trends develop.

One possible backtesting approach is to study how a single-day decline of -10% or more in a stock’s price influences its subsequent performance. This method involves pinpointing past instances of such sharp drops and calculating the average returns over different periods—such as 1, 5, and 20 days afterward. The goal is to see whether a steep intraday loss tends to lead to a rebound or further declines.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Animoca Partners with GROW to Connect Crypto and Traditional Finance

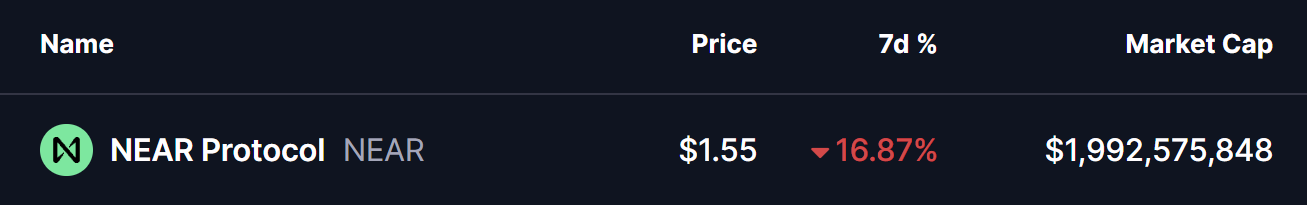

Near Protocol (NEAR) Flashes Potential Bullish Reversal Setup – Will It Bounce Back?

Solana Price Prediction: Grayscale Predicts New Bitcoin ATH, DeepSnitch AI’s Snowball to $900K Fuels the 100x Narrative

Whole Foods to install smart food waste bins from Mill starting in 2027