Dash to $100 in October? 4 Key Drivers Behind the Privacy Coin’s Breakout Potential

Dash (DASH) is gaining traction as privacy coins rebound, with whales accumulating and a key technical breakout signaling potential for a surge toward $100.

As privacy concerns surge in October, Dash (DASH) emerges as a strong contender for a major breakout alongside Zcash (ZEC), the leading privacy coin.

Many analysts believe DASH could soon return to the $100 mark, or even go higher. What supports this prediction? The following analysis explores four main drivers behind this potential move.

1. Rising Interest in Privacy Coins

According to a recent report from Milkroad, only two sectors remained profitable over the past month: exchange tokens and privacy coins. The report highlights Zcash, Dash, and Monero as key representatives of the privacy coin resurgence.

Only 2 crypto sectors made money this month.Privacy Coins and Exchange Tokens, everything else bled out.That tells you a lot about where capital hides when markets turn risk off.If you’re building a portfolio for the next leg, don’t just chase hype sectors. pic.twitter.com/UZ60jXane1

— Milk Road (@MilkRoadDaily) October 14, 2025

The growing public interest in privacy has become the first major catalyst behind Dash’s rebound. Analysts note that privacy coins have been the best-performing group in the market, posting an average gain of more than 60%.

Search interest and media coverage for privacy-focused cryptocurrencies have also reached their highest levels since 2017, suggesting that the “privacy culture” within blockchain is awakening once again.

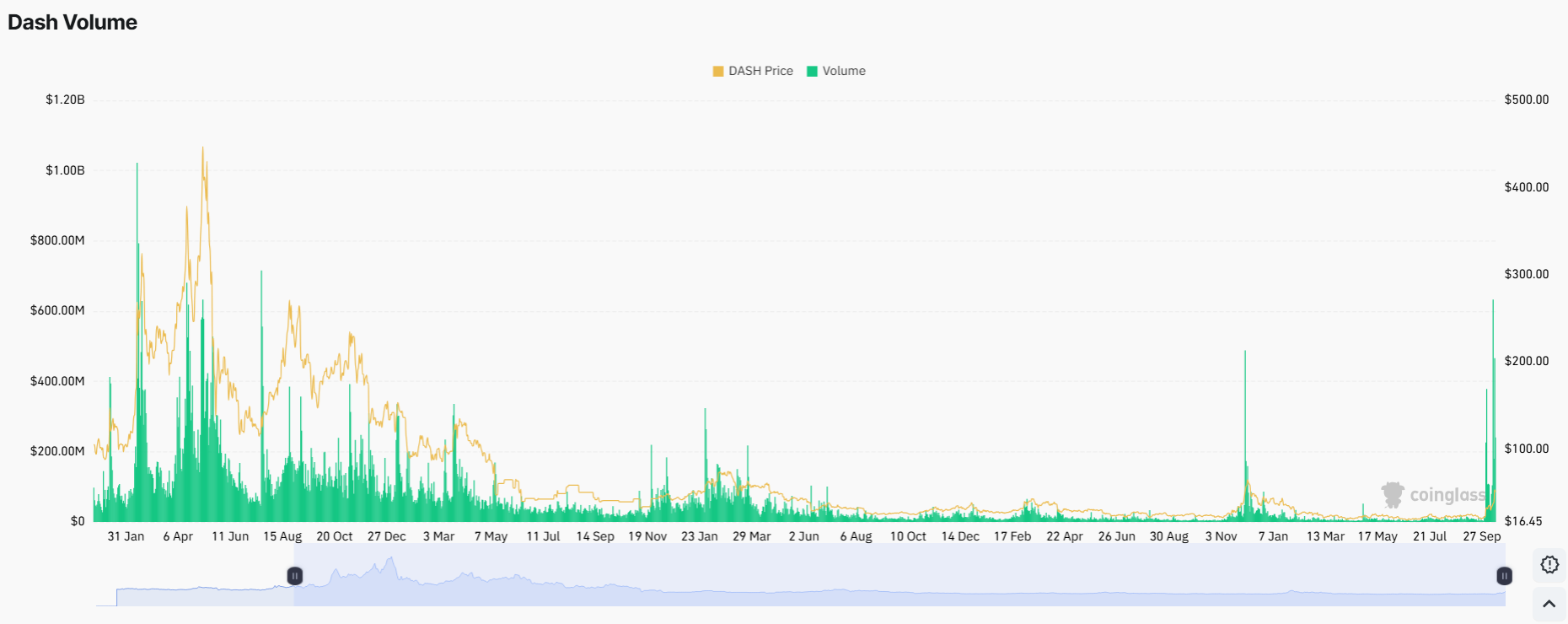

2. Explosive Trading Volume

Dash’s daily trading volume in October reached a record high of over $600 million. Data from CoinGecko shows that the current daily volume remains in the $200–$300 million range, 10 times higher than at the beginning of the month.

Dash Volume. Source:

Coinglass

Dash Volume. Source:

Coinglass

The last time DASH saw such strong volume was in early 2021, when the surge in activity fueled a rally to $400.

This renewed trading activity signals growing investor confidence in the altcoin and could provide the foundation for another bullish move, potentially mirroring the rally seen in 2021.

3. Whale Accumulation

Another bullish sign comes from the accumulation pattern among top DASH wallets.

Data from BitInfoCharts shows that the top 100 addresses have increased their DASH holdings from 25% of the total supply in early 2025 to more than 36%, marking a 10-year high.

TOP 100 DASH Richest Addresses. Source:

BitInfoCharts

TOP 100 DASH Richest Addresses. Source:

BitInfoCharts

The concentration of supply among large holders has not decreased, even after DASH rose over 100% in October. This stability indicates that whales are not taking profits yet, suggesting continued confidence and readiness for another leg up.

4. Technical Breakout

From a technical perspective, DASH has confirmed a breakout from a multi-year descending wedge pattern during October’s volatile price action.

This breakout is a classic bullish signal that often precedes major upward momentum. Analysts believe it could propel DASH to $100 or beyond in the coming weeks.

$DASH is trying to escape this (almost) 3000 days long falling wedge. If #DASH closes this week above (approx) $40 and then next week as well, this thing could shoot for a breakout target of $1K (ish) After that we can reach all the way up to the extensions from 2017 highs at… pic.twitter.com/GhoFGBOxTG

— Vuori Trading (@VuoriTrading) October 12, 2025

“Dash may soon reach $100, and if things heat up, it could jump past $200,” Joao Wedson, Founder & CEO ofAlphractal, predicted.

Despite these positive signs, these catalysts are short-term in nature. If market interest cools, trading volume declines, or whales begin distributing their holdings, DASH’s ability to sustain its growth will depend on how widely it achieves real-world adoption.

Ultimately, lasting growth for DASH will require more than market excitement—it will depend on whether the coin can demonstrate genuine utility and continued demand in the broader crypto ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP’s $2.4–$2.5 Support Level Under Pressure: Will It Bounce Back or Drop Further?

- XRP faces critical $2.4–$2.5 support test amid broader crypto market declines, with technical indicators hinting at potential rebound if buyers defend this range. - Ripple's institutional expansion through Palisade acquisition and chip-enabled prepaid partnerships aims to drive long-term value despite 15% weekly token decline. - Key technical levels at $2.60 (200-day EMA) and $1.90 (June support) could determine whether XRP follows DOGE's volatile pattern or establishes sustained bullish momentum. - Mark

Hyperliquid News Today: Buzz and Speculation Drive BSC Meme Coin Rally, GIGGLE Approaches $90 Million

- GIGGLE, a BSC meme coin, surged 22% to $87.21M market cap, sparking broader BSC meme token rallies. - "Binance Life" and "Hakimi" saw 20-15% spikes, driven by speculative demand and community hype per Lookonchain. - BSC's low fees and Binance's ecosystem support create fertile ground for meme coins, noted blockchain researchers. - Experts caution BSC meme coins remain highly volatile, with risks from social media sentiment and unclear regulations.

Crypto Fraud Rises While International Authorities Strain to Catch Up

- Singapore and Malaysia intensify cross-border crackdowns on crypto scams, seizing $150M assets linked to Cambodian syndicates and pursuing regional fugitives. - ZachXBT ranks Nigeria, India, Canada, UK, and Russia as top jurisdictions for crypto fraud recovery challenges due to legal delays and frozen assets. - Meta deploys AI tools to combat WhatsApp/Messenger scams, aligning with Singapore's facial recognition mandates under the Online Criminal Harms Act. - Global fraud surges include $500M telecom loa

Treasury Targets International Network Supporting North Korea's Nuclear Program

- U.S. Treasury sanctions 8 North Korean bankers and 2 firms for laundering $5.3M in crypto to fund nuclear programs, targeting First Credit Bank and Ryujong Credit Bank. - Report reveals North Korea's cybercrime schemes siphoned $3B in digital assets over three years via global shell companies and financial networks in China/Russia. - U.S. seeks UN sanctions on 7 ships illegally exporting $200M-$400M/year in coal/iron to China, but faces Russian/Chinese opposition to stricter measures. - Secondary sanctio