Key Market Information Discrepancy on October 15th - A Must-Read! | Alpha Morning Report

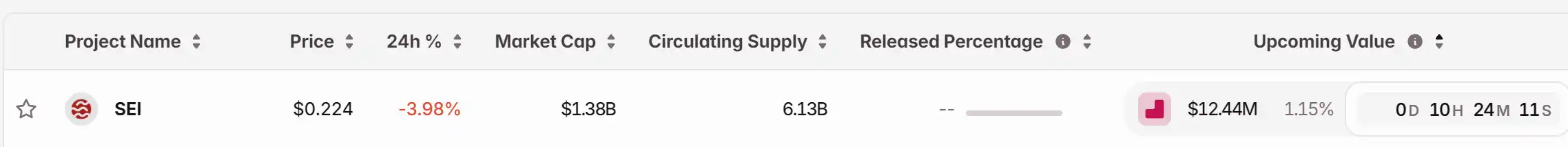

1.Top新闻:鲍威尔暗示支持进一步降息,因美国就业市场降温 2.代币解锁:$SEI

Top News

1.Powell Suggests Support for Further Rate Cuts as U.S. Job Market Cools

2.BNB Chain and Four.Meme's First Batch of "Rebirth Support" Airdrop Has Been Successfully Distributed

3.Farcaster Announces Suspension of Deposit Bonus Event Registration

4.Binance Denies Allegations of Charging Listing Fees and Dumping Tokens

5.Over $697 Million Liquidated Across the Network in the Past 24 Hours, Over 200,000 People Liquidated

Articles & Threads

1. "The Enrichment of Those Who Quietly Get Rich Through Arbitrage on Polymarket"

After receiving a $2 billion investment, Polymarket is valued at $9 billion, one of the highest funding amounts a project in the Crypto space has received in recent years. For those who know how to truly make money on Polymarket, this is a golden age. While most people treat Polymarket as a gambling den, smart money sees it as an arbitrage tool. In the following in-depth article, BlockBeats interviewed three seasoned Polymarket players to dissect their money-making strategies.

2. "Can We Still Call the Coins We Are Speculating on Meme Coins?"

The "1011" flash crash came so suddenly that upon waking up, everyone's attention followed the market's bloodbath. Nevertheless, despite this, with the market quickly recovering, especially with $BNB hitting an all-time high, the BSC meme market remains very active. The various discussions about the BSC meme coin market, although no longer the top hot topic where "gods are fighting", are still worth further consideration.

Market Data

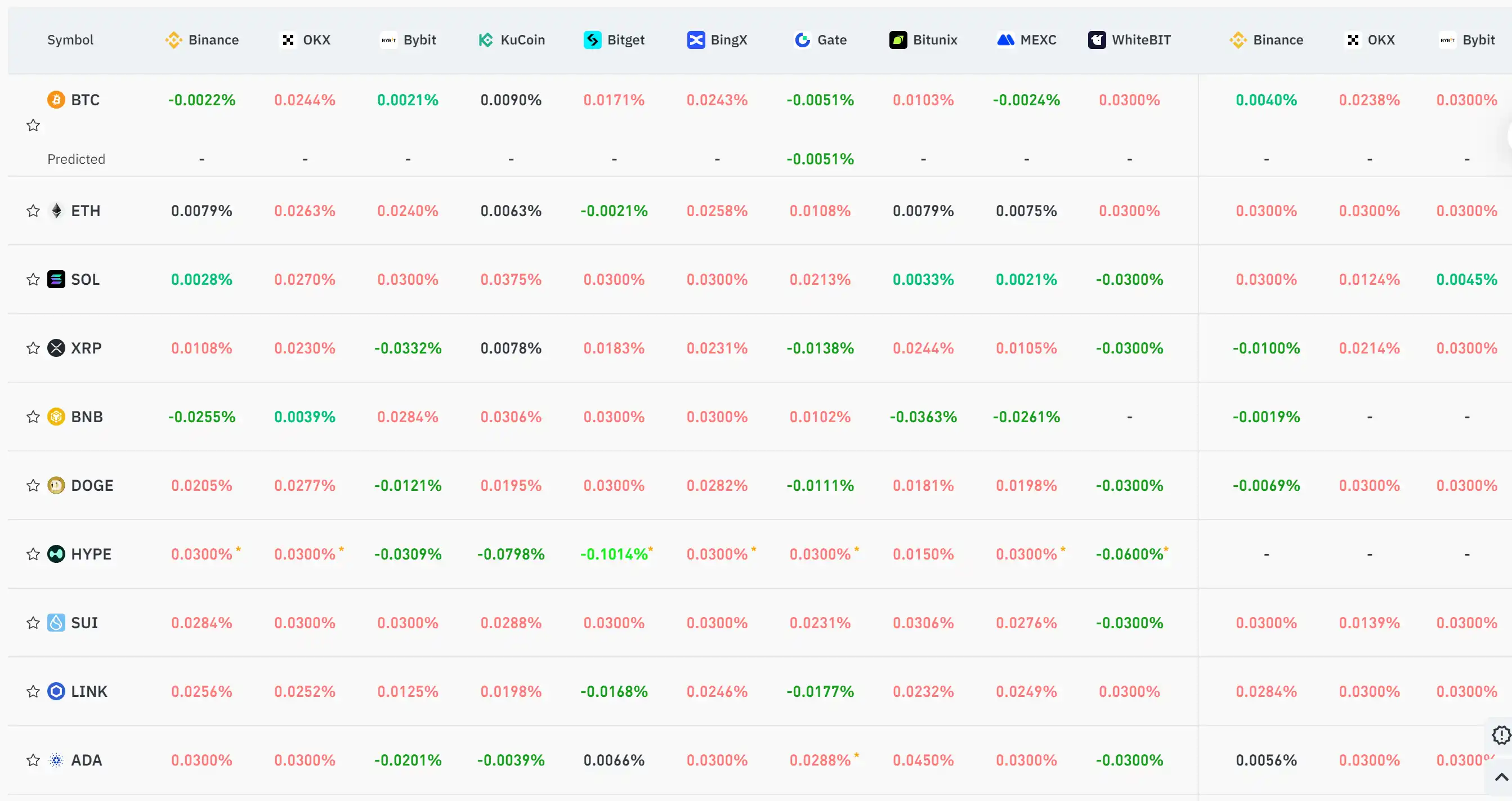

Daily Market Overall Capital Heat (reflected by funding rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

FARTCOIN Trades at $0.347 as 9.6% Daily Gain Meets Strong $0.38–$0.40 Resistance

Aster Holds Near $1.06 as Tightening Channel Highlights Key Resistance

Pepe Gains 2.6% This Week While Holding Support and Testing $0.054706 Resistance