Crypto Trader Says Solana Challenger Primed to Surge to New All-Time Highs, Updates Outlook on Dogecoin, Sei and PENGU

A widely followed crypto analyst is laying out his thoughts on the future price action of a slate of altcoins.

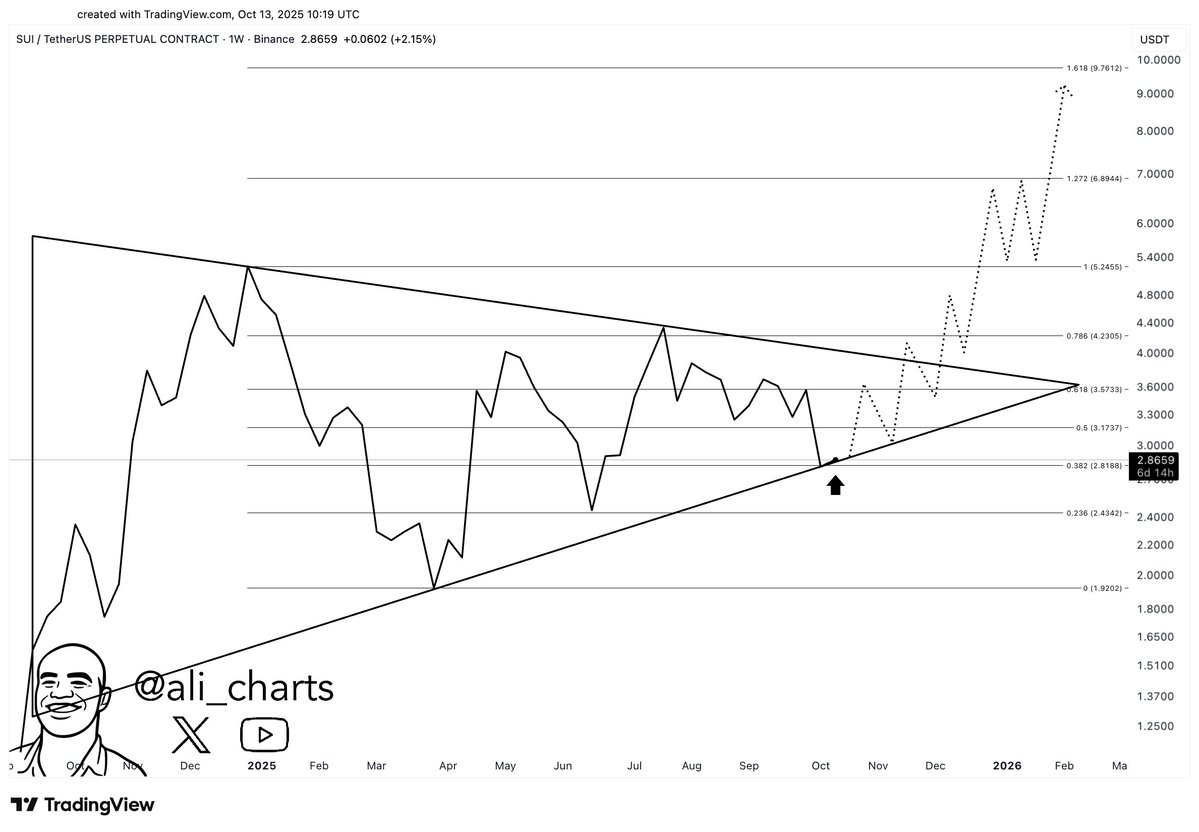

Crypto trader Ali Martinez tells his 160,000 followers on the social media platform X that the layer-1 platform Sui Network ( SUI ) is on the verge of a rally.

“I just went long on SUI! Strength is undeniable and could be one of the fastest to recover.

As long as $2.60 holds, a breakout to new all-time highs looks very likely.”

Source: Ali Martinez/X

Source: Ali Martinez/X

Moving on to the popular meme token Dogecoin ( DOGE ), Martinez says the dog-based altcoin is on the verge of a rebound.

“As long as $0.16 holds, Dogecoin DOGE still has a strong shot at rebounding toward $0.48.”

Source: Ali Martinez/X

Source: Ali Martinez/X

Looking at the decentralized finance (DeFi) layer-1 blockchain Sei ( SEI ), the analyst foresees a bull run in the near future.

“Nothing has changed! SEI still eyes a bullish breakout to $0.90. Mark my words.”

Source: Ali Martinez/X

Source: Ali Martinez/X

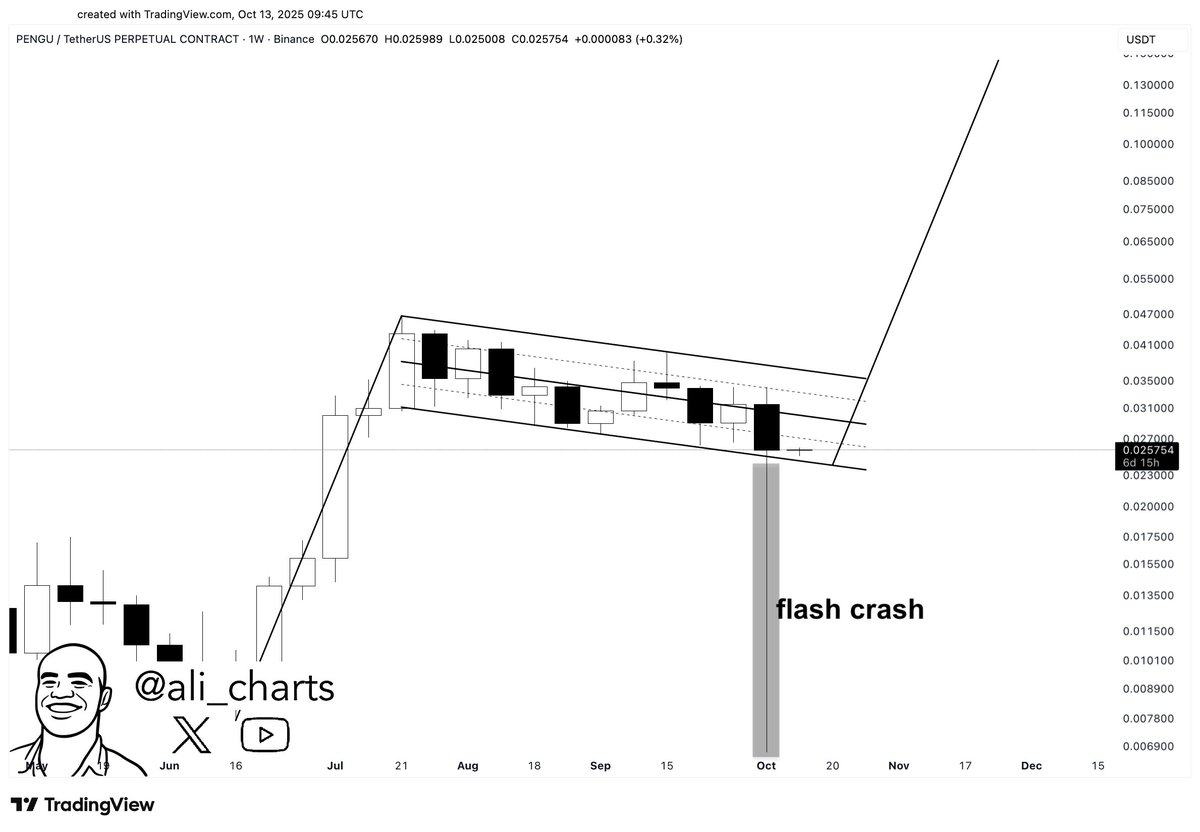

Finally, taking a glance at the native token of the Pudgy Penguins non-fungible token (NFT) collection PENGU , the analyst says that the memecoin has a lot of upside despite a “flash crash” last week.

“What happened on Friday was far from normal. Some call it a black swan; others call it extreme manipulation.

Most charts now show insane wicks to the downside, but strip out the noise and you’ll see PENGU holding structure.

If $0.023 holds, a breakout to $0.13 is in play.”

Source: Ali Martinez/X

Source: Ali Martinez/X

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Increasing Importance of Stablecoins in Institutional Investment Strategies

- In 2025, U.S. GENIUS Act and EU MiCA regulations drove institutional adoption of USDC as a compliant, transparent stablecoin. - USDC's 98% U.S. Treasury-backed reserves and monthly audits made it preferred over USDT for regulated entities. - Institutions used USDC to reduce settlement delays by 35% and improve Sharpe ratios by 12% through yield-generating strategies. - With $73.7B circulation and $140B Q3 transaction volume, USDC became a 24/7 global liquidity tool for emerging markets.

Cryptos losing momentum among American investors: what the FINRA study reveals

Is Worldcoin (WLD) Poised for a Breakout? This Key Bullish Pattern Suggest So!

Urgent Deadline: Italy Demands Crypto Firms Register by Dec 30 or Face Shutdown