Aster Drifts Lower on Thinning Demand—Will Price Drop to $1?

Aster faces heavy selling pressure with RSI and CMF signaling strong outflows. Holding above $1.17 is key to avoiding a deeper fall toward $1.00.

Aster’s price is showing growing signs of weakness as bearish sentiment tightens its grip on the market. The altcoin has failed to find stability following the recent correction.

However, with investor skepticism deepening and overall market conditions providing little support for recovery, a further downtrend is likely.

Aster Continues To Lose Support

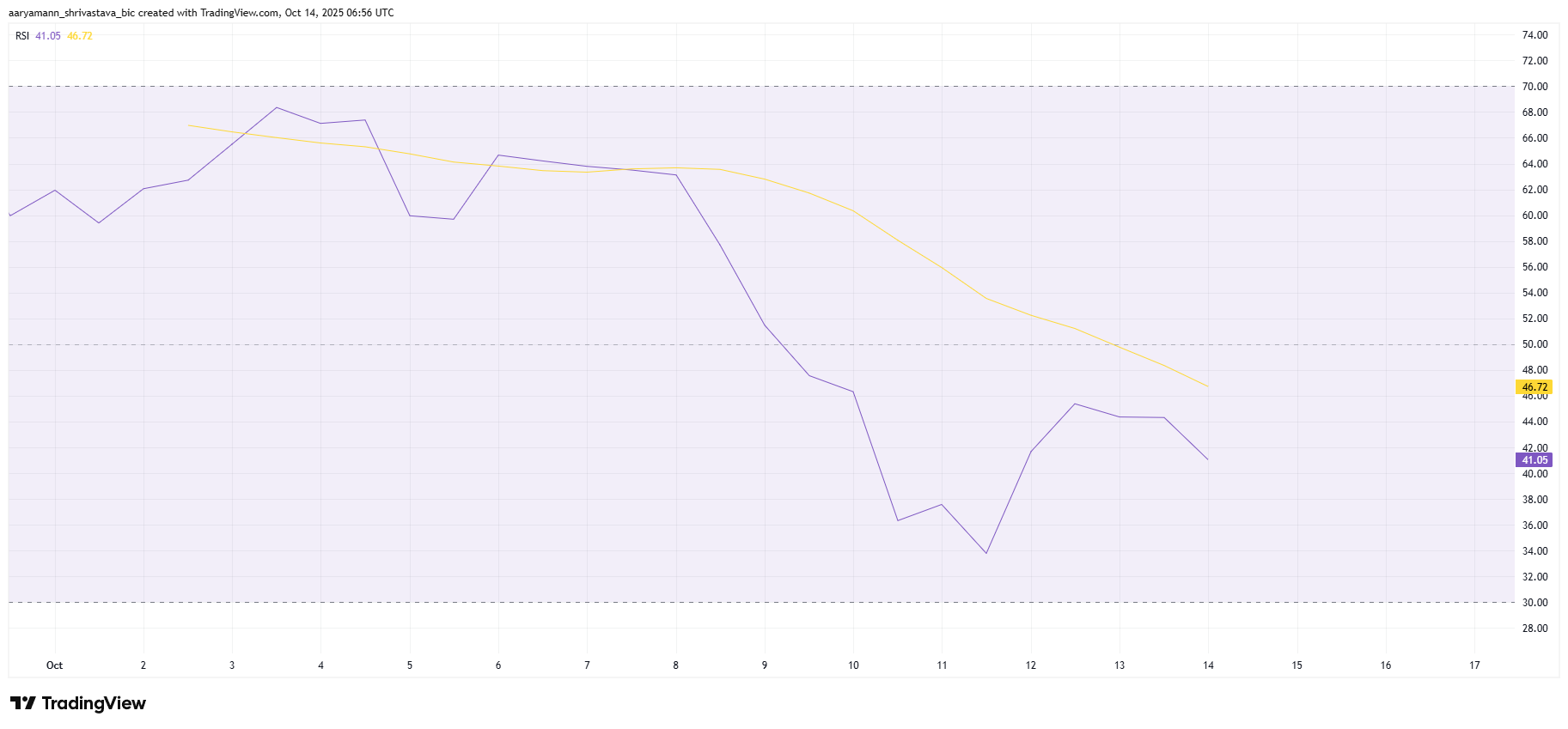

The Relative Strength Index (RSI) for Aster shows a steady decline, confirming a rise in bearish momentum. The indicator is currently slipping deeper into the negative zone, reflecting the growing dominance of sellers. The lack of buying pressure and weak trading volume suggest that confidence among investors remains low.

Compounding the issue, the broader crypto market has not shown signs of recovery, further limiting Aster’s chances of rebounding. Without broader bullish cues, the token may continue to face downward pressure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ASTER RSI. Source:

ASTER RSI. Source:

ASTER RSI. Source:

ASTER RSI. Source:

From a macro perspective, technical indicators point toward continued outflows. The Chaikin Money Flow (CMF) has noted a sharp downtick, signaling that capital is leaving the asset as investors liquidate positions. This rise in selling activity indicates waning conviction among holders, who appear to be exiting before further losses.

The weak price action and ongoing corrections have damaged investor sentiment, reducing participation from both retail and institutional players. Unless new buying interest emerges soon, the sustained outflows reflected in CMF could extend Aster’s downtrend in the short term.

ASTER CMF. Source:

ASTER CMF. Source:

ASTER CMF. Source:

ASTER CMF. Source:

ASTER Price May Drop Further

At the time of writing, Aster’s price stands at $1.35, having failed to breach the $1.48 resistance level. Given current indicators, the altcoin remains vulnerable to further correction as selling pressure builds.

If bearish momentum continues, Aster could decline toward the $1.17 support level. Losing this crucial support may open the door to a deeper fall toward $1.00. This represents a 26% drop that could trigger additional liquidations and accelerate outflows.

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

However, if investor confidence improves and accumulation resumes, Aster could attempt a recovery. Regaining strength above $1.48 could pave the way for a rally toward $1.63, effectively invalidating the prevailing bearish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Telegram, the world's largest social platform, launches major update: Your graphics card can now mine TON

Telegram’s ambition for privacy-focused AI

A well-known crypto KOL is embroiled in a "fraudulent donation scandal," accused of forging Hong Kong fire donation receipts, sparking a public outcry.

Using charity for false publicity is not unprecedented in the history of public figures.

An overview of two new projects in the Polkadot ecosystem and what they will bring to Polkadot Hub

HIC: Continue to bring truly valuable new projects to Polkadot in a sluggish market!