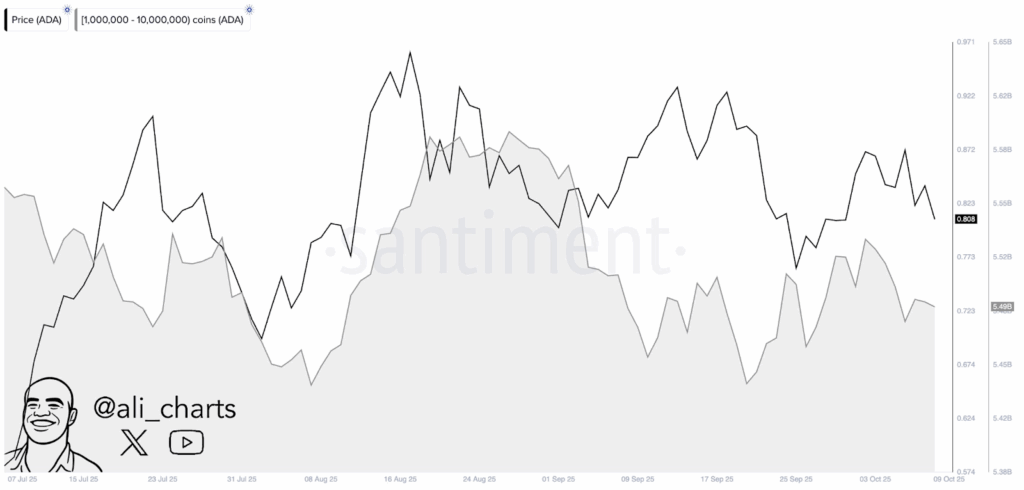

- Large wallets peaked holdings in August, then steadily offloaded 40M ADA amid price struggles.

- Price and whale holdings diverged post-August, indicating distribution despite attempts at recovery.

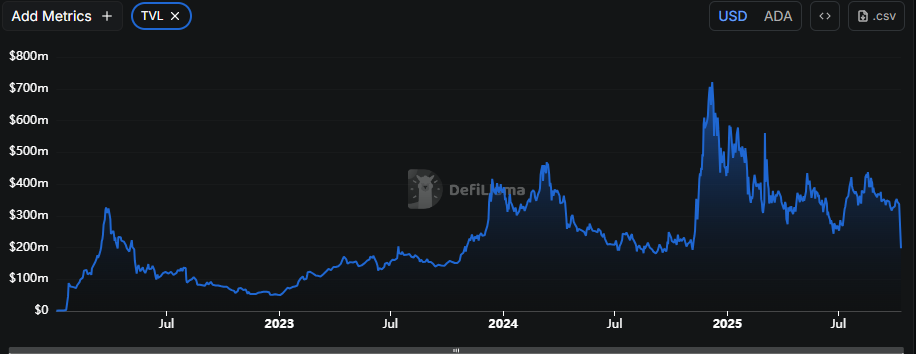

- Total Value Locked in Cardano DeFi fell sharply after early 2025 peak, mirroring whale sell-off and waning confidence.

Cardano’s price plunged 20.6% in the last 24 hours, hitting $0.65 amid heavy whale selling. With 40 million ADA offloaded recently, market pressure is mounting, signaling increased volatility and uncertainty for ADA’s.

Whale Accumulation Peaks Before Distribution Phase

Between July and early August 2025, whales steadily amassed ADA, pushing large wallet holdings higher. This accumulation phase supported a rising price, signaling bullish momentum as big players drove demand. By mid-August, both the price of ADA and whale holdings hit their peaks. This simultaneous surge often marks the end of a strong accumulation period and the onset of profit-taking.

Source: Ali Charts Via X

Source: Ali Charts Via X

After reaching this high point, large wallets began unloading positions. The steady decline in whale ADA holdings contrasts with the price attempts at recovery, illustrating a classic distribution phase. Whales capitalized on brief price rallies to reduce exposure, indicating a shift from buying to selling pressure.

Price and Holdings Diverge, Indicating Bearish Pressure

After August, ADA’s price tried to bounce back but did so unevenly, while whale holdings kept dropping steadily. This difference shows that smart investors were selling before the market got worse.

The selling continued through September and October, with both the price and whale holdings falling. The ongoing decline in large wallet balances shows that confidence is fading and the market is turning bearish. This kind of whale activity is a warning sign for traders, as it often signals big price changes ahead.

Cardano’s DeFi Ecosystem Mirrors Market Sentiment

Supporting this, the Total Value Locked (TVL) in Cardano’s DeFi grew strongly in early 2025, reaching over $750 million as the ecosystem expanded. But then TVL dropped sharply below $300 million, matching the whale sell-off and falling prices.

Source: Defillama

Source: Defillama

This big drop in TVL shows money leaving the system and a loss of investor trust, adding to the negative market outlook. The rise and fall of the DeFi ecosystem reflects overall market mood and the risks Cardano investors face.

Data from Santiment and DeFiLlama makes it clear that whale activity has played a major role in Cardano’s recent price moves.

The shift from accumulation to distribution by large holders preceded the downturn in price and TVL. Traders should closely monitor whale activity as it often signals early trend changes in this volatile market.