Research Report|In-Depth Analysis and Market Cap of Falcon Enso(ENSO)

Bitget2025/10/14 06:41

By:Bitget

1. Project Overview

Enso is a decentralized shared network built on the Tendermint Layer-1 blockchain. It aims to unify all smart contract interactions, systematically addressing the challenges of chain-level fragmentation and usability. Its core mechanism is the

“Intent Engine”—developers and users only need to declare their intended outcomes, while network participants collaboratively generate executable bytecode without manually specifying cross-chain execution paths.

Serving as a unified chain abstraction layer, Enso integrates multi-chain ecosystems, rollups, and appchains, providing highly abstracted and automated cross-chain operations. Its technical architecture covers request initiation, abstraction submission, and solution aggregation modules, compatible with multiple virtual machine systems (e.g., EVM, SVM, MVM). Validators simulate and verify bytecode validity and use an auction mechanism to efficiently handle cross-chain fees, creating an endogenous circular economy.

The

$ENSO token has a total supply of 100 million, allocated as described below, and is used for network gas, governance, staking, and security maintenance. Enso currently supports dual-chain deployment on Ethereum and BNB Chain. It has launched the Checkout Web3 payment solution, processing over

$17 billion in settlements, integrating more than

145 production projects, and is continuously enhancing network functionality through governance iterations.

2. Project Highlights

Intent Engine for Chain Abstraction, Redefining Multi-Chain Interaction Enso’s Intent Engine addresses usability obstacles caused by blockchain fragmentation. Users and developers simply declare their goals, and the network automatically schedules cross-chain smart contract operations, removing underlying chain differences and enabling seamless multi-chain interactions.

Developer-Friendly One-Stop Chain Abstraction Toolkit Enso offers modular chain abstraction and unified APIs, allowing developers to build DApps without manually adapting to each chain. Advanced features like cross-chain bridging and payments can be quickly integrated, reducing development overhead and boosting composability and productivity.

Multi-Role, Multi-Level Incentives and Circular Economy Network roles include:

Action Providers (contribute abstractions and earn rewards)

Graphers (algorithmic selection)

Validators (ensure execution safety)

Consumers (initiate intent requests)

The $ENSO token covers gas payments, governance, staking rewards, and fee auctions, with a circular incentive mechanism ensuring participant returns.

High-Scalability, Low-Cost Modular Architecture The modular chain abstraction architecture minimizes latency, optimizes costs, and improves scalability. To date, Enso has processed over

$15 billion in transactions across

100+ applications. Beyond EVM, the network will extend to SVM, MVM, and other VMs, providing broad compatibility for the developer ecosystem and building multi-chain interoperability infrastructure.

3. Market Outlook

As a representative project in the chain abstraction infrastructure sector, Enso’s Intent Engine and deployed cross-chain capabilities provide strong first-mover advantage and network effects.

Valuation: $125 million

Integrated protocols: 250+

Total transaction volume: $15+ billion

Total supply: 100 million

Initial circulating supply: ~20.59%

With the growing narrative around chain abstraction, Enso is positioned to become a foundational protocol for the Web3 intent layer.

4. Economic Model

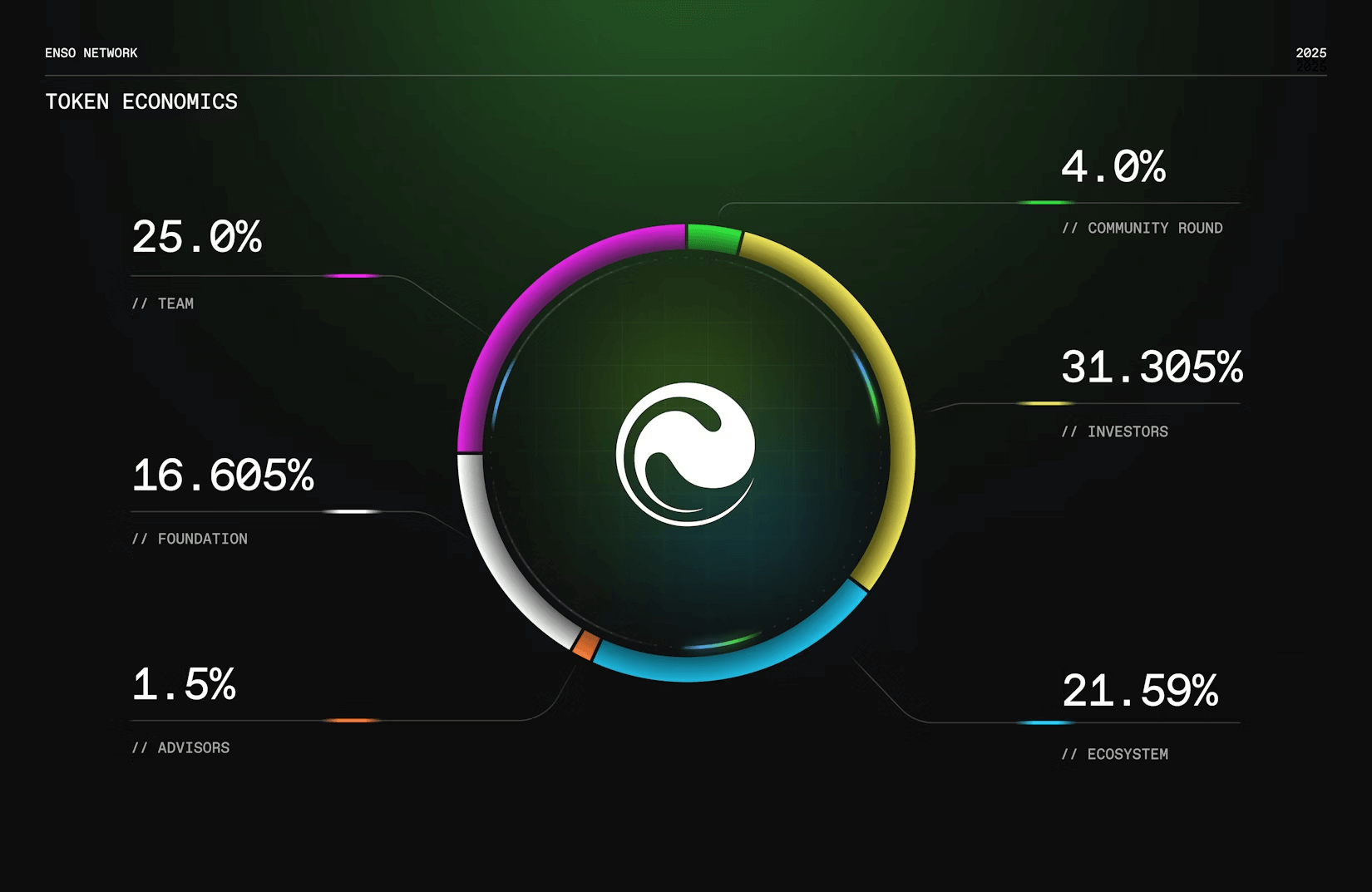

Total Supply: 100 million ENSO

Allocation Structure

Investors (Strategic Investment): 31.305%

Team (Core Development & Early Contributors): 25%

Ecosystem Fund (Partner incentives, developer support, etc.): 21.59%

Foundation Operations (Liquidity, operations, future development): 16.605%

Community Round (User onboarding, airdrops, rewards): 4%

Advisors (Operations & strategic partnerships): 1.5%

Token Utility

Core Network Functions

Staking & Validation: ENSO must be staked to participate as a validator, ensuring network security and consensus stability. Delegation allows holders to earn rewards.

Transaction / Execution Fees: Users pay ENSO for operations (cross-chain calls, smart contract execution, AI agent requests). Fees are distributed to participants (validators, graphers, action providers).

Governance: ENSO holders participate in protocol upgrades, parameter adjustments, reward allocations, and ecosystem fund usage. Voting power correlates with token holdings.

Ecosystem Functions

Developer & Ecosystem Incentives: ENSO rewards developers, partners, and other ecosystem participants. Tokens from the foundation and ecosystem fund support subsidies, ecosystem building, and marketing.

Access Premium Features: ENSO can be used to access specific features or AI agent services, paying for advanced queries, strategies, or smart contract compositions.

Value Capture & Burn: Some network fees may be reclaimed or burned to enhance token scarcity and capture network growth value.

5. Team & Funding

Core Team Members:

Connor Howe (Founder & CEO): Previously at Sygnum, responsible for stablecoins, multi-sig, and tokenized products.

Lindy Han (Business Development Lead): Formerly in multiple DeFi projects, experienced in strategic partnerships and ecosystem growth.

Milos Costantini (Core Developer): Experienced in Solidity smart contract development and deployment.

Peter Phillips (CTO): Previously developed for DuckDuckGo and Mozilla, created Aragon via Autark, experienced in blockchain architecture.

Funding:

Total Raised: $9.2 million

2021: $5 million led by Polychain Capital

2024: $4.2 million

Investors: Polychain Capital, Multicoin Capital, Spartan Group, Hypersphere Ventures, P2P Capital, Zora, Dfinity Beacon Fund, and 60+ angel investors.

6. Potential Risks

Short-Term Pressure: 4% community tokens already released; impact is minimal. Monitor ecosystem incentive releases.

Medium-Term Pressure (6–12 months): Team/advisor token unlocks may create market pressure.

Long-Term Pressure (12–24 months): Investor/VC unlocks combined with ecosystem rewards could peak selling pressure.

Mitigation: Staking rewards, token utility, phased releases, and ecosystem growth can reduce selling pressure.

Network health and token value depend on actual transaction volume and adoption; underperforming DeFi markets or low cross-chain demand could impact governance and staking utility, affecting network activity and token value.

7. Official Links

Website:

https://www.enso.build

Twitter:

https://x.com/EnsoBuild

Disclaimer: This report was generated by AI and human-verified for accuracy. It is not intended as investment advice.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Cointribune•2025/11/30 11:03

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Cointribune•2025/11/30 11:03

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

Coinpedia•2025/11/30 03:39

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Coinpedia•2025/11/30 03:39

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$91,342.34

+0.79%

Ethereum

ETH

$3,011.57

+0.40%

Tether USDt

USDT

$1

-0.03%

XRP

XRP

$2.19

+0.05%

BNB

BNB

$878.41

-0.08%

USDC

USDC

$0.9998

-0.02%

Solana

SOL

$136.77

-0.11%

TRON

TRX

$0.2810

-0.04%

Dogecoin

DOGE

$0.1491

-0.05%

Cardano

ADA

$0.4194

+0.55%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now