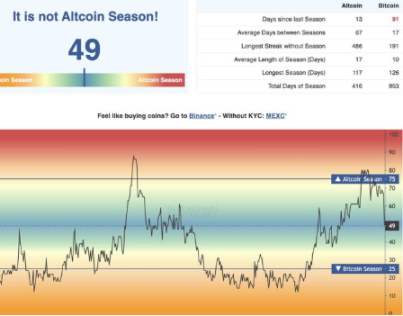

Bitget executive predicts: There will be no "altcoin season" in this bull market—data and structural signals are confirming it

The COO of Bitget recently made a public statement:

“There will not be a traditional Altseason in this cycle.”

This is the first mainstream exchange to publicly deny the arrival of an Altseason, sparking heated discussion in the industry.

However, when we closely examine on-chain data and market structure, we may find—he might be right.

🔹1. No New Narrative Fuel

Every bull market has been driven by a new “narrative engine”:

2017: ICO frenzy

2021: DeFi and NFT

But in 2025, the market has yet to see innovations or trends of similar scale.

Although sectors like AI, RWA, and DePIN are each exciting in their own way, they have not formed a unified market consensus and lack the effect of “mass mania.”

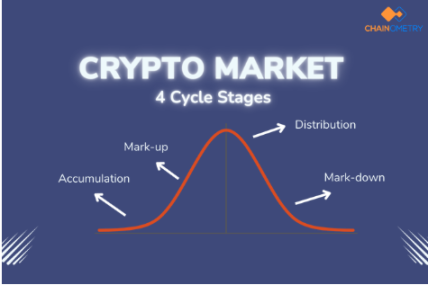

🔹2. Liquidity Remains Locked in BTC and ETH

Currently, market dominance is still firmly held by bitcoin and ethereum.

BTC Dominance remains high, and the ETH/BTC structure has not shown a clear breakout signal.

This means that market funds are mainly concentrated in “core assets,”

and the space for liquidity rotation among altcoins has been greatly compressed.

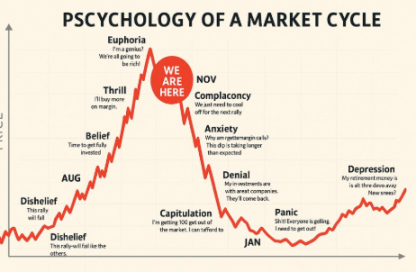

The premise of previous Altseasons was BTC moving sideways, ETH strengthening, and funds spilling over to small-cap assets,

but at present, this structure has not appeared.

🔹3. Retail Investor Enthusiasm Is Absent

The 2021 Altseason was ignited by retail FOMO.

But now, after experiencing the last crash, retail investors are more cautious.

Social media sentiment indices are sluggish, and the growth of active on-chain wallets is slow,

indicating that **“mass sentiment” has yet to be reignited**.

🔹4. Institutional Fund Allocation Logic Has Changed

Driven by ETFs, institutional funds have shifted their focus to BTC and ETH.

The volatility and liquidity of small and mid-cap tokens

make them “not worth the risk” in institutional portfolios.

This means that the main source of funds in this bull market is completely different from 2021—

more rational, more concentrated, and less favorable for a broad altcoin rally.

🔹5. Technicals and Volume Confirm: Lack of Systematic Breakthrough

From a trading structure perspective:

Most mainstream altcoins are still hovering below key resistance zones;

DEX trading volume is slowly climbing, but far from explosive;

On-chain capital flows do not show signs of widespread rotation.

In other words, what we are seeing now is only localized speculation and structural rebounds,

not a fully launched Altseason.

Conclusion:

The Bitget COO’s “no Altseason theory” is not alarmist.

Against the backdrop of limited macro liquidity, rational institutional allocation, and unrecovered retail confidence,

this cycle looks more like a “Bitcoin-Dominant Cycle”

rather than the all-out altcoin frenzy of 2021.

However, this does not mean there are no opportunities.

On the contrary, it means:

Funds will concentrate on a few projects that truly have narrative, technology, and liquidity support.

In the coming months,

investors should shift from “chasing pumps” to “selecting quality sectors,”

and look for strong coins with sustainability in a structural market.

✅ In one sentence:

“This is not an Altseason where everyone can make money, but a structural bull market where only a few understand rotation.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.