Why smart investors are starting to "gradually lock in profits" instead of blindly chasing highs at this moment

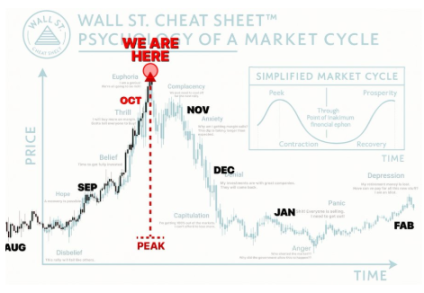

The heat of the crypto market is entering a dangerous zone.

Whether from on-chain data, sentiment indicators, or crowd behavior curves, the current stage is extremely similar to the late stages of the previous three bull market cycles.

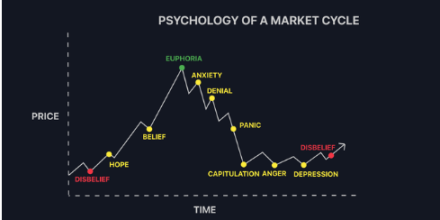

Most investors still repeat the same mistake: holding positions for too long, not selling at the top, and panic selling after a crash.

The real winners often start quietly taking profits when others are greedy.

1️⃣ The market is already near the top

From on-chain activity, net inflows to exchanges, to social media sentiment indicators, all are repeating the signs seen before the last bull market peak.

Investors are generally immersed in the illusion of "this time is different," forgetting the similar logic before every bubble bursts.

Thinking about an exit plan now is much more rational than panic selling after a -70% drawdown.

2️⃣ Lack of discipline, not emotional loss of control

Almost everyone knows to "buy low and sell high,"

but very few have actually defined: when is the moment to 'sell high'?

At the moment you enter the market, you should set up your take-profit mechanism.

Without a clear profit realization plan, greed and fear will take over your decisions.

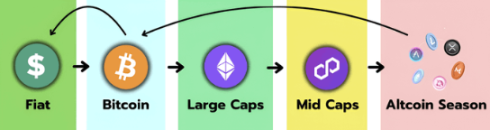

3️⃣ The sequence of market rotation is already predetermined

The growth rhythm of the crypto cycle has hardly ever changed:

BTC → ETH → large-cap altcoins → small-cap altcoins

The final stage of each cycle is when most people lose the most.

The "end-of-cycle carnival" in media and social networks only makes retail investors believe even more—

"This bull market will never end."

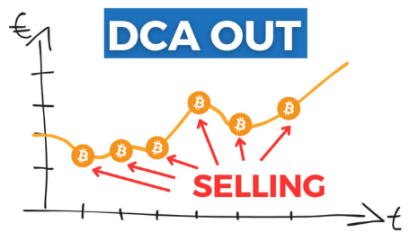

4️⃣ The lowest-risk profit-taking strategy

True experts do not wait for the market to turn before selling.

Locking in profits in batches is the most effective risk control method:

📊 Sell 30% before the frenzy

🚀 Sell 30% during the extremely optimistic phase

🔁 Sell another 30% during the "one last pump"

🎯 Leave the last 10% for high-risk bets

This strategy can ensure returns while minimizing emotional risk.

5️⃣ Observe the moves of "smart money"

At the top in 2021, whales had already sold off massively on-chain,

while retail investors were still cheering that "new highs are just the beginning."

Institutional funds never wait for the last wave—they exit earlier and faster than you.

6️⃣ Three major warning signals at the end of the cycle

To judge whether the market has entered the peak stage, focus on the following indicators:

The Fear and Greed Index enters the extreme greed zone

Altseason Index above 75

**BTC market cap dominance (BTC.D)** drops rapidly

When these three appear simultaneously, history tells us:

The final celebration is about to end.

7️⃣ Three common mistakes investors make

No gradual exit, but a one-time decision

Trying to perfectly time the top, resulting in missing the selling point

Exiting completely and missing opportunities, or holding everything and getting trapped

The market is not a zero-sum game of "all in or all out,"

True wisdom lies in balance, rhythm, and discipline.

8️⃣ The "temptation trap" at the market top

When the market enters its peak, prices often see several short-term surges,

attracting investors to re-enter.

But no one can predict which "surge" will be the last.

A single wrong heavy chase at the top could evaporate 60%-70% of your profits in just a few days.

9️⃣ What you should do right now

✅ Review your investment portfolio

✅ Analyze the current market structure

✅ Assess your risk tolerance range

✅ Set clear take-profit and exit targets

The earlier you plan, the more assets you can preserve.

Conclusion:

The market is approaching the end of the cycle.

The winners are not those who "hold on to the end,"

but those who exit the market with discipline and a plan.

In the crypto market, profits are only real after they are realized.

Taking action now may be the key to preserving your wealth and winning the next cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.