Date: Mon, Oct 13, 2025 | 07:30 AM GMT

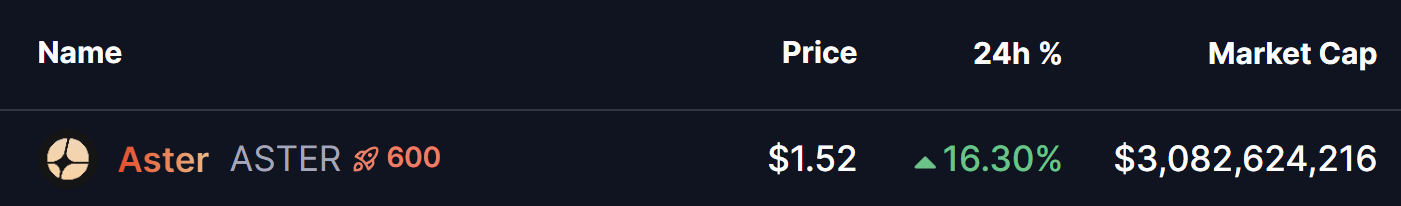

After one of the most unforgettable and painful events on Friday night that triggered over $19 billion in liquidations, the cryptocurrency market appears to be regaining strength. Ethereum (ETH) has bounced more than 9%, reclaiming the $4,175 market, and major altcoins are now showing early signs of recovery — including the decentralized exchange token Aster (ASTER).

Today, ASTER is back in the green with an impressive 16% surge, and more importantly, its technical chart is flashing a powerful bullish formation that may suggest a much larger move could be on the horizon.

Source: Coinmarketcap

Source: Coinmarketcap

Power of 3 Pattern in Play

On the 4-hour chart, ASTER is forming a classic “Power of 3” pattern, a setup often associated with smart money behavior — moving through three key stages: accumulation, manipulation, and expansion before a strong directional breakout.

Accumulation Phase

For several sessions, ASTER traded in a sideways range between $2.28 (resistance) and $1.52 (support). This period of consolidation represented the accumulation phase, where both buyers and sellers established positions while the price moved steadily within a tight range.

Manipulation Phase

During the recent market chaos, ASTER briefly broke below the $1.52 support, plunging to a low near $1.10 (highlighted in red). This drop mimics the typical “stop-hunt” seen in Power of 3 setups — where weak hands are flushed out before the market reverses sharply.

Aster (ASTER) 4H Chart/Coinsprobe (Source: Tradingview)

Aster (ASTER) 4H Chart/Coinsprobe (Source: Tradingview)

Expansion Phase Incoming?

After testing the lows, ASTER has bounced back above the $1.52 zone, reclaiming this level as support. This move signals that the expansion phase could be in progress, as buyers are stepping back in with renewed momentum.

What’s Next for ASTER?

The immediate hurdle now lies at the 100-hour moving average (MA) around $1.80, which has acted as dynamic resistance. A break and sustained close above $1.80 could confirm a bullish reversal, opening the door for a rally toward $2.28 — the upper boundary of the previous range.

If bulls manage to reclaim this zone with conviction, the Power of 3 projection points toward a potential upside target near $3.41, derived by measuring the height of the accumulation range and extending it from the breakout point.

On the flip side, failure to hold $1.52 may delay or invalidate this bullish scenario, keeping ASTER confined within its broader consolidation pattern for a while longer.