Crypto VC Inflows Reach $3.48 Billion Weekly Record as Institutions Pile In

Venture capital inflows into crypto soared to a record $3.48 billion last week, led by Pantera and Hack VC. The shift toward CeFi and infrastructure highlights a maturing market focused on long-term, utility-driven growth.

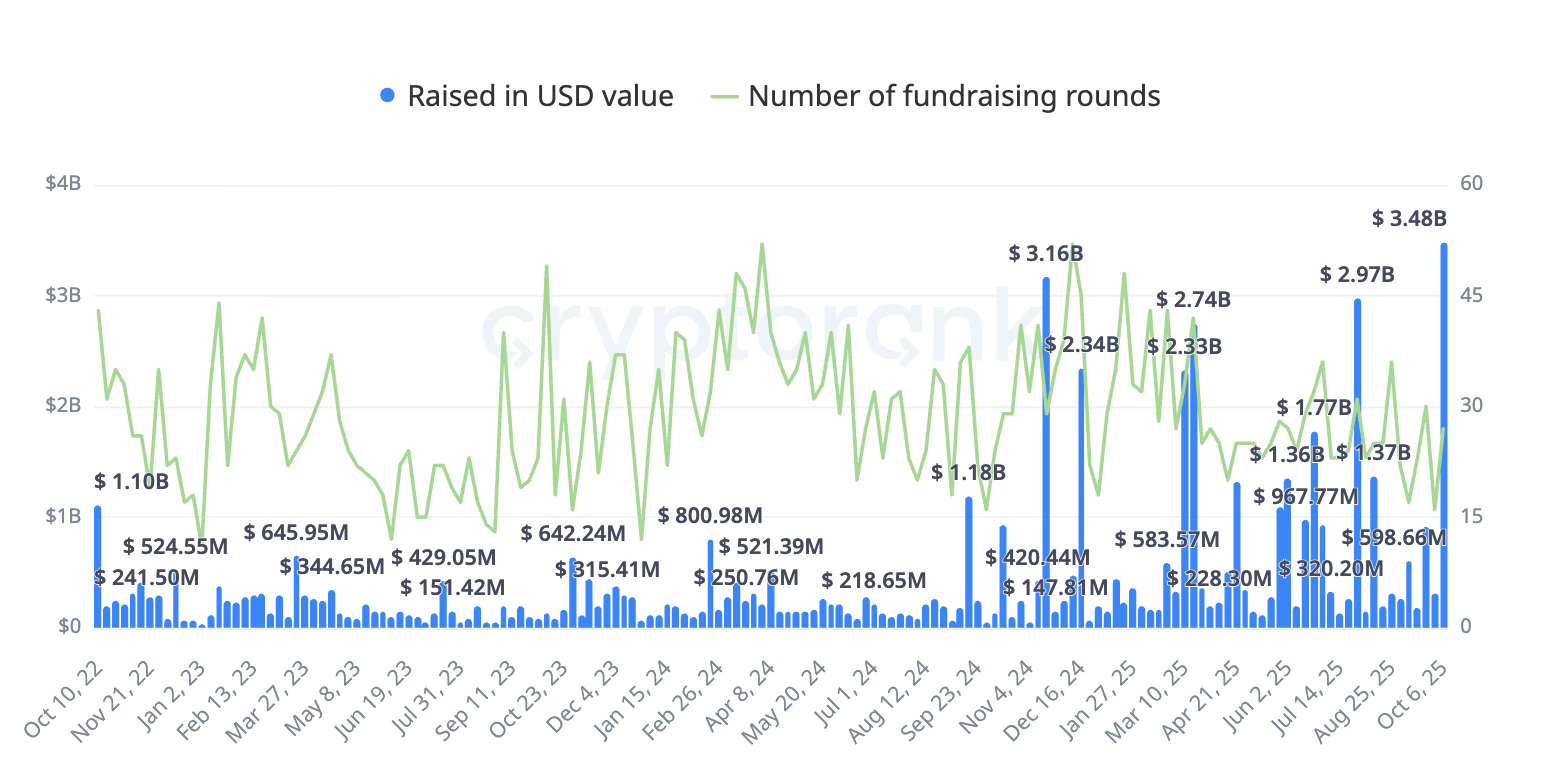

The cryptocurrency sector witnessed a surge in venture capital inflows last week, with fundraising totaling $3.48 billion, marking a new weekly record high.

This milestone highlights how major venture capital firms and institutional giants are increasing their investments in the blockchain space.

Venture Capital Flows Into Crypto at Record Pace

According to CryptoRank, between October 6 and 12, crypto venture fundraising hit $3.48 billion, surpassing the previous ATH of $3.16 billion set in November 2024. The record haul encompassed 27 funded projects and companies, reflecting broad participation across the ecosystem.

Crypto VC Fundraising in October. Source:

CryptoRank

Crypto VC Fundraising in October. Source:

CryptoRank

Pantera Capital emerged as the most active participant, closing four rounds, including two in which it took the lead. Hack VC followed closely, spearheading two investments.

Other prominent firms, each leading one round, included General Catalyst, Road Capital, Delphi Ventures, Sequoia Capital, Andreessen Horowitz (a16z), and Galaxy. The blockchain services category dominated activity, accounting for 12 rounds. Centralized finance (CeFi) followed with 6 rounds.

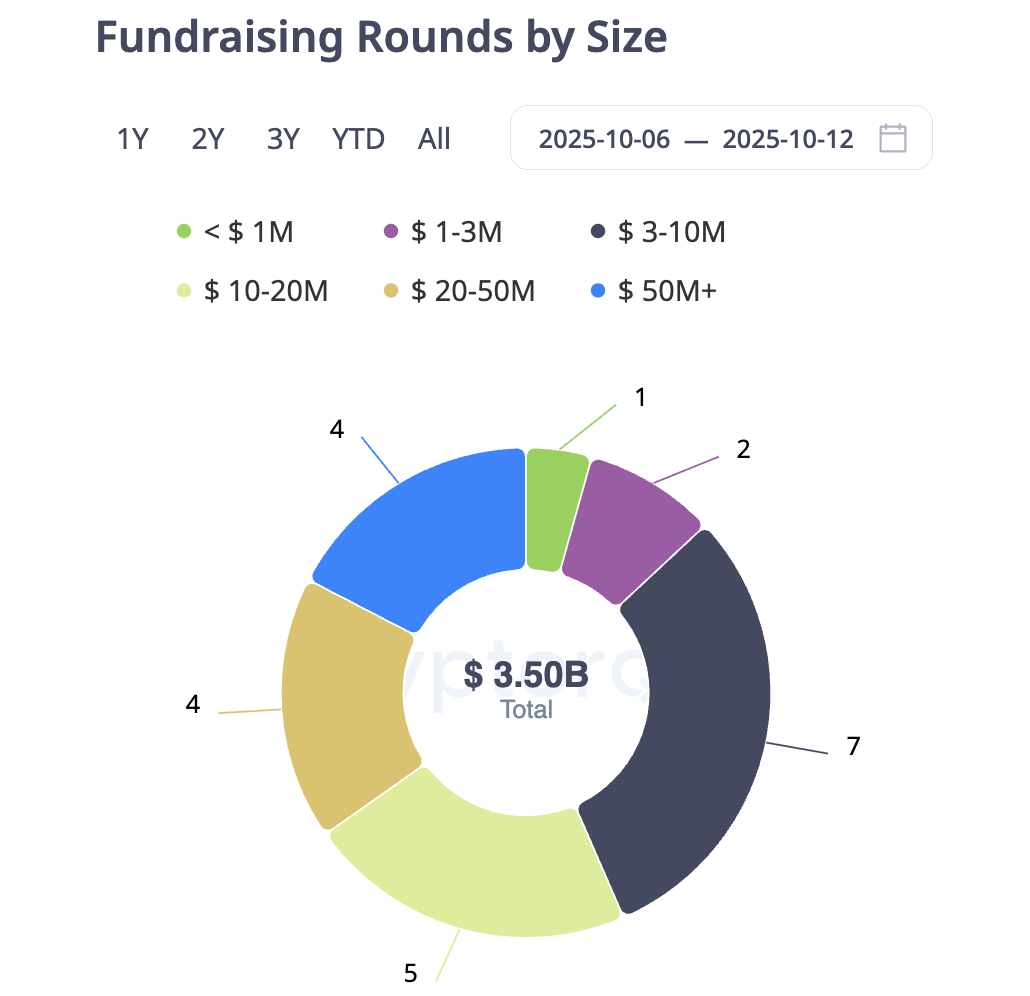

The most common funding bracket during the week was the $3–10 million range, which accounted for 7 rounds. Another 5 rounds fell within the $10–20 million range. Larger rounds also played a significant role.

There were 4 fundraises each in the $20–50 million and $50 million+ categories. This contributed heavily to the overall record total.

Crypto VC Fundraising Rounds Size in October. Source: CryptoRank

Crypto VC Fundraising Rounds Size in October. Source: CryptoRank

Notably, this weekly peak builds on a strong third quarter for crypto venture funding, which tallied $8 billion across 275 deals. While this was marginally below the $10 billion achieved in the second quarter, it still ranked among the strongest periods since 2021. CryptoRank stressed that the slight downturn from Q2’s heights suggests a maturation phase rather than contraction.

“The modest decline signals a healthy normalization after two consecutive quarters of growth rather than a reversal of momentum,” the report read.

Moreover, CeFi and blockchain infrastructure captured over 60% of Q3 funding, driven by projects emphasizing cash flow generation and regulatory compliance. In contrast, decentralized finance (DeFi) and blockchain-specific initiatives secured approximately 25%.

Meanwhile, GameFi, non-fungible tokens (NFTs), and SocialFi combined for less than 10%. This reallocation signals a departure from hype-driven narratives toward models with verifiable economic utility.

Looking ahead, CryptoRank projects $18–25 billion in total venture inflows for 2025, positioning it as the strongest year since 2021.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Cultural Dynamics of Technology: How Insights into Society Drive Innovation and Investment Achievements

- Cultural anthropology is reshaping tech innovation by integrating human behavior insights into AI design, education, and investment strategies. - STEM programs at institutions like Morehouse and Howard use culturally responsive curricula to boost Black student retention and drive inclusive innovation. - Mentorship initiatives like AUGMENT and Google's programs link cultural intelligence to 2-3x higher success rates in tech transformations, generating $4.50 ROI per dollar invested. - AI-first companies em

New Prospects in Higher Education Programs Fueled by STEM

- U.S. higher education is reorienting STEM programs to align with labor market demands, addressing a projected 1.4M worker shortfall by 2030 through workforce-ready curricula and industry partnerships. - Education ETFs, private equity, and university endowments are increasingly investing in STEM-focused institutions, driven by sector growth rates 3.5x higher than non-STEM fields and scalable digital learning platforms. - Systemic inequities in STEM are being tackled via mentorship programs and basic needs

The Emergence of DASH Aster DEX and Its Impact on the Decentralized Finance Sector

- Aster DEX, a BNB Chain-based DeFi platform, achieved $1.399B TVL and $27.7B daily trading volumes in Q3 2025, redefining institutional-grade decentralized trading. - Its hybrid AMM-CEX model and ZKP-enabled privacy attracted 2M users, with 77% transactions masked, while institutional adoption grew via RWA tokenization and cross-chain upgrades. - Regulatory clarity (MiCA/CLARITY Act) and innovations like Aster Chain (10k TPS) position DeFi as a capital-efficient alternative to traditional finance, despite

BlackRock CEO Larry Fink: Sovereign Wealth Funds Are Buying Bitcoin During Price Declines