Date: Sun, Oct 12, 2025 | 05:45 PM GMT

After one of the most unforgettable and painful events on Friday night that wiped out nearly $19 billion in liquidations , the cryptocurrency market is showing early signs of recovery today. Ethereum (ETH) has jumped more than 8%, reclaiming the $4,100 mark, and major altcoins are beginning to follow the upside momentum — including Injective (INJ).

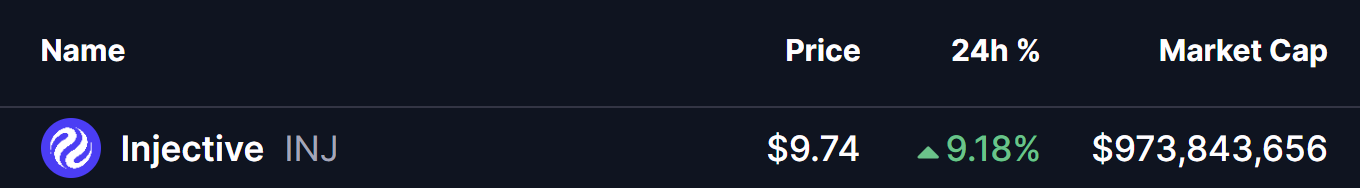

INJ is back in green, climbing nearly 9% today, and this rebound came exactly from a key support level that could play a decisive role in shaping the token’s next move.

Source: Coinmarketcap

Source: Coinmarketcap

Falling Wedge Pattern in Play

On the weekly chart, INJ appears to be forming a falling wedge pattern — a technical structure that typically signals selling exhaustion and often hints at a potential bullish reversal ahead.

The recent sell-off pushed INJ down toward the wedge’s lower boundary near $2.74, which has so far acted as a crucial bottom. From that zone, the token has managed to bounce back toward $9.73, showing that buyers are beginning to step in and defend the area aggressively.

Injective (INJ) Weekly Chart/Coinsprobe (Source: Tradingview)

Injective (INJ) Weekly Chart/Coinsprobe (Source: Tradingview)

However, bearish sentiment hasn’t completely disappeared. INJ could still consolidate sideways for some time as traders continue to digest the recent volatility before attempting a breakout.

What’s Next for INJ?

INJ is now showing early signs of a bullish reversal setup, but before confirming a breakout, the token might continue to trade within its narrow range as momentum gradually builds. If buying pressure strengthens near the wedge’s lower boundary, INJ could stage a breakout above the upper resistance trendline — a move that may set the stage for a broader trend reversal.

In that case, the next key upside target would be around the 100-day moving average (MA) at $21.13, a crucial technical level that could decide the token’s mid-term direction.

A sustained move above this MA would confirm that INJ has regained bullish momentum, potentially marking the start of a strong recovery phase after the market-wide crash.