- User activity and market cap surge as new decentralized apps drive Solana’s rapid growth.

- XRPL’s new token standard boosts institutional adoption and strengthens XRP’s long-term utility.

- Rising liquidity, exchange outflows, and institutional interest position AVAX for strong market performance.

The crypto market is once again heating up, and savvy investors are already planning for the next altcoin season. While many tokens are prone to heating up and falling with hype around the market, there are a few projects with excellent fundamentals and growing utility that are more than market price movements. These protocols do deliver on development and progress. Each of Solana, Ripple, and Avalanche has something unique to add to the space, but they share one common characteristic—momentum.

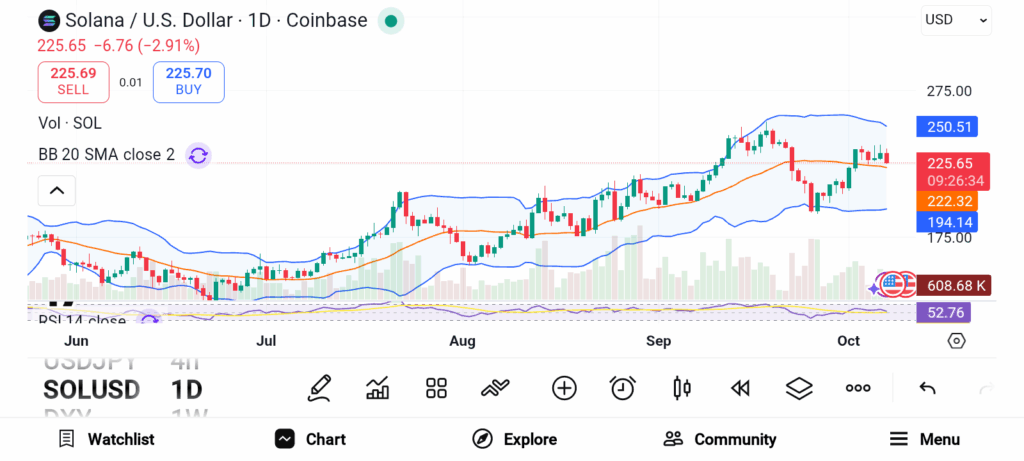

Solana (SOL)

Source: Trading View

Source: Trading View

Solana’s SOL is undoubtedly among the strongest contenders in the market. In just a week, the network grew rapidly from 1.7 million daily active users to nearly 2.4 million. A 35% rise indicates how fast the activity is rising. This appears to be a growing trend that correlates to emerging decentralized applications, and in turn has likely brought users and developers to the platform.

Additionally, during this timeframe Solana’s market cap grew by $22 billion. This surge brings the project closer to its previous all-time highs, and also demonstrates investing confidence in its future. Solana is one of the fastest growing – easy to use but also low cost – projects making it one of the most efficient blockchain projects at this time.

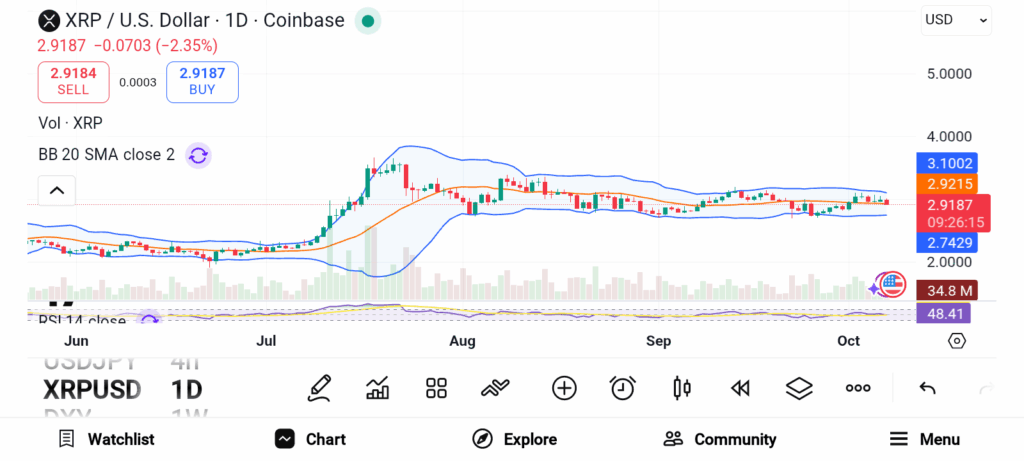

Ripple (XRP)

Source: Trading View

Source: Trading View

Ripple is catching up with investors once again with a new round of updates to the XRP Ledger — XRPL . The newly launched Multi-Purpose Token (MPT) Standard is clearly a significant leap forward for enterprise-grade tokenization, incorporating compliance features such as asset freezing and identity-linked transfers as native functionality of the network.

With these features, the XRPL becomes a highly attractive platform for institutions to enter the tokenized finance space. Every transaction on the XRPL incurs a very small amount of XRP as a burn, leading to an overall gradual reduction of supply. So as XRPL achieves greater adoption, it increases scarcity.

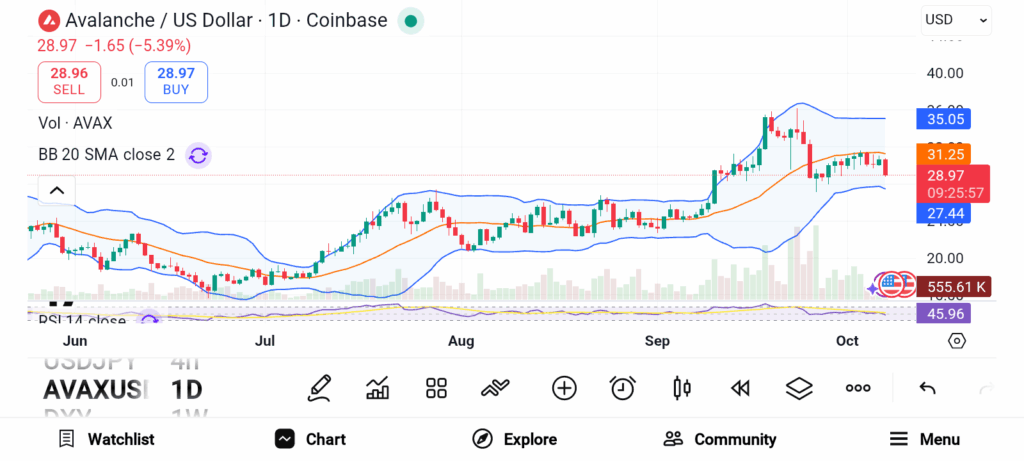

Avalanche (AVAX)

Source: Trading View

Source: Trading View

Avalanche’s AVAX is quietly building serious momentum. Exchange outflows recently hit nearly $10 million, hinting that holders are moving AVAX off exchanges, reducing selling pressure. On the decentralized exchange front, activity now averages around $500 million daily. That level of liquidity reflects strong demand within the ecosystem.

The Avalanche Foundation’s $1 billion AVAX Treasury program also reflects confidence. With $460 million already secured in front of the planned $675 million SPAC listing, institutional interest is ramping up. Smart contract deployments have tripled year-over-year, reinforcing developer interest. Prices continue to trade tightly around $30 indicating strong support ahead of any potential breakout.

Solana is leading the pack with speed, scale, and increasing developer engagement. Ripple is reinventing institutional tokenization with intuitive built-in compliance. Avalanche is cementing its rationale with increasing liquidity and institutional engagement. Collectively these three altcoins reflect the real-world progress they’re making with solid technical advancement.