Will XRP Price Crash to $0.60 as Trade Tensions and Inflation Delays Rattle Markets?

The XRP price is walking into a storm. A delayed U.S. inflation report, a renewed trade war between the world’s largest economies, and panic-driven selling across crypto charts ; it’s all happening at once. XRP has already broken below key support levels, and traders are wondering whether the next stop could be $0.60. Let’s unpack what’s really going on and what might come next.

XRP Price Prediction: Inflation Report Delay Meets a New Trade War

Markets hate uncertainty, and right now, there’s plenty of it. The Bureau of Labor Statistics has postponed its crucial September inflation report to October 24 due to the government shutdown. That means investors are flying blind on one of the most important indicators guiding Federal Reserve policy.

Then came another shock: President Donald Trump reignited the U.S.-China trade war , announcing a 100% tariff on Chinese goods starting November 1. In response, China restricted its exports of rare earth minerals — a vital resource for U.S. tech manufacturing. Together, these moves are shaking global confidence.

For crypto traders , this isn’t just macro noise. Trade wars and inflation uncertainty directly hit risk appetite. When the global economy looks fragile, liquidity dries up, and speculative assets like XRP take the hardest punch.

How Macro Events Are Crushing XRP Price Sentiment?

XRP’s decline isn’t happening in isolation. The inflation delay means investors have no updated CPI data to anchor their expectations. If inflation turns out higher than expected later this month, it could kill any chance of the Fed delivering another rate cut in October.

Meanwhile, tariffs tend to push consumer prices higher — meaning more inflation pressure just as the Fed tries to ease policy. This combination is dangerous for crypto because higher inflation and higher tariffs both lead to a stronger dollar, squeezing digital assets further.

In short, until Washington gets clarity on inflation and trade, the market is in risk-off mode — and XRP price is caught in the crossfire.

XRP Price Prediction: A Breakdown in Progress

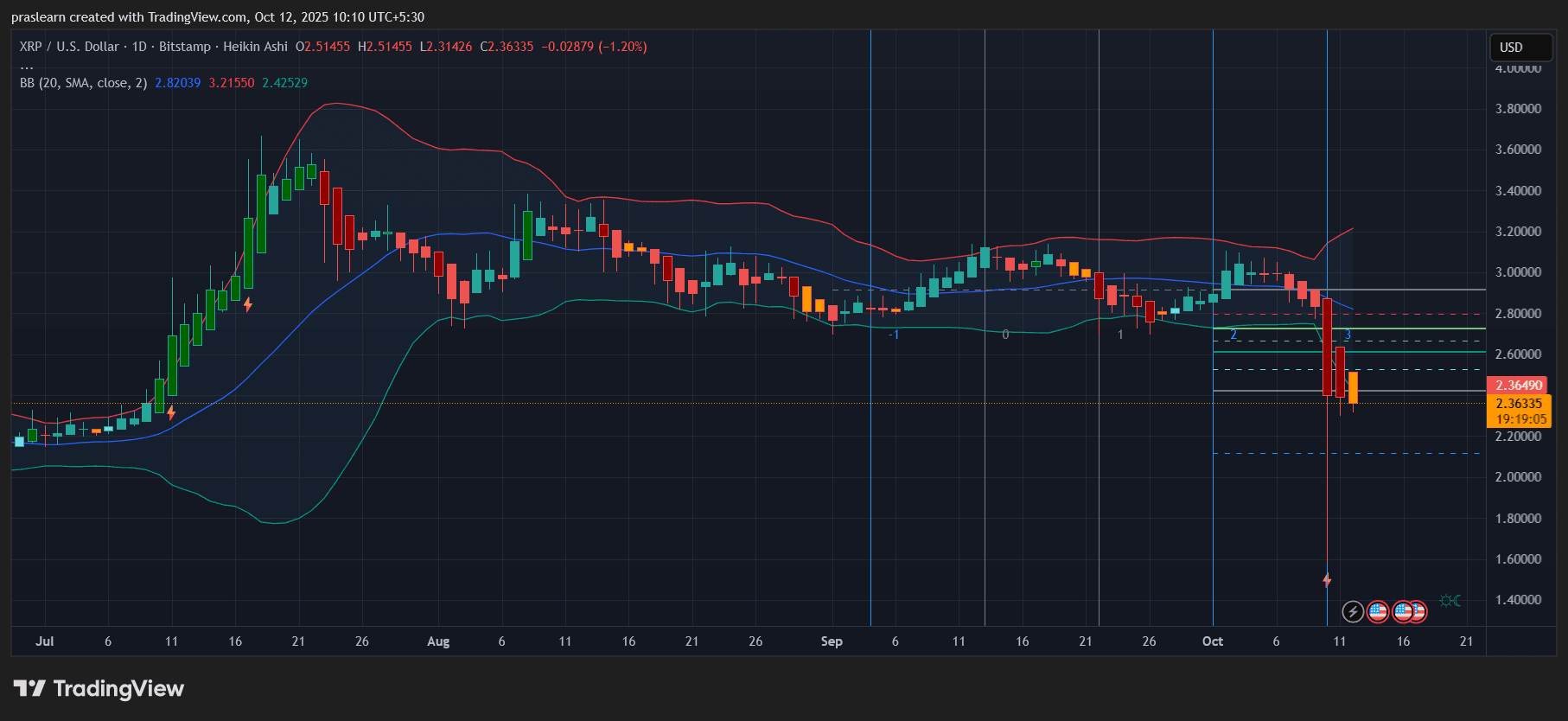

XRP/USD Daily Chart- TradingView

XRP/USD Daily Chart- TradingView

Now, let’s talk technicals. The daily XRP price chart shows a clear breakdown below the middle Bollinger Band around $2.82. The price is hugging the lower band near $2.36, with Heikin Ashi candles flashing deep red — a strong indicator of sustained selling momentum.

Earlier this week, XRP’s intraday wick even touched near $1.60 before buyers stepped in. That’s not random volatility — that’s panic-selling capitulation. If the market loses $2.20 support decisively, there’s little standing in the way of a slide toward the $1.50–$1.00 zone. And if macro pressure escalates, that speculative $0.60 level becomes more plausible than most traders want to believe.

Bollinger Bands are widening, confirming volatility expansion. This setup often precedes large directional moves. Given the bearish fundamentals, the odds lean toward another leg down before any meaningful recovery.

Trade War Impact on the Broader Crypto Market

The 100% tariff threat is not just about China — it’s about investor confidence. When trade barriers go up, risk capital goes down. The last time tariffs spiked during Trump’s first term, global equities and crypto both entered correction phases.

If China retaliates by dumping U.S. bonds or tightening rare earth exports further, it could trigger another wave of global sell-offs. That’s bad news for Bitcoin’s correlation-sensitive assets like XRP. While Bitcoin may find safe-haven bids, altcoins typically underperform in such macro turmoil.

For XRP price, whose momentum depends heavily on sentiment and liquidity, this macro tension could amplify the downside risk dramatically.

What Could Prevent a Full XRP Collapse?

There’s still a potential lifeline. If the CPI report (due Oct. 24) shows inflation cooling sharply, the Fed could justify another rate cut by month-end. That would weaken the dollar, restore some risk appetite, and spark a short-term relief rally in crypto.

Technically, XRP could then rebound toward the $2.80–$3.00 resistance zone. But the strength of that rally would depend entirely on macro stability — not just crypto momentum.

In other words, any bounce before the inflation data would likely be a trap. Long-term investors should watch for confirmation of support holding above $2.20 before assuming the bottom is in.

XRP Price Prediction: XRP’s Fragile Position in a Volatile Macro Storm

What this really means is that XRP price is trading inside a perfect storm — no reliable inflation data, a renewed U.S.-China trade war, and uncertain Fed policy. All three forces are compressing liquidity and amplifying fear.

XRP’s chart structure looks fragile, and its fundamentals aren’t strong enough right now to counter a global risk-off wave. The probability of testing $1.50 is high, and if macro conditions worsen in late October, a temporary capitulation to $0.60 cannot be ruled out.

That said, sharp declines often set the stage for explosive rebounds — once clarity returns. For now, traders need to stay nimble and avoid chasing every short-term bounce.

Bottom Line

October has become the month of uncertainty: no CPI clarity, no political consensus, and now, a revived trade war. $XRP sits at the intersection of all these pressures; a volatile asset in an unstable world.

Unless inflation cools and the Fed doubles down on easing, XRP’s path of least resistance is still downward. A relief rally might come later this month, but for now, the risk of another sharp leg down possibly toward $0.60 is very real.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dragonfly Partner’s heartfelt essay: Reject Cynicism, Embrace Exponential Thinking

The industry's focus is shifting from Silicon Valley to Wall Street, which is a foolish trap.

Vitalik's 256 ETH Bold Gamble: Privacy Communication Needs More Radical Solutions

He made it clear that neither of these two applications is perfect, and there is still a long way to go to achieve true user experience and security.

Polymarket: The Rise of Cryptocurrency Prediction Markets