Trump’s 100% Tariffs: Is This the End for Dogecoin?

Dogecoin price just got caught in the crossfire of global politics. President Donald Trump’s shock move to impose a 100% tariff on Chinese goods has reignited the U.S.-China trade war, spooking investors worldwide. Stocks are already tumbling, consumer sentiment has hit its lowest point since May, and traders are rushing out of risky assets. For meme coins like DOGE price, built more on hype than fundamentals, this is the perfect storm. The big question now isn’t whether Dogecoin can rally—but whether it can avoid a freefall that takes it dangerously close to zero.

Dogecoin Price Prediction: Why the Trade War News Matters for DOGE Price?

President Donald Trump’s sudden announcement of a 100% tariff hike on Chinese goods has reignited fears of a global trade war. The ripple effects are clear: higher inflation, a weaker job market, and investors rushing away from risky assets. For cryptocurrencies like Dogecoin price, which thrive in speculative environments, this kind of macroeconomic tension often triggers sharp volatility.

The connection is simple. Tariffs fuel uncertainty. Uncertainty weakens consumer confidence and drains liquidity from markets. When people feel jobs and savings are at risk, they stop gambling on meme coins.

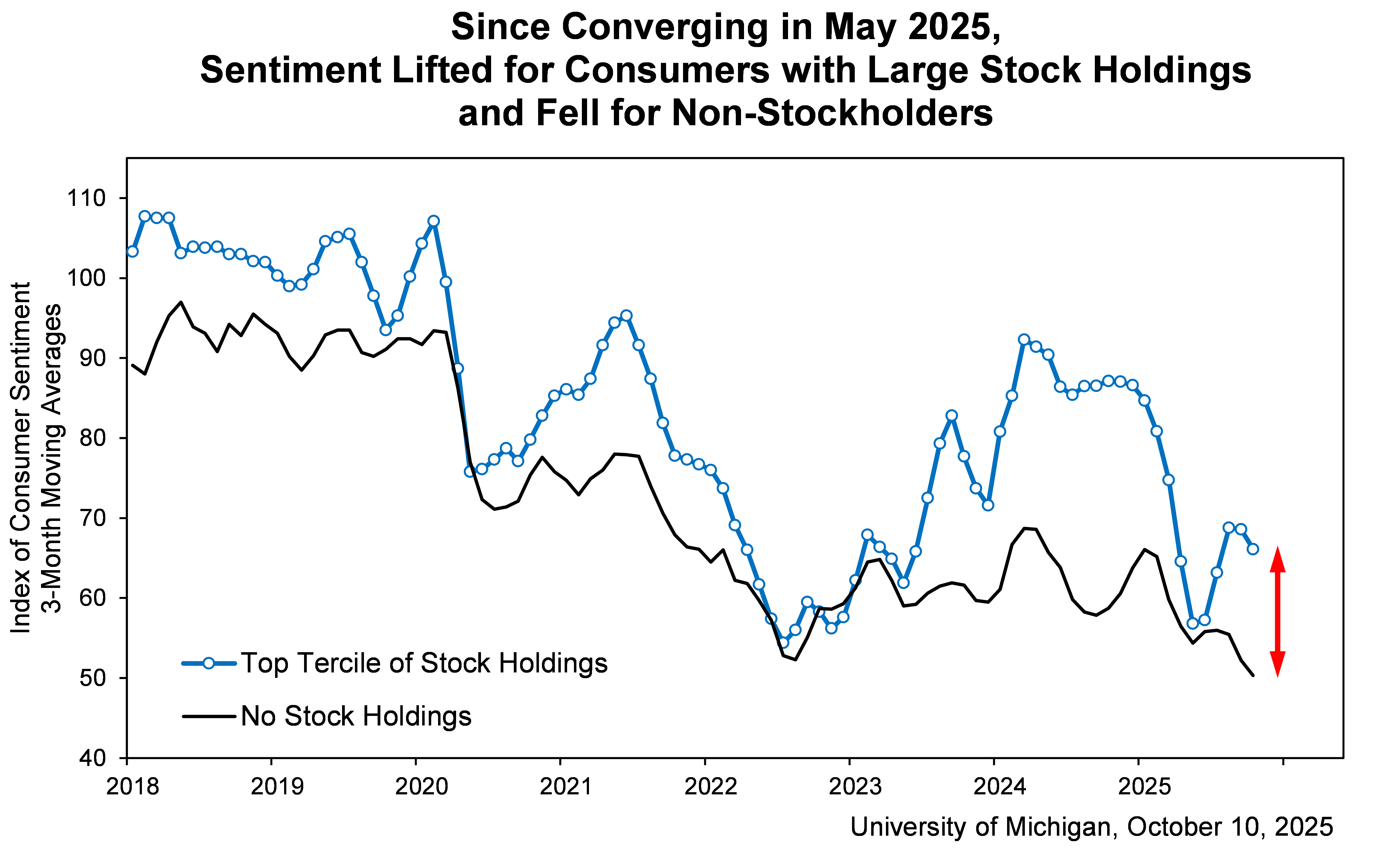

What the Consumer Sentiment Data Tells Us?

The latest Michigan Consumer Sentiment Index slipped again in October, marking the lowest reading since May. That month also saw a sharp market reaction to Trump’s earlier tariff threats. Now, with trade tensions back on the table, consumer psychology is clearly fragile.

Why does this matter for DOGE price? Because sentiment drives flows into risk assets. When optimism is scarce, retail traders tighten their exposure, and meme coins like Dogecoin feel the pressure first.

DOGE Price Chart Analysis: Bearish Signals Pile Up

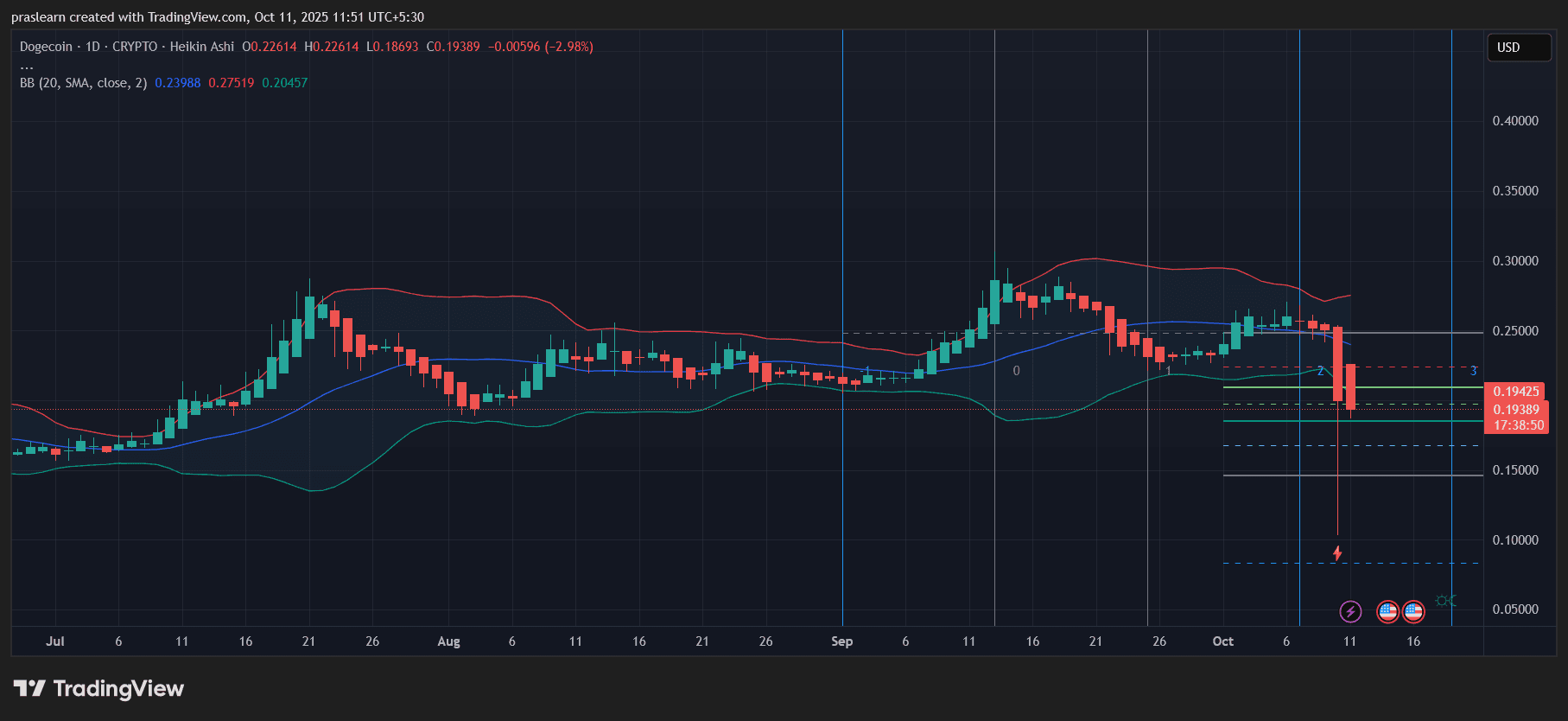

DOGE/USD Daily Chart- TradingView

DOGE/USD Daily Chart- TradingView

Looking at the daily DOGE price chart:

- Dogecoin price has broken sharply below the mid-Bollinger Band (0.23), with momentum pushing it near the lower band at 0.20.

- Yesterday’s long red candle sliced through support zones, showing strong selling pressure.

- A wick down to 0.15 signals panic selling levels traders are watching closely.

The key support is at 0.18–0.15. If this zone breaks decisively, DOGE risks cascading further toward 0.10, and from there the psychological fear of “zero” becomes a headline driver.

Dogecoin Price Prediction: Could DOGE Price Really Crash to Zero?

Technically, no. Dogecoin price is too widely held, too liquid, and has a strong retail following . But “crash to zero” in trader language means an asset could collapse to near-worthless levels compared to its recent highs. For DOGE, that could look like a plunge back to 0.05 or even lower if global risk-off sentiment deepens.

The bigger risk is perception. If macro headwinds continue to hammer equities, commodities, and jobs, speculative meme coins will become the first assets dumped. In such a climate, DOGE can easily lose 70–80% of its current value.

What to Watch Next?

Trump’s tariffs officially kick in on November 1. Expect heightened volatility before and after that date. If China retaliates further with rare earth restrictions, high-tech and crypto markets could sink together. Consumer sentiment trends will be key. Another sharp drop in November would confirm a retreat from risk assets.

Dogecoin Price Prediction: The Next 30 Days for DOGE

In the short term, $Dogecoin looks vulnerable. Unless buyers defend the 0.18–0.15 support band, DOGE could slide toward 0.10. Any relief rally will likely struggle to push beyond 0.25 given the macro backdrop.

Longer term, $DOGE isn’t headed to literal zero, but the narrative of collapse could dominate headlines as the trade war escalates. Expect extreme volatility, panic-driven dips, and short-lived rebounds. Traders should brace for turbulence, not stability.

📈 Want to Trade DOGE?

Start now on Bitget: Sign Up Here

Check Live DOGE Chart: DOGE/USDT on Bitget

or You an check the Crypto Exchange Comparison.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The "Five Tigers Competition" concludes successfully | JST, SUN, and NFT emerge as champions! SUN.io takes over as the new driving force in the ecosystem

JST, SUN, and NFT are leading the way, sparking increased trading and community activity, which is driving significant capital inflows into the ecosystem. Ultimately, the one-stop platform SUN.io is capturing and converting these flows into long-term growth momentum.

The End of Ethereum's Isolation: How EIL Reconstructs Fragmented L2s into a "Supercomputer"?

EIL is the latest answer provided by the Ethereum account abstraction team and is also the core of the "acceleration" phase in the interoperability roadmap.

Research Report|In-Depth Analysis and Market Cap of Stable (STABL)