Why Are Retail Investors Always Being "Rekt"? Understanding How Market Makers Operate

The primary function of a Market Maker is to provide liquidity, earn small bid/ask spread profits through two-way quoting, assist in efficient market pricing, and potentially influence prices through market manipulation.

Original Author: Sol you can't understand, KOL in Crypto

This sudden needle-like drop, many brothers say it's Binance market maker issue, including $PAXG, which is pegged to gold, also experienced a needle drop.

Why do many retail investors say they always buy at the top and sell at the bottom?

So, what is a market maker? And how does it operate?

1. Fee Rebates

2. Two-way quoting, earning a small spread profit after both sides are filled, accumulating meager profits. The essence lies in capturing liquidity using time and information latency.

3. Price discovery, assisting in efficient market pricing, providing liquidity

4. Playing as a market maker, manipulating the market, coordinating with news to sell liquidity to retail investors

The English translation of "做市商" is Market Maker. In other words: where there is no market, a Market Maker "makes" a market.

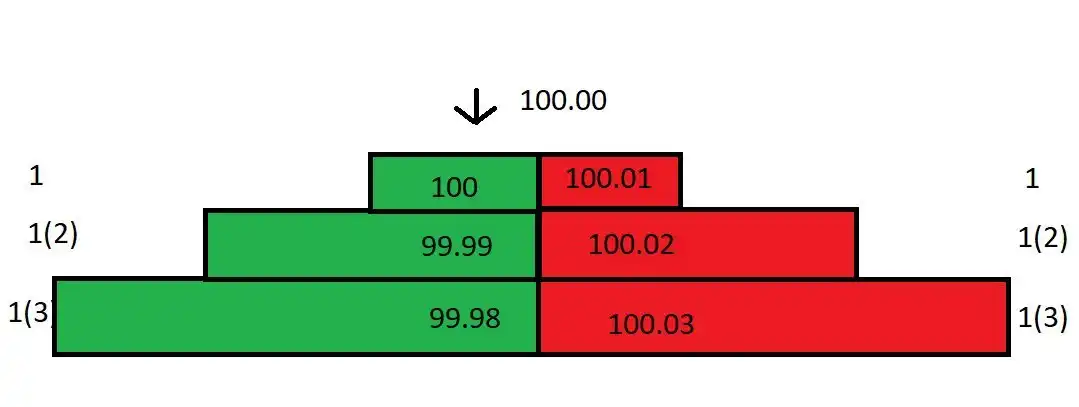

First, suppose you are a project's market maker. There is an order book that looks like this:

Let's make some assumptions: there are no other investors placing limit orders in this market, you are the sole liquidity provider in this market, meaning you are the only market maker; the smallest price tick size is 0.01; all takers pay a 0.025% fee, and all makers receive a 0.01% rebate.

You are a market maker, the maker of orders, for all orders that are market matched with you, you receive a 0.01% rebate.

The difference between the best bid and best offer price (best bid and best offer, referred to as bb/o) is called the spread, and the current order book's spread is 0.01.

Now, a market sell order comes in and matches your buy order at 100. You paid 100 for this trade, while the counterparty only received 100-0.025*100=99.975. Here, the 0.025 (100*0.025%) is the fee, and you can receive a 0.01% rebate from it. So, you effectively paid only 99.99.

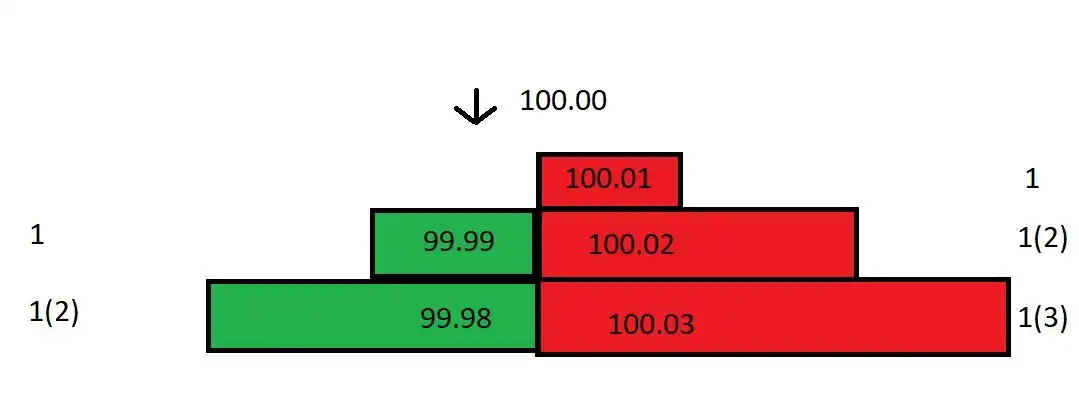

Since the buy one has been removed, the order book structure has changed, and now the spread is 0.02. However, the market price is still 100, as this is the price of the last trade:

If a buy order comes in at this moment, it will be matched with your sell one at 100.01. You bought at a price of 99.99 in the previous trade and are now selling at 100.01, making a profit of 0.02. With the addition of rebates, the total profit from this buy and sell can reach about 0.03.

Although the spread between your buy one (100) and sell one (100.01) is only 0.01, the actual profit is as high as 0.03!

If continuous market orders come in to match with your orders, you can earn 0.03 from each trade, accumulating wealth rapidly!

Unfortunately, the market did not develop as smoothly as you expected. After you bought at 99.99, the spot market price immediately dropped from 100 to 99.80. You quickly canceled your buy orders at 99.99 and 99.98 to avoid arbitrage by others.

As the price has now dropped to 99.80 while your sell one is still at 100.01, this price is too high, and no one will match with you at this price. Of course, you could lower your sell one to 99.81, but this would result in a loss of 0.17.

Don't forget, you are the only market maker in the market. You can fully utilize this advantage, adjust the order book, and minimize your losses!

You calculated at what price you could place a sell order to break even. Since you bought at 99.99 and want to sell at a breakeven price, your sell one should be placed at 99.98 (taking into account rebates, the effective price received is 99.99, breaking even).

So, you adjusted the order book, placing buy orders at 99.80 and 99.79 for the buy one and buy two, respectively, and placed a sell order at 99.98:

Despite the current large spread, being the only market maker in the market allows you to decide not to lower the sell order price. If someone is willing to match at the sell one price of 99.98, everyone is happy. If not, it's okay because your buy orders are already lowered to 99.80, and market orders will come in to match with yours.

At this point, a market buy order comes in and matches with your buy order. Now you hold 2 contracts, and the average cost of your position will be distributed as follows: (99.79 + 99.99) / 2 = 99.89. (In the previous transaction, we executed at a price of 99.99, and in this transaction, it was 99.79. The lower execution price compared to the buy order price is because of a 0.01% rebate on fees.)

OK, now the average position cost has been reduced to 99.89. You lower your ask price from 99.98 to 99.89. Suddenly, the significant spread has halved. Next, you can continuously perform these operations to gradually reduce costs and narrow the spread.

In the example above, the price only fluctuated by 0.2%. What if the price suddenly fluctuates by 5%, 10%, or even more? Even with the above method, it could lead to losses because the spread is too significant!

Therefore, a market maker needs to study 2 questions:

How much is the price volatility in different time windows?

What is the market's trading volume?

Volatility, in simple terms, is the degree to which the price deviates from its average, and price volatility varies under different time windows. A certain asset may experience erratic price movements on a 1-minute candlestick chart but exhibit a stable trend on a daily chart. Trading volume informs us about liquidity, which affects the order book's spread and transaction frequency.

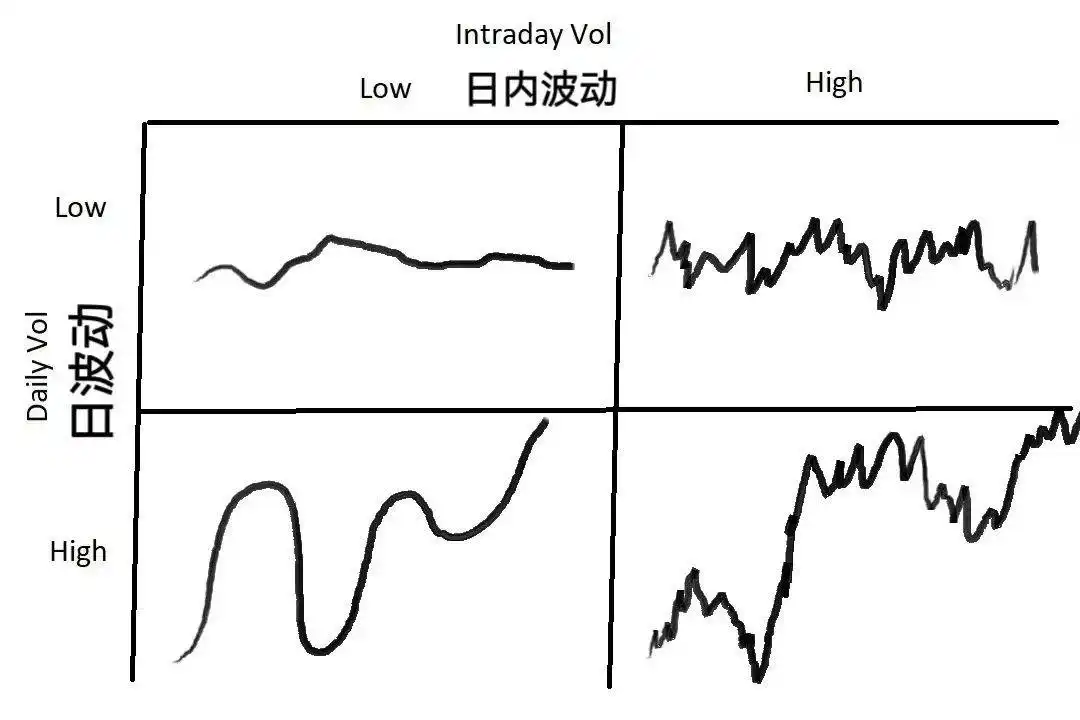

The above chart illustrates 4 types of price fluctuations, and market makers should choose different responses based on the varying volatility:

If the overall market volatility is low, with both daily and intraday volatility being minimal, you should opt for a smaller spread to maximize trading volume.

If the daily volatility is low but the intraday volatility is high (meaning the price experiences significant fluctuations without substantial changes), you can widen the spread and use larger order sizes. If the price moves against you, you can employ the cost-averaging method mentioned earlier to reduce losses.

If the daily volatility is high but the intraday volatility is low (indicating a stable price trend), you should use a smaller, tighter spread.

If both daily and intraday volatility are high, you should widen the spread and use smaller order sizes. This is the riskiest market scenario, often scaring off other market makers. However, within this crisis, there are also numerous opportunities. Most of the time, market makers earn stable profits, but when the market behaves erratically, it can break through one side of your order book, forcing you into a loss-making exit.

Market making trading has 2 key steps: determining the fair price and determining the spread.

The first step is determining the fair price, which is where to place your orders. Pricing is not only the first but also a crucial step. If your understanding of the fair price is too off, you might end up holding inventory that you can't offload and eventually have to close your position at a loss.

One way to price is by referencing the price of the asset in other markets. For example, if you are trading USD/JPY in the London market, you can refer to its pricing in the New York market. However, this pricing method becomes very unreliable if there are significant price fluctuations in other markets.

The second pricing method is using the mid-price, where the mid-price = (bid price + ask price) / 2. Pricing around the mid-price is a seemingly simple yet very effective method because the mid-price is the result of the market dynamics. Quote around mid, the market is probably right. Using the mid-price for pricing, the market is likely correct.

Aside from the two pricing methods mentioned above, there are many other pricing methods such as algorithmic models, market-depth-based pricing, which will not be detailed here.

The second concern for market makers is the spread. To determine the appropriate spread, you need to consider a series of questions: What is the average trading volume in the market? How large is the variance in this volume? What is the average size and variance of the take orders? What is the order book depth around the fair price, and so on. Additionally, you need to consider the price fluctuation and variance in a very short time window as the fees that market makers have to pay/get, other minor factors like interface speed, order cancellation speed, etc.

In a very short time frame, the profit expectation for market makers is actually negative because every taker order wants to transact with you when they have a price advantage unless it's a stop-loss order. Every other participant in the market wants to profit from you.

Imagine you are a market maker. Where would you place your orders?

To capture the maximum spread while ensuring your orders can be filled, you need to place your orders at the forefront of the order book, i.e., at the bid/ask prices. As soon as the price moves, your order at the bid price will quickly be filled. However, frequent price movements are detrimental — for instance, right after you take on inventory, the price changes, and your sell order at the initial ask price might not get filled at the order price.

In a market with low liquidity and small price movements, placing orders at the best bid/ask can provide some level of security. However, this can lead to another issue — other market makers may identify your orders and tighten the spread, trying to outpace your orders with a tighter spread. Market participants will continue to aggressively narrow the spread until there is no profit left.

Now let's explore, from a mathematical perspective, how to determine the spread. Let's start with volatility. We need to understand the volatility of the asset's price/volume around its mean in very small time periods. The following mathematical calculations will assume that price movements follow a normal distribution, although this might deviate from reality.

Assuming a 1-second sampling period, taking the last 60 seconds as a sample, and assuming that the current mid-price mean is the same as it was 60 seconds ago (keeping in mind that the mean stays constant) with a standard deviation of 0.04 from the mean to the current price. Given our assumption of price movements following a normal distribution, we can further deduce that in 68% of the time, prices will fluctuate within 1 standard deviation ($-0.04 to +$0.04) from the mean; in 99.7% of the time, prices will fluctuate within 3 standard deviations ($-0.12 to +$0.12) from the mean.

Okay, let's quote a spread of 0.04 on both sides of the mid-price, making the spread equal to 0.08. In 68% of the time, prices will fluctuate within 1 standard deviation ($-0.04 to +$0.04) around the mean. So, for orders on both sides to be executed, the price must move beyond both sides, i.e., exceed 1 standard deviation. There is a 32% of the time (1-68% = 32%) when the price movement will exceed this range. Therefore, we can roughly estimate the profit per unit of time: 32% * $0.04 = $0.0128.

We can continue our deduction: If we place orders with a 0.06 spread (positioned 0.03 away from the mid-price on each side), corresponding to 0.75 standard deviations (0.03/0.04 = 0.75), the probability of price movement exceeding 0.75 standard deviations is 45%, estimating a profit per unit of time of 45% * 0.03 = $0.0135. If we place orders with a 0.04 spread (positioned 0.02 away from the mid-price on each side), corresponding to 0.5 standard deviations (0.02/0.04 = 0.5), the probability of price movement exceeding 0.5 standard deviations is 61%, estimating a profit per unit of time of 61% * 0.02 = $0.0122.

We find that placing orders with a 0.06 spread, i.e., at 0.75 standard deviations from the mean, can achieve the maximum profit, which is $0.0135! In this example, we look at scenarios of 1/0.75/0.5 standard deviations. Comparing them, placing orders at 0.75 standard deviations yields the highest profit. Further proving this intuitively, I used excel for different standard deviations to derive the expected returns and found that the expected returns form a convex function; this function reaches its maximum value around 0.75 standard deviations!

The above assumes that price fluctuations follow a normal distribution with a mean of 0, meaning the market's average return rate is 0. In reality, the mean price will vary. Mean deviation makes it harder for one side of the order book to be filled. When we hold inventory, not only do we lose money, but the expected profit margin also decreases.

In summary, a market maker's expectation consists of two parts: first, the probability that an order will be filled. For example, placing an order at 1 standard deviation will be filled 32% of the time. Second, the probability that an order will not be filled. For example, placing an order at 1 standard deviation, the price will move within the spread 68% of the time, causing the order not to be filled.

In cases where orders are not filled, the mean price is likely to change. Therefore, market makers must manage the "inventory cost," which can be seen as borrowing that incurs interest. As time passes, volatility increases, and borrowing costs rise. Market makers can use the average volatility of each period to develop a regression strategy and limit holding costs.

Finally, why do many retail investors say they always buy at the peak and sell at the bottom? This is not unfounded, and this article provides the answer!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How a Query from an Office Supplies Specialist Transformed a $12 Billion Trucking Approach

- A non-trucking board member's question prompted Ryder System to shift focus from leasing to targeting 80-85% of companies owning their own trucks. - The strategic pivot aligns with growing demand in long-haul freight driven by e-commerce, trade agreements, and tech innovations like IoT fleet management. - Industry consolidation and sustainability trends, including electric trucks, are reshaping competition as firms expand specialized services like temperature-controlled logistics. - Ryder's experience hi

Ethereum News Update: Disorder or Planning? Apeing's Early Sale Breaks the Typical Meme Coin Mold

- Apeing ($APEING) emerges as a structured meme coin contender with a verified whitelist presale offering 10,000% projected gains, contrasting chaotic market norms. - Bitcoin and Ethereum show mixed recovery signals while Pepe ($PEPE) and Bonk ($BONK) dominate headlines amid growing institutional interest in meme coins. - Apeing's hybrid model combines meme virality with AI-driven utilities and audited infrastructure, drawing comparisons to Ethereum's blockchain evolution. - Risks persist due to market vol

Bitcoin Updates: Major Institutions Increase Bitcoin Holdings During Price Drops While Solana ETFs Resist Market Downturn: Opportunity or Crisis?

- Institutional investors and presale participants are buying dips in Bitcoin , Solana , and BNB as market volatility creates accumulation opportunities. - Hyperscale Data (GPUS) boosted its Bitcoin treasury to $70.5M (77% of market cap), aiming to expand to $100M via dollar-cost averaging. - Solana ETFs defied broader outflows with $568M net inflows, contrasting Bitcoin's $3.7B ETF exodus and signaling shifting institutional risk appetite. - Market dynamics hinge on Fed policy, ETF stabilization, and tech

Bitcoin Updates: IMF Warns of Widespread Risks Amid Growing Popularity of Tokenized Finance

- IMF highlights tokenized finance's efficiency gains but warns of systemic risks like smart contract interdependencies and liquidity vulnerabilities. - Upcoming Chainlink ETFs signal growing institutional adoption, with Grayscale and Bitwise advancing regulated exposure to $100B+ oracle network assets. - Analysts predict over 100 new crypto ETFs in six months, but XRP's 18% price drop underscores market volatility despite regulatory approvals. - IMF anticipates regulatory frameworks to address cross-platf