Key Notes

- Ethereum and Bitcoin lead liquidation losses at $233M and $180M respectively, affecting nearly 200,000 traders forced from positions.

- Trump cites China's 69% control of rare earth production as justification for planned massive tariff increases and additional countermeasures.

- Altcoins including Litecoin and Zcash saw strong momentum before Trump's announcement suddenly invalidated technical analyses and reversed gains.

The cryptocurrency market is back in the red as Donald Trump threatens more tariffs on China, citing rare earths control and hostility. Long-position traders were the most affected, and total liquidations already surpass $770 million in the last 24 hours.

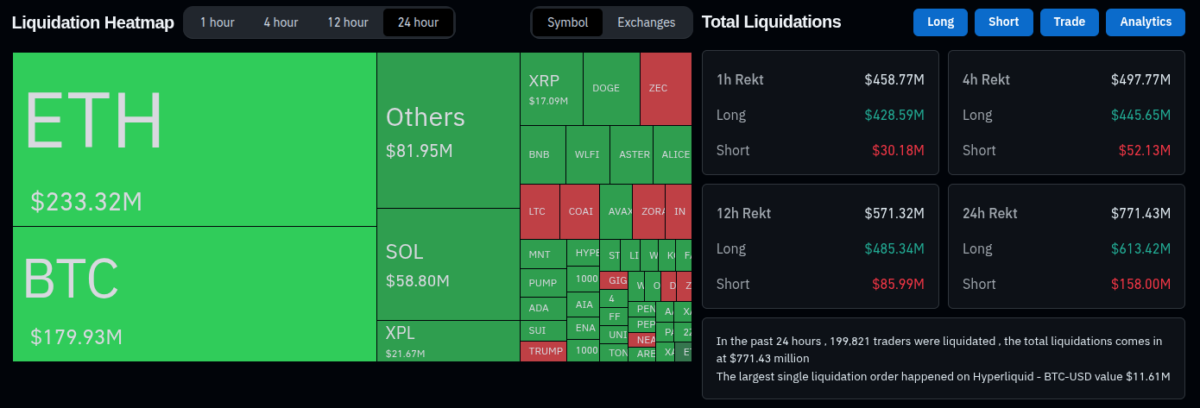

Data Coinspeaker retrieved from Coinglass on October 10 shows $771.3 million liquidations in the period, out of which $613 million were from long positions. Ethereum ETH $3 781 24h volatility: 13.2% Market cap: $456.02 B Vol. 24h: $101.80 B leads the realized losses with $233.32 million liquidated in 24 hours, and Bitcoin BTC $112 303 24h volatility: 7.5% Market cap: $2.24 T Vol. 24h: $177.13 B follows closely with $179.93 million.

Nearly 200,000 traders were affected and forced out of their positions, while the single largest liquidation happened in the BTC/USD pair on Hyperliquid, with a nominal value of $11.61 million. Hyperliquid has been one of the highest-volume perpetual exchanges in the crypto market, gaining significant relevancy in the space, providing open interest allocations for the largest whales.

Liquidation heatmap and total liquidations in the last 24 hours of October 10, 2025 | Coinglass

Trump-China Rare Earth and Tariffs Situation

The economic war between Donald Trump’s US and Xi Jinping’s China has, once again, escalated to public threats foreshadowing increased tariffs and other potential “countermeasures,” as Trump said.

A recent post by The Kobeissi Letter listed a few related developments on the situation. According to the post, President Trump mentions China’s rare earths control, with the country “becoming very hostile” around that topic, adding that the adversary is lying while “holding the world captive” in a “monopoly position.”

Per Donald Trump’s statement, the US is preparing a “massive increase of tariffs on Chinese products,” together with considering “many other countermeasures.” Like crypto, the US stock market now accumulates significant losses, making new weekly lows on the chart.

PRESIDENT TRUMP'S STATEMENT ON CHINA JUST NOW:

1. China is "becoming very hostile" and controlling rare earths

2. "Always felt that China is lying, and now, as usual, I have been proven right"

3. China is "holding the world captive" in a "monopoly position"

4. There is "no…

— The Kobeissi Letter (@KobeissiLetter) October 10, 2025

The Trump-China tension over rare earths stems from China’s dominant 69% share of global production in 2023, giving it leverage over critical materials used in EV batteries, defense systems, and tech, as noted by Polytechnique Insights in January 2025.

Discussions around China’s rare earth control have happened throughout the year, driving international relations negotiations and back-and-forths on tariff decisions.

With the recent escalation, most cryptocurrency-related analyses were suddenly invalidated, catching the market off guard and triggering massive liquidations. Before Trump’s statement, altcoin cryptocurrencies were showing strong momentum. For example, Litecoin LTC $98.57 24h volatility: 23.4% Market cap: $7.53 B Vol. 24h: $3.83 B was outperforming other coins with a 15% surge , and Zcash ZEC $223.7 24h volatility: 9.2% Market cap: $3.65 B Vol. 24h: $1.70 B made new local highs around $230 , accumulating over 600% gains year-over-year and over 300% month-over-month, per CoinMarketCap data in a snapshot earlier today .

Traders and investors now need to wait or position themselves accordingly, as macroeconomic developments and tariff war escalations impact all markets.