Shitcoin plunges over 80%, while who made a bloody fortune "buying the dip" in this epic crash?

$400 WBETH, $30 BNSOL... Have you copied it all down?

Original Title: "In the Midst of a Major Plunge, Who Made Billions Riding the Knife's Edge? What Near Opportunities for Sudden Wealth are Within Reach?"

Original Author: Azuma, Odaily Planet Daily

Following 3/12 and 5/19, it is certain that 10/11 will be a day written in cryptocurrency history.

Yesterday evening, due to President Trump's sudden tariff remarks, the global financial market experienced a sharp decline, and the cryptocurrency market similarly suffered a severe blow — BTC briefly dropped to 101,500 USDT, ETH briefly dropped to 3,373.67 USDT, SOL briefly dropped to 144.82 USDT, and BNB briefly dropped to 860 USDT.

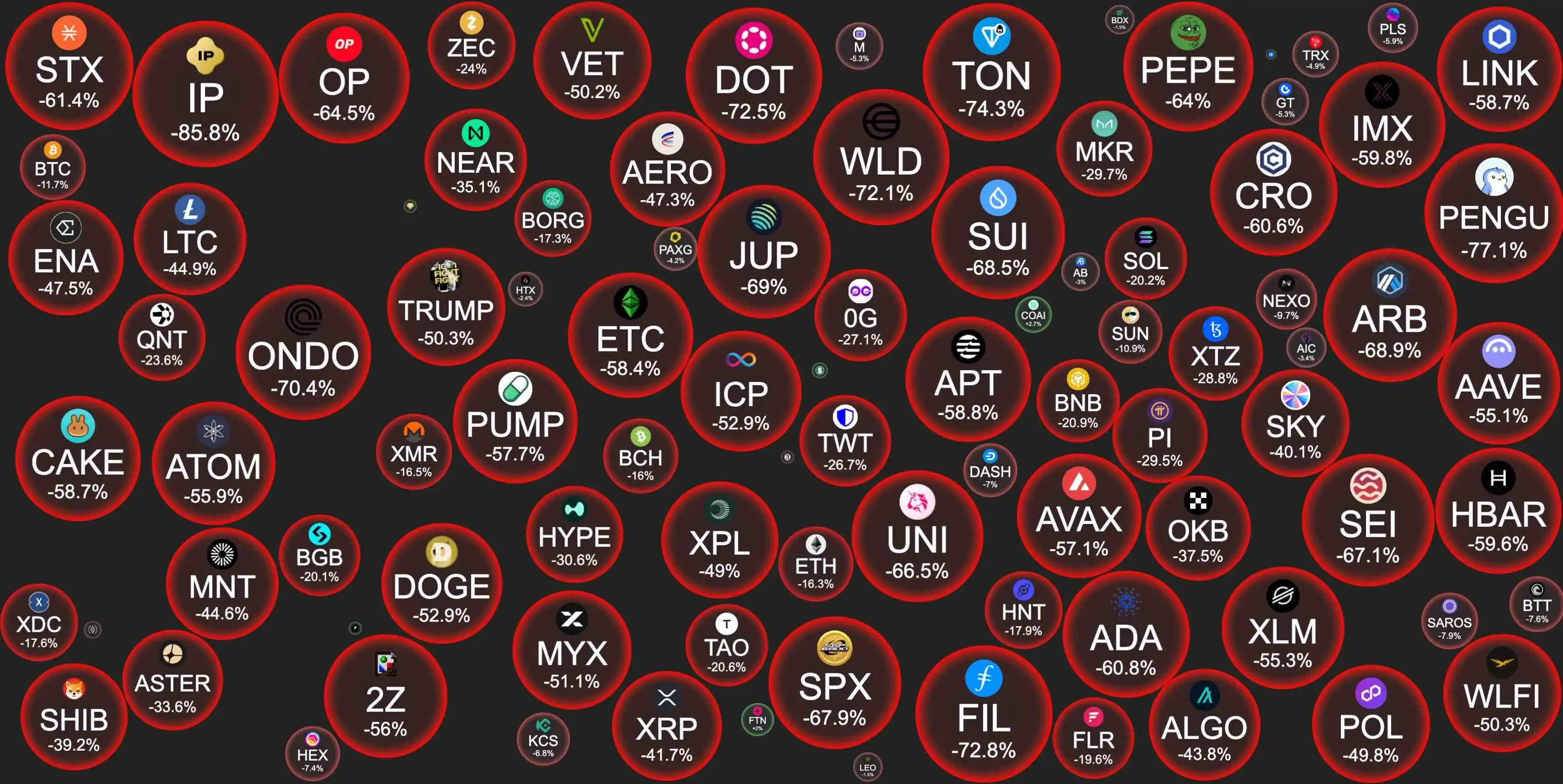

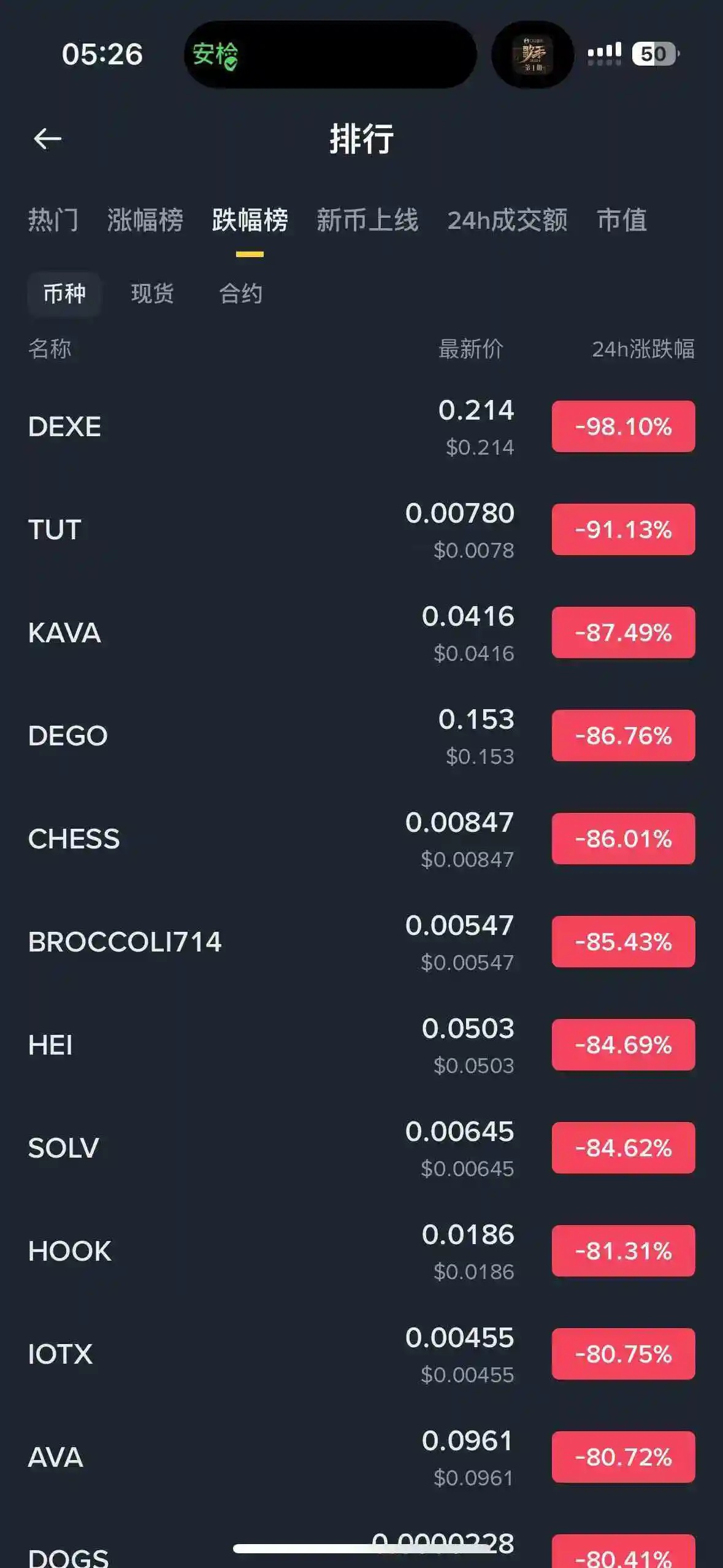

Even more sensational were the smaller market cap shitcoins, which, either due to cascading liquidations or market conditions, experienced short-term declines of over 80% and even 90%. I experienced 3/12 and 5/19 firsthand, but in my memory, I have never seen shitcoins collectively exhibit such an exaggerated single-day plunge.

Odaily Note: Morning snapshot of Binance's decline leaderboard, which is not even the lowest point of the plunges.

Coinglass data shows that as of around 7:40 this morning, the total amount of liquidations in the past 24 hours across the entire network was $19.133 billion, with a staggering 1,618,240 people being liquidated. The largest single liquidation was an ETH long position worth $203 million on the Hyperliquid platform.

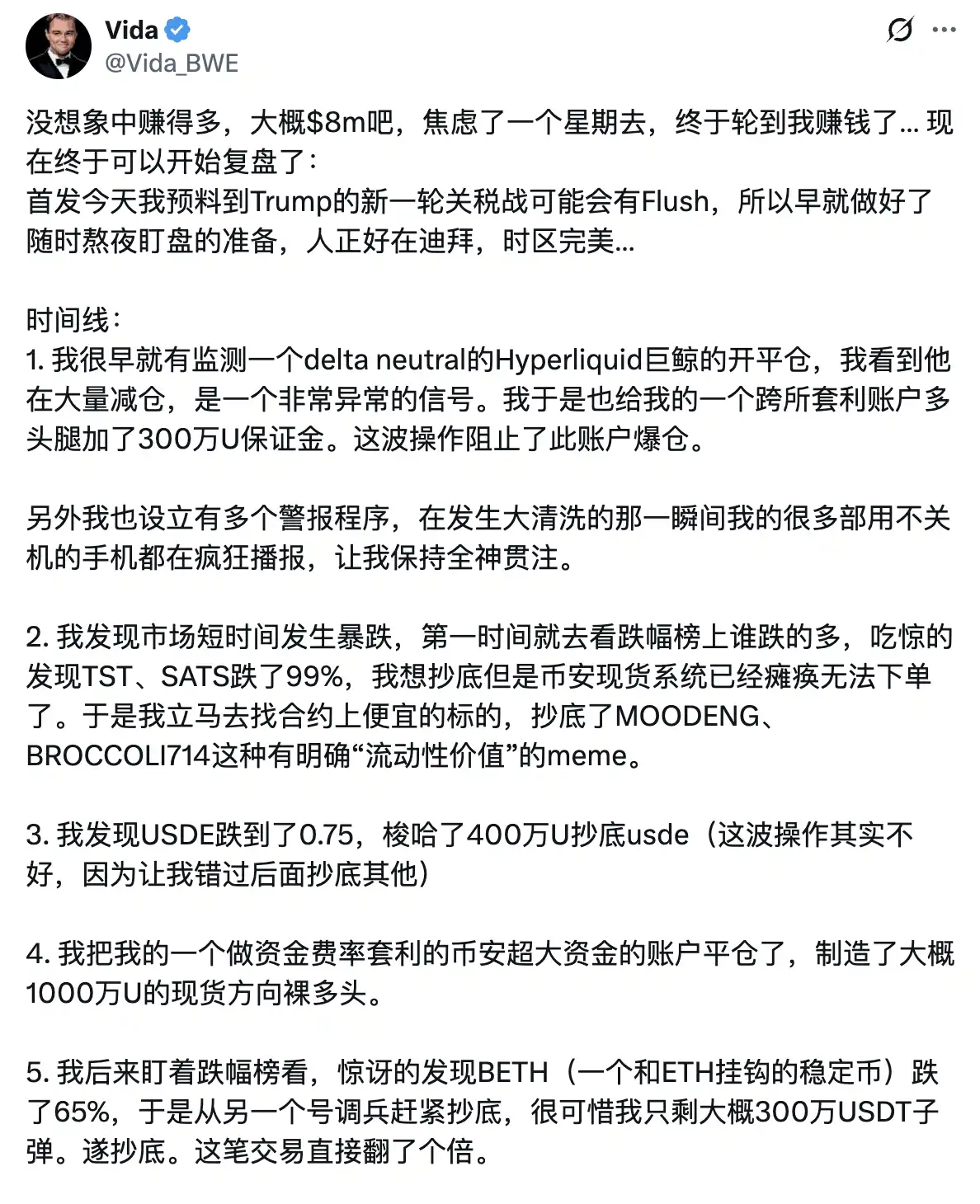

In such an extreme market situation, while the vast majority of users' positions have suffered heavy losses (for example, Maji experienced multiple liquidations overnight), there are also those who "snatched chestnuts from the fire," seizing the sudden wealth opportunities in extreme market conditions.

Wealth Opportunity One: Direct Shorting

The simplest wealth opportunity is naturally direct shorting, which requires no elaborate explanation.

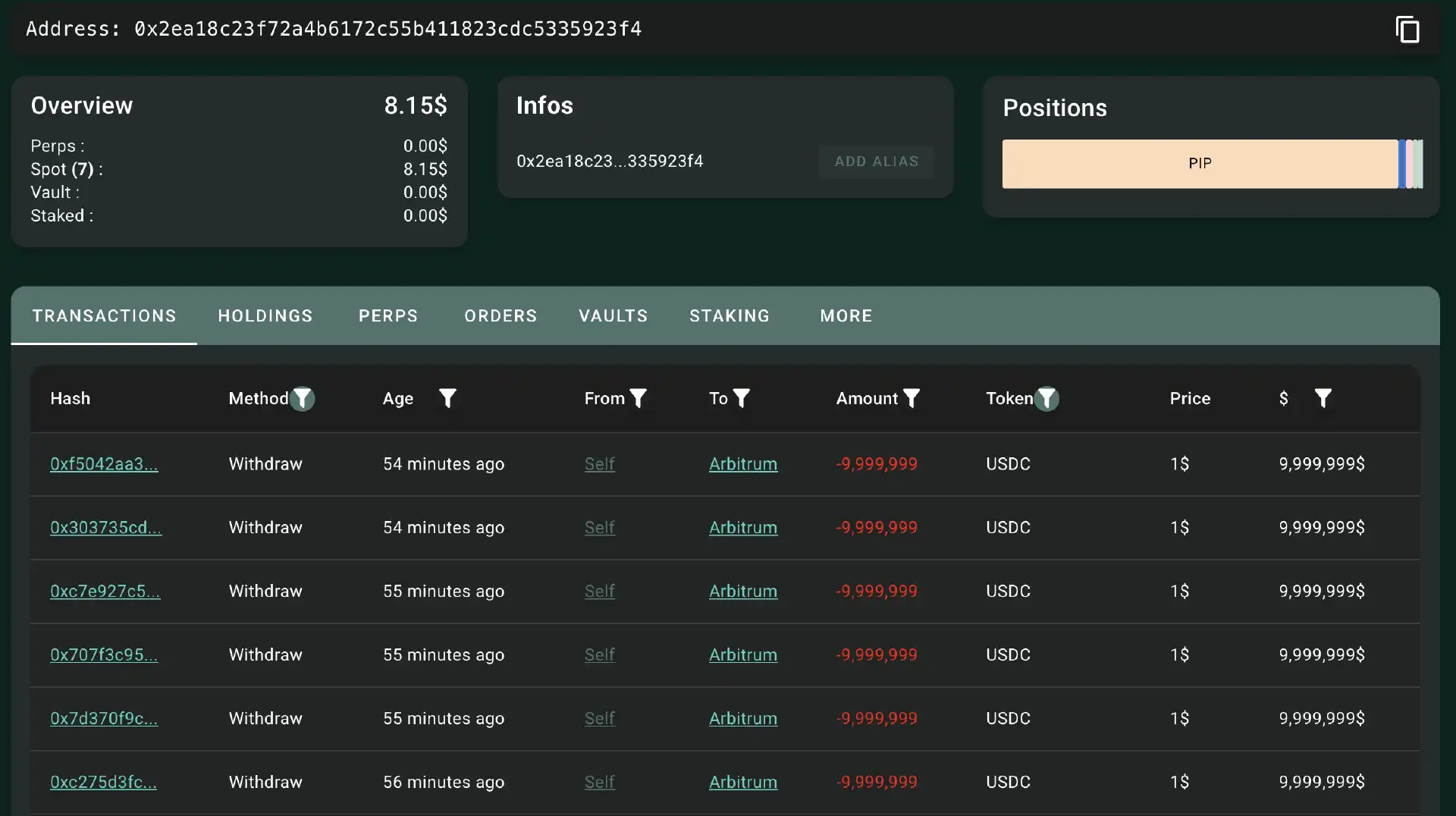

As a simple example, data from Hypurrsan shows that a whale address starting with 0x2ea18 profited $72.33 million in the past 24 hours by shorting BTC and ETH. The whale has already withdrawn $60 million USDC back to Arbitrum, securing the gains.

Wealth Creation Opportunity 2: Buying the Dip

Compared to contract players, spot traders' biggest opportunity is naturally buying the dip — if you had a limit order at a low price last night or pulled an all-nighter, you would have had the chance to buy:

XRP at $1.25;

DOGE at $0.095;

SUI at $0.55;

IP at $1;

XPL at $0.25;

ARB at $0.1;

AAVE at $79;

PENDLE at $1.65;

JUP at $0.05;

ENA at $0.13;

UNI at $2;

TRUMP at $1.5;

ATOM at $0.001 (yes, you read that right!);

IOTX at $0.00000 (yes, you still read that right! See the chart below)…

Aside from low-cap altcoins, mainstream coins like ETH and SOL, although seemingly not experiencing significant drops, also presented excellent buying opportunities — affected by liquidity constraints, the prices of some liquidity derivative tokens experienced significant fluctuations, with WBETH dropping to $430 at one point and BNSOL dropping to $34.9 — who would have dared to imagine seeing ETH at 400 and SOL at 30 before going to bed last night…

Opportunity for Sudden Wealth III: Stablecoin Depegging

Apart from the still somewhat uncertain world of altcoins, the short-term depegging of USDe was also a major bottom-buying opportunity last night.

Possibly due to market liquidity effects (some users needing to swap USDe back to USDT to top up margin), USDe experienced a depegging last night, plunging to $0.6268 at one point amidst panic and cascading liquidations. Some users took advantage of this opportunity to buy the dip and made a significant profit after the peg was restored.

Subsequently, Ethena's official X-post confirmed the security of USDe and even stated that the protocol made additional gains during the extreme market conditions—「Due to market turbulence and mass liquidations, the secondary market price of USDe experienced volatility. We can confirm that the minting and redemption functions of USDe have been consistently operational without any halts, and USDe still maintains overcollateralization. Due to the liquidation impact, the market's futures trading price has been consistently lower than the spot price and remains below the spot price. As Ethena holds spot positions and shorts futures contracts, this unexpectedly generated additional revenue for USDe. Thus, due to the effects of the unexpected event, USDe's overcollateralization rate will be higher than yesterday.」

No Need to Panic, Only a Few Profit, and Missing Out is Destiny

For those who missed out on last night's market movements (including myself), watching the above opportunity slip away may evoke some envy or anxiety. However, the reality is that perhaps less than 1% of users were able to get rich overnight, while over 99% of users woke up only to face losses in their accounts.

Overnight, nearly $20 billion disappeared into thin air in the futures market, marking a night of significant wealth transfer and a night where many users lost everything...In a market where volatility is so extreme, all we can do is reduce risk and preserve ammunition—after all, only by staying in the game can we play until the end.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO Climbs 5.83% as Recent Gains Counteract Overall Downtrend

- ALGO surged 5.83% in 24 hours on Dec 2, 2025, but remains down 58.74% annually amid broader crypto market declines. - Short-term buying interest drove the rally, though analysts warn of continued volatility due to macroeconomic uncertainties. - The 24-hour rebound contrasts with a 4.37% seven-day loss, highlighting uneven recovery in the crypto sector. - Traders remain cautious as isolated buying pressure emerges, but long-term bearish trends persist despite temporary optimism.

Chainlink ETF Set to Debut as LINK Slips Amid Market Weakness

Striking baristas win $38.9 million in compensation, yet contract disputes continue

- Starbucks settles NYC Fair Workweek Law violations for $38.9M, including $35.5M restitution to 15,000+ workers. - Striking baristas demand collective bargaining amid ongoing labor disputes and unionization efforts at 550 stores. - Mayor-elect Mamdani and Sen. Sanders join protests, framing demands as moral issues against corporate resistance. - Settlement addresses 500,000 scheduling violations since 2021, with workers receiving $50/week compensation. - Starbucks defends labor law complexity but faces cr

Alphabet's AI-driven ecosystem accelerates flywheel momentum, driving shares up by 68% in 2025

- Alphabet's stock surged 68% in 2025, outperforming peers like Microsoft and Nvidia , driven by strong AI monetization and cloud growth. - Analysts raised price targets to $375-$335, citing Google Cloud's $15.2B Q3 revenue (34% YoY) and $155B cloud backlog growth. - The company's AI ecosystem spans Search, YouTube, and Workspace, generating premium subscriptions and ad yield through Gemini's 650M MAUs. - Projected cloud revenue could exceed estimates by $40B, but risks include regulatory scrutiny and comp