Author: David, TechFlow

The Uptober market in October belonged not only to the lively new Binance Memes, but also to some long-neglected ancient coins.

In industry jargon, these old coins are called “Dino Coins,” referring to mature tokens that pioneered certain sectors but whose initial hype has gradually faded.

For example, ZEC (Zcash) surged from a low of around $53 at the end of September to $230 a week after the National Day holiday, with a monthly increase of over 370%. The catalyst for the revival of old coins was not institutional buying or technical upgrades, but rather a single tweet.

On October 1, Silicon Valley legendary investor Naval Ravikant, who has 2.9 million followers, posted a highly controversial view on X: “Bitcoin is insurance againstfiat, and Zcash is insurance against Bitcoin.”

Soon after, ZEC spiked rapidly, and other privacy coins also enjoyed a long-awaited surge as sentiment spilled over. With the price rally came heated debates, and the long-dormant privacy narrative suddenly became a hot topic again.

If you missed this ZEC rally, join us as we review the entire process of this old coin’s new hype, to see just how influential a big name can be and what opportunities remain in the privacy sector.

Interest Involved, Old Coin’s New Hype

Naval Ravikant is a prominent name in the Silicon Valley investment circle. As the co-founder of AngelList, he built this $4 billion startup financing platform.

His personal investment record is also impressive, with early investments in over 200 companies including Uber and Twitter.

In the crypto space, Naval’s credentials are equally deep. In 2014, he co-founded MetaStable Capital, one of the earliest crypto hedge funds. According to public reports, the fund achieved a 540% return in 2017, with early holdings including Ethereum, Bitcoin, and other crypto assets.

On October 1, Naval tweeted that Zcash is insurance against Bitcoin, and in subsequent tweets argued that Bitcoin lacks privacy, pointing out that Bitcoin’s public ledger makes it so that “even Satoshi himself cannot use Bitcoin” without exposing his identity, and that governments/banks can track all transactions through chain analysis.

Zcash, on the other hand, can serve as a supplement rather than a competitor to Bitcoin, using zero-knowledge proofs to hide key details such as sender, receiver, and amount.

The problem is, these benefits of Zcash have long been known; this feels more like a big name randomly hyping an old coin, as the privacy narrative has been cold for a long time.

Looking at the timeline, Naval’s tweet coincided perfectly with ZEC’s surge. However, Naval may not be entirely neutral here, as there are undisclosed interests involved.

According to multiple public reports, as early as 2015, Naval invested $715,000 in a company called Zerocoin Electric Coin Company, which later changed its name to Electric Coin Company, the very company that developed Zcash.

In addition, Naval previously served as a board member of the Zcash Foundation, giving him some influence over governance decisions.

Therefore, this level of investor hyping an old coin has drawn criticism from the community, who believe he is using his influence to pump early portfolio projects, making it hard to believe this is a neutral technical discussion or investment advice.

Interestingly, Naval has remained silent on these doubts, neither admitting nor denying them.

Regardless of the controversy, Naval’s influence was clearly reflected in the price. His tweet garnered 2.9 million views and triggered a chain reaction among KOLs. Balaji Srinivasan (former a16z CTO), Mert Mumtaz (Helius CEO), and others posted in support of privacy coins, further amplifying market sentiment.

The end result: ZEC rose from $53 at the end of September to $230, and from the time he posted the tweet, the increase has exceeded 300%.

Sentiment Spillover, Privacy Sector Chain Reaction

Naval’s call not only pushed up ZEC, but in recent days, sentiment has spread to the entire privacy coin sector.

Railgun (RAIL) became the biggest dark horse. This relatively niche privacy coin surged 240% during the same period, from $1.79 to a high of $4.83. Its 24-hour trading volume soared by 1270%.

In addition to the spillover from ZEC, Railgun also benefited from other catalytic events.

On October 9, the Ethereum Foundation released the Kohaku privacy roadmap, specifically mentioning the integration of Railgun’s zk-multisig technology, which is one of Vitalik’s favorite privacy features.

Other privacy coins also saw decent gains.

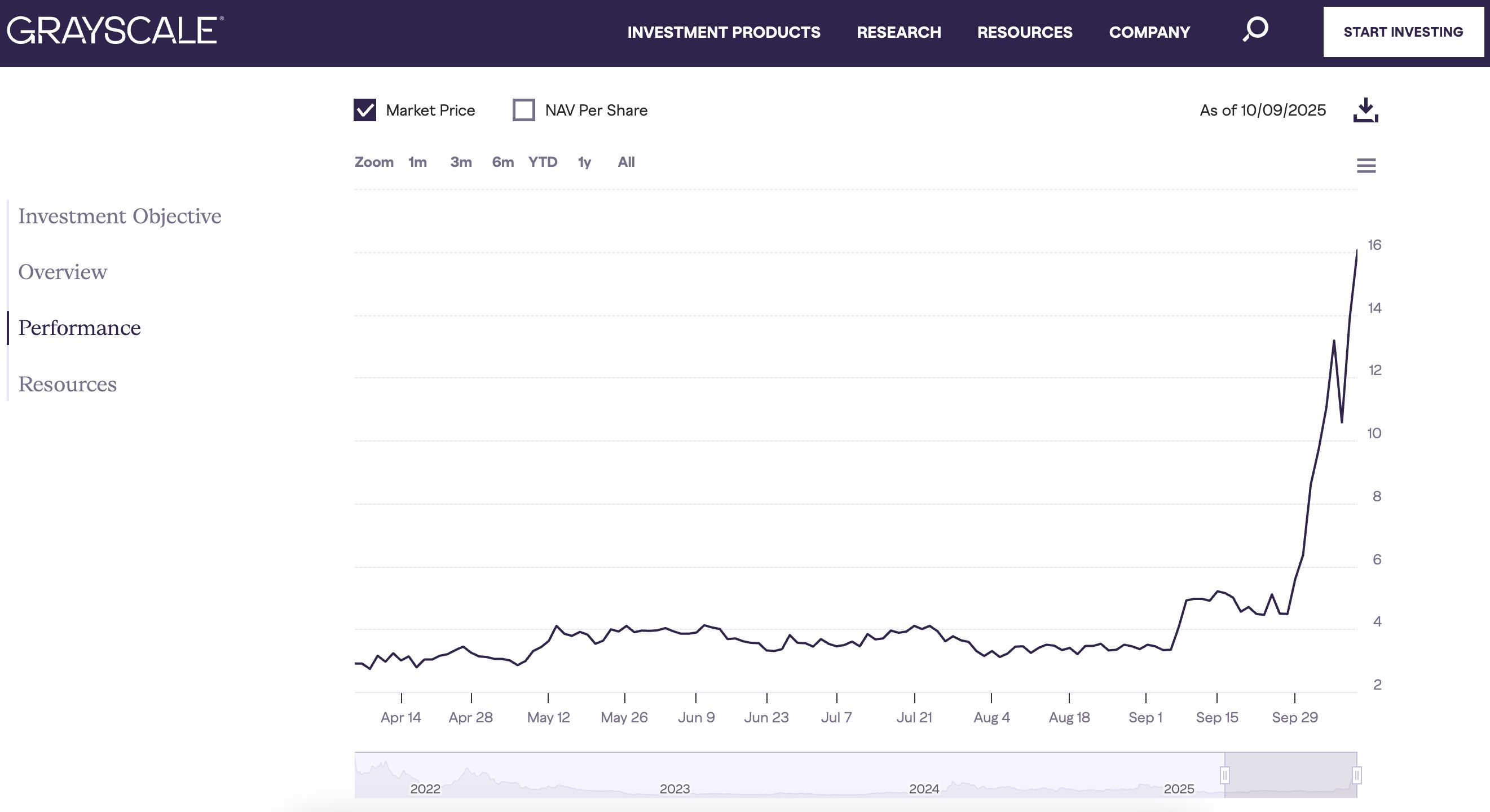

During ZEC’s surge, Grayscale also announced the reopening of its Zcash Trust for private placement.

Grayscale Trust is a compliant channel for traditional funds to enter the crypto market. Although it is not as popular as the Bitcoin and Ethereum trusts, it is significant for ZEC, as it is one of the few compliant ways for institutional funds to hold ZEC.

According to official data, Zcash Trust’s assets under management (AUM) have reached about $85 million, and the per-share price has risen 340% in six months.

With all this news released at the same time, the market has refocused on the privacy sector. Although it is difficult to fully track specific capital inflows, the increase in social buzz is very obvious.

In addition to the tokens mentioned above, there are some other projects that may also benefit from this wave of short-term sentiment driven by the privacy narrative.

-

Aster: Dark Pools and Private Trading

Aster’s popularity is well known, but few pay attention to its dark pool model.

As an on-chain Perp DEX, one of its highlights is the “Hidden Orders” feature. It allows the size, price, and direction of orders to be completely invisible before execution, with results only confirmed on-chain after the trade. This mechanism uses zero-knowledge proofs to protect traders from MEV attacks, frontrunning, and liquidation sniping.

With the Binance Meme craze and the privacy narrative combined, $ASTER itself may still be worth watching.

-

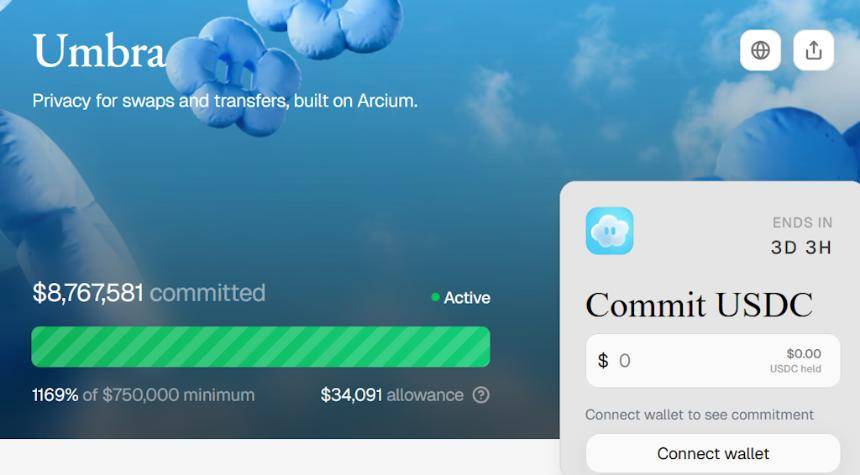

Umbra: Auditable Privacy

Umbra’s core value lies in providing “stealth mode” for Solana: through device-side encryption and Arcium’s multi-party computation (MPC) technology, users can make private transfers without sacrificing blockchain verifiability and speed.

Unlike the fully anonymous Monero, Umbra has a built-in compliance framework, creating encrypted links between private and public wallets via an auditor program, with information disclosed only under court orders. This auditable privacy meets users’ needs for financial privacy while avoiding Tornado Cash-style regulatory risks.

Currently, privacy projects on Solana are at an earlier stage compared to Ethereum. Solana is known for its speed and performance, and moving toward privacy will inevitably require support from leading projects.

Public information shows that Umbra will launch its mainnet in Q1 2026. If progress goes smoothly, it may attract professional traders in the Solana ecosystem who need to prevent frontrunning, users requiring bank-level confidentiality, and institutions seeking compliant privacy tools.

It’s worth noting that MetaDAO, the launchpad platform for Umbra, has seen its own token META rise about 191% in the past 30 days. This relates to another topic about launchpad mechanisms, which will not be discussed further here due to space limitations.

-

Ethereum Foundation Kohaku Roadmap: Privacy from Edge to Core

On October 8, the Ethereum Foundation officially released the Kohaku privacy roadmap, marking the first time in Ethereum’s history that privacy has been elevated from an “optional feature” to a “protocol-level commitment.” Kohaku is a modular open-source SDK (software development kit) that provides privacy primitives for wallets, enabling developers to easily integrate strong cryptographic features. This move is personally endorsed by Vitalik Buterin, and a 47-member Privacy Cluster team has been established to coordinate cross-organizational work.

Core features include:

-

Light clients: In-browser verification to avoid trusting RPC nodes and leaking IP addresses

-

Private transaction streams: Integration of zk-based protocols like Railgun for confidential sending/receiving

-

Social recovery: Tools like ZK Email and ZKpassport allow wallet recovery without exposing private keys

-

dApp single accounts: Isolate transaction records of different applications to prevent correlation analysis

This is not reinventing the wheel, but integrating existing mature privacy solutions (such as Railgun, Elusiv) into a unified SDK to lower the development threshold. Ethereum plans to showcase the initial prototype at Devcon in November 2025 and promote native account abstraction (AA) in 2026, making privacy a “default option” rather than an advanced feature.

The Kohaku roadmap specifically mentions Railgun’s zk-multisig feature. As an “officially recognized” privacy engine, Railgun will gain broader wallet integration through the Kohaku SDK, which is one of the key catalysts for RAIL’s 270% surge on October 9.

More broadly, Kohaku represents a fundamental shift in Ethereum’s attitude toward privacy, and privacy tokens on Ethereum may see a wave of short-term speculation.

-

Aztec Mainnet Coming Soon: Telling the L2 Privacy and Decentralization Story

Aztec Network is a privacy-first zero-knowledge rollup L2 based on Ethereum, with $119.1 million in funding (led by a16z and Paradigm), focusing on “programmable privacy” to allow developers to build applications where users control data disclosure.

On September 17, 2025, Aztec deployed the 2.0.3 full-feature upgrade, meaning all mechanisms required for mainnet are now in place.

The core difference between Aztec and other privacy solutions is “computational privacy”: not only hiding transaction amounts and addresses, but also the entire contract execution logic. This paves the way for enterprise adoption.

For example, tokenized assets (RWA) can be settled on-chain without exposing trading strategies, and KYC/AML requirements can be met through selective disclosure.

The Aztec roadmap shows that mainnet Alpha will launch at the end of 2025, with fully decentralized sequencers and validators, and no gradual decentralization transition period.

This contrasts with most L2s, such as Optimism, which still have centralized sequencers in the early stages, and other L2s have also made compromises on sequencer centralization.

Although infrastructure is not a new narrative and the entire crypto market may not need new L1/L2s, having a unique selling point in an old sector still has the chance to attract some attention and capital.

Overall, most of these projects are still in the early stages, but the privacy sector is indeed growing from a marginal demand to a must-have option for mainstream on-chain infrastructure, and local opportunities may exist in this quiet transformation.