Today’s Preview

- Linea (LINEA): Will unlock 1.08 billion tokens worth approximately $29.4 million at 19:00 (UTC+8) on October 10, 2025, accounting for about 6.57% of the total circulating supply.

- Babylon (BABY): Will unlock 321 million tokens worth around $17.4 million at 18:00 (UTC+8) on October 10, 2025, or roughly 24.74% of total circulating supply.

- Ethereum Foundation: Will release the new privacy-focused wallet, Kohaku, at the Argentina Devcon in November 2024, aiming to enhance user transaction privacy.

Macro & Hot Topics

- Luxembourg Sovereign Wealth Fund (FSIL): Announced that 1% of its $730 million portfolio will be allocated to Bitcoin ETFs, making it the first national fund in the Eurozone to invest in bitcoin. It may increase allocation to crypto assets up to 15% in the future.

- Chainalysis Report: Over $75 billion in crypto assets linked to criminal activity have been identified on public blockchains worldwide. Multiple countries are expected to move towards adopting crypto as sovereign reserves.

- Ethereum Fusaka Upgrade: Scheduled to go live on December 3, 2025. The block gas limit will be raised to 150 million, with the introduction of PeerDAS to improve transaction efficiency and scalability.

Market Overview

1.BTC & ETH: Both experienced mild declines and sideways movement over the last 4 hours. The market remains cautious, with about $201 million in liquidations over the past 24 hours, mainly from long positions.

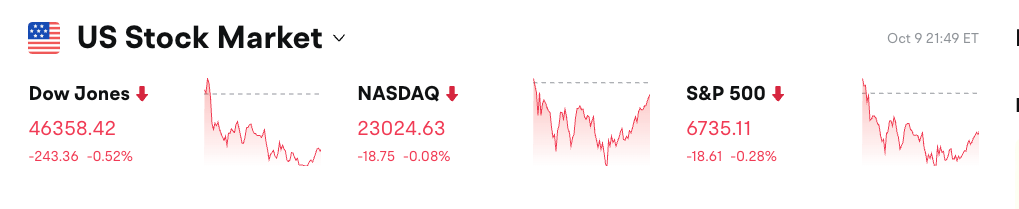

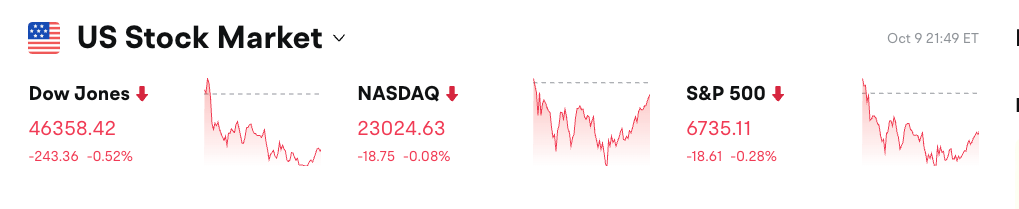

2.US Stock Market: Closed mostly lower on Wednesday. The Dow fell 0.52%, the Nasdaq dropped 0.08%, and the S&P 500 slipped 0.28% as investors turned more cautious.

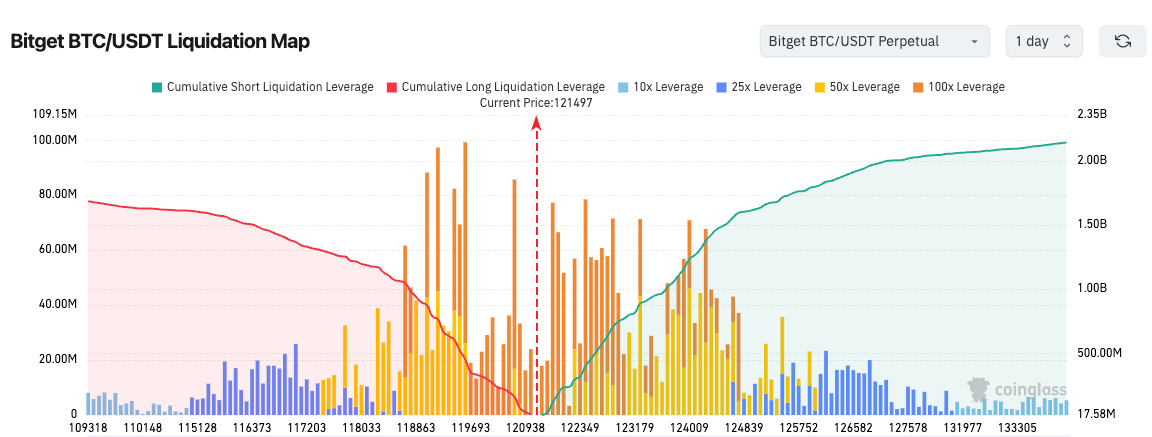

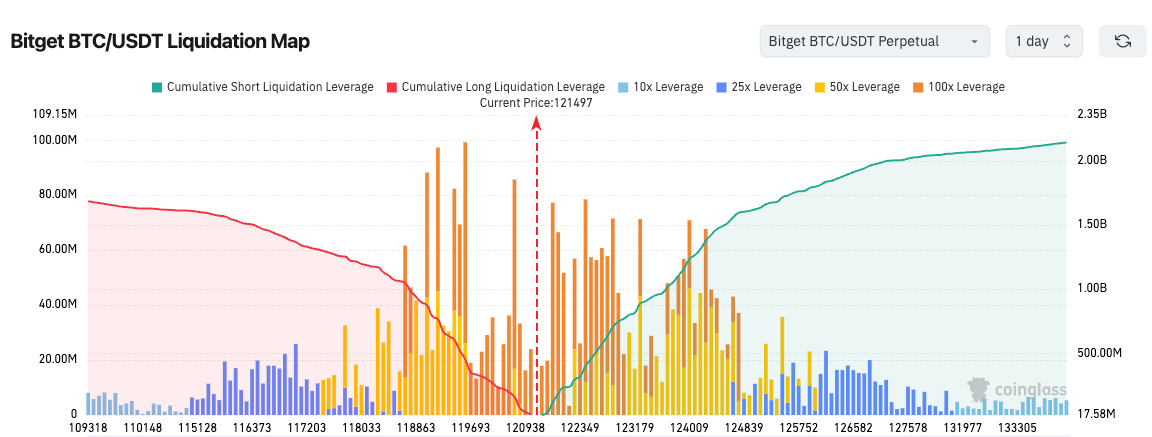

3.Bitget BTC/USDT: Currently at 121,497; notable increase in short-term long liquidations. Caution advised as downside risks and further long position liquidations may occur.

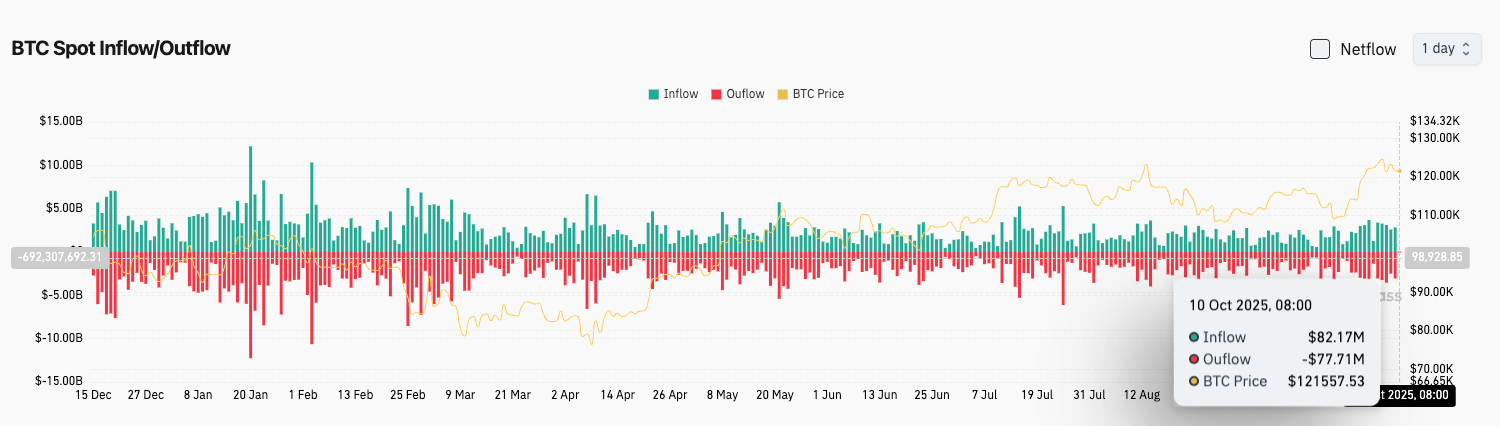

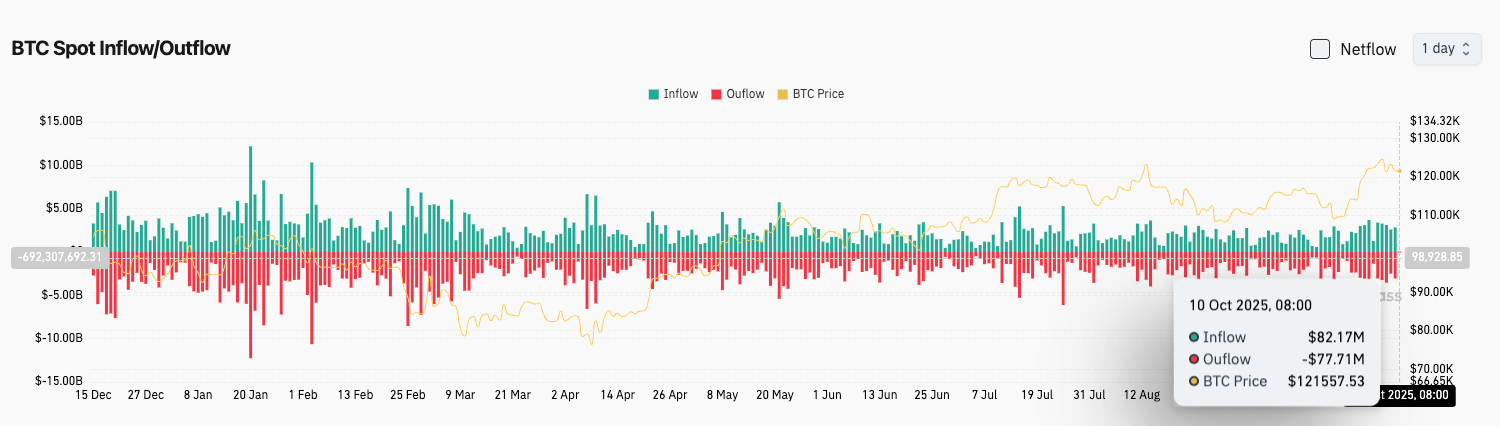

4.BTC Spot Flows (last 24h): Inflows totaled $818 million, outflows were $775 million, net inflows reached $43 million.

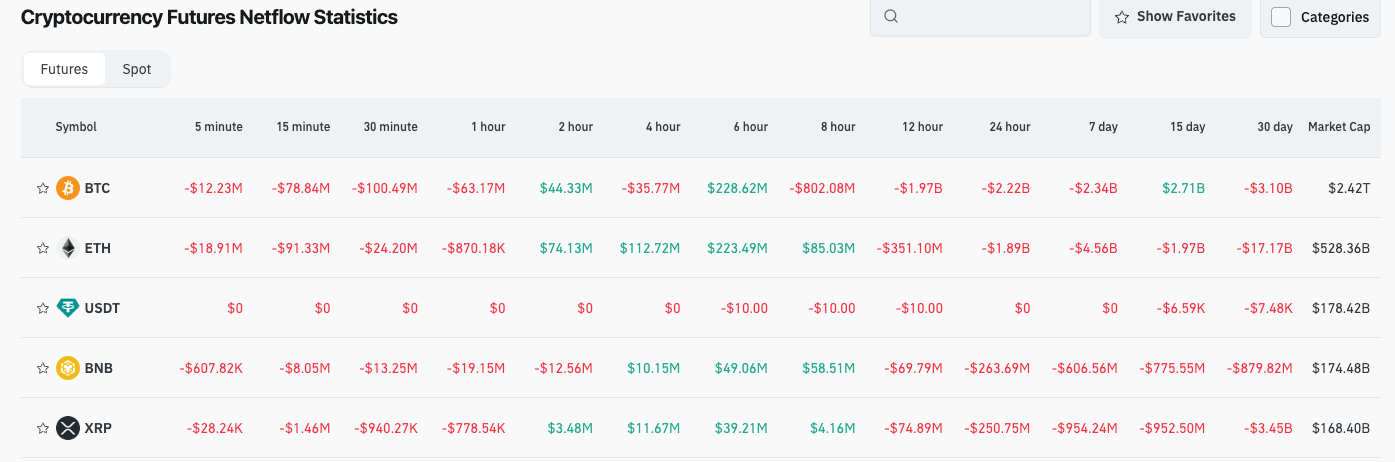

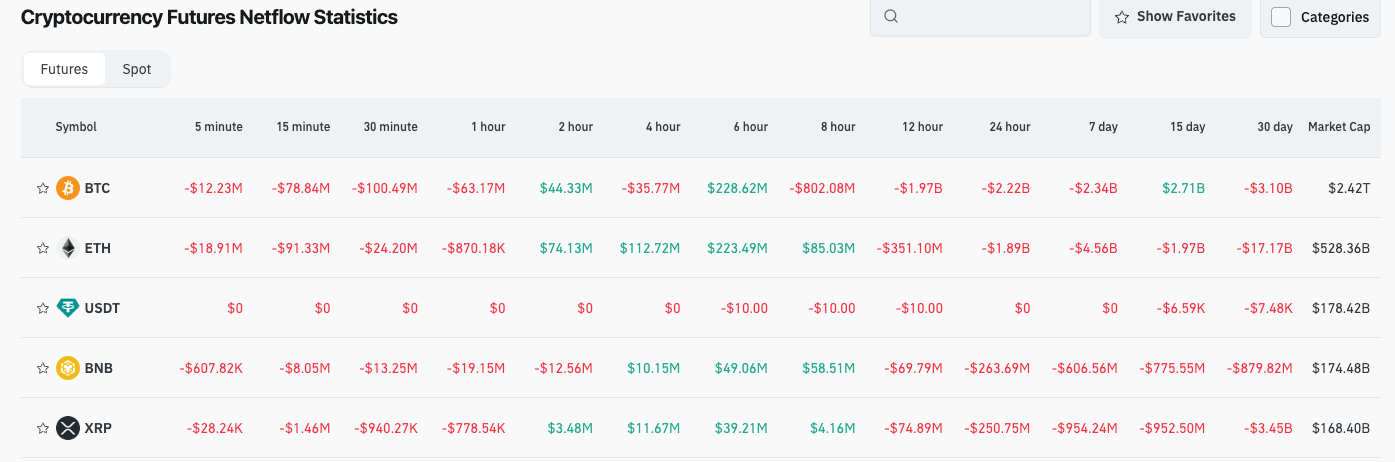

5.Derivatives Net Outflows (last 24h): BTC, ETH, BNB, and XRP all saw greater outflows, indicating possible trading opportunities.

News Highlights

- European Sovereign Wealth Fund: Makes its first bitcoin allocation. The Bank of France has proposed granting the EU’s ESMA direct oversight of major crypto enterprises.

- US Government Shutdown: Should a partial shutdown occur, crypto hearings are expected to proceed as scheduled, with discussion focused on financial innovation, regulatory authority, and stablecoin legislation.

- Bitcoin, Ethereum, XRP: Pulled back on investor profit-taking and risk aversion, though Bitcoin ETF inflows remain steady.

- Swiss AMINA Bank: Becomes first regulated financial institution to offer native Polygon (POL) staking, further integrating traditional finance with the Polygon ecosystem.

Project Developments

- Polygon: Partners with AMINA Bank for the first regulated institution-based staking service for POL tokens, offering up to 15% APY.

- BNB Smart Chain: Daily gas consumption surpassed 5 trillion, with 77% stemming from 24 million swap transactions.

- AMINA Bank: Launched custody and staking services for native Polygon tokens, broadening its digital banking product suite.

- Jupiter & Ethena Labs: Jointly launched the new stablecoin JupUSD, expected to go live in Q4 2025.

- Ethereum Foundation: Set to release the privacy wallet Kohaku, prioritizing transaction privacy protection.

- Linea (LINEA): Upcoming token unlock, with a record number of ecosystem partners.

- Chainalysis: Expands asset tracking services to multi-chain scenarios, enhancing compliance capabilities.

- FSIL (Luxembourg’s sovereign fund): Completes its first allocation to Bitcoin ETFs.

Disclaimer: This report is generated by AI, with human review for information accuracy. It does not constitute any investment advice.