Aave and Blockdaemon partner to advance institutional access to DeFi

Blockdaemon, a leading staking provider for institutions, and Aave Labs, a key contributor to the Aave protocol, have joined forces in a strategic partnership aimed at boosting access to decentralized finance opportunities for institutions.

- Aave Labs and Blockdaemon say the partnershio aims at expanding institutional access to DeFi.

- Blockdaemon Earn Stack customers can now earn further by putting staking rewards and idle balances to work.

- The integration includes support for Bitcoin, Ethereum and stablecoins.

Aave Labs and Blockdaemon are eyeing institutional-grade access to Aave’s decentralized finance markets and are tapping into Blockdaemon’s Earn Stack and Aave Vaults to unlock this.

Per an announcement on October 9, 2025, the integration opens new opportunities for institutions.

Why is this big for Aave?

According to details, Aave ( AAVE ) is set to be the exclusive primary lending provider for Blockdaemon Earn Stack, a non-custodial platform that offers staking services across more than 50 protocols.

The integration will leverage Aave Vaults to allow institutional clients to access staking rewards. Providing access to on-chain markets unlocks over $70 billion in liquidity and allows institutional investors to tap into secure yield opportunities.

Aave is a leading DeFi lending protocol and the integration further expands this.

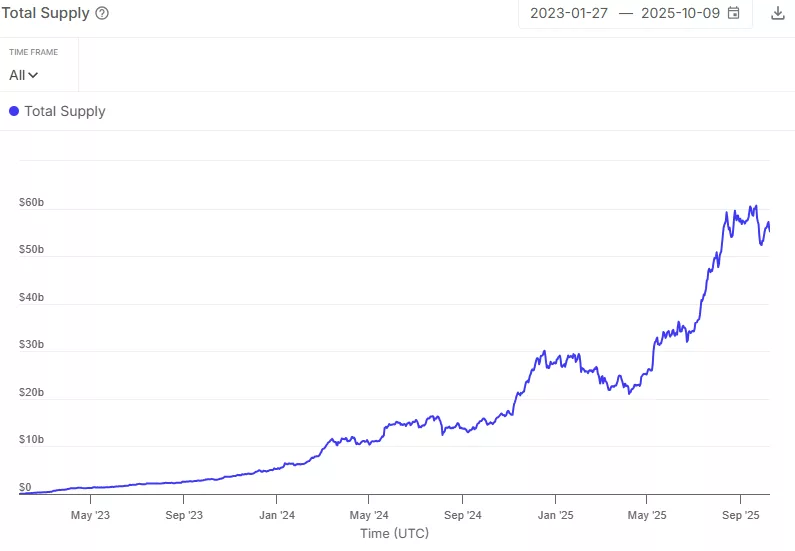

Aave supply growth chart. Source: Sentora on X

Aave supply growth chart. Source: Sentora on X

Importantly, Blockdaemon customers can now put staking rewards and their idle balances to work across DeFi markets. Furthermore, they retain full control of their assets.

“With this strategic partnership, institutions can now gain direct access to Aave’s DeFi markets through Blockdaemon’s market-leading infrastructure, opening new avenues for growth across top crypto assets and stablecoins,” said Konstantin Richter, founder and chief executive officer of Blockdaemon.

Bitcoin, Ethereum support

As noted, Blockdaemon has picked Aave as its primary lending provider given the DeFi protocol’s long-trusted operations and robust risk controls. Blockdaemon customers and the broader DeFi community will have access to a range of supported cryptocurrencies. This includes Bitcoin, Ethereum, and stablecoins.

Support also includes assets on Horizon, an institutional market for borrowing against real-world assets. Tokenized RWAs are currently one of the sectors witnessing strong growth.

Data shows the Horizon RWA market size has surpassed $200 million, with over $54 million borrows. The platform launched in August 2025.

Users supply stablecoins such as Ripple USD, USDC, and GHO Token, and tokenized assets like Superstate’s USTB and Janus Henderson’s JTRSY into RWA pools. Deposited tokenized assets serve as collateral for users looking to borrow USDC, RLUSD, or GHO.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The truth behind BTC's plunge: Not a crypto crash, but a global deleveraging triggered by the yen shock

DAT: A Concept in Transition

From traditional market-making giants to core market makers in prediction markets, SIG's forward-looking layout in crypto

Whether it's investing or trading, SIG is always forward-looking.