IOSG: Understanding Stablecoin Public Chains in One Article

Public blockchains centered on stablecoins have already achieved the necessary scale and stability. To become everyday currencies, they still need: a consumer-grade user experience, programmable compliance, and transactions with imperceptible fees.

Author|Sam @IOSG

Introduction

According to Artemis' 2025 research report, the economic scale settled via stablecoins in 2024 has reached approximately $26 trillion, already matching the level of mainstream payment networks. In contrast, the fee structure in traditional payments is like an "invisible tax": about 3% in fees, additional foreign exchange spreads, and ubiquitous wire transfer charges.

Stablecoin payments compress these costs to just a few cents or even less. When the cost of moving funds plummets, business models will be thoroughly reshaped: platforms will no longer rely on transaction fees for survival, but instead compete on deeper value—such as savings yields, fund liquidity, and credit services.

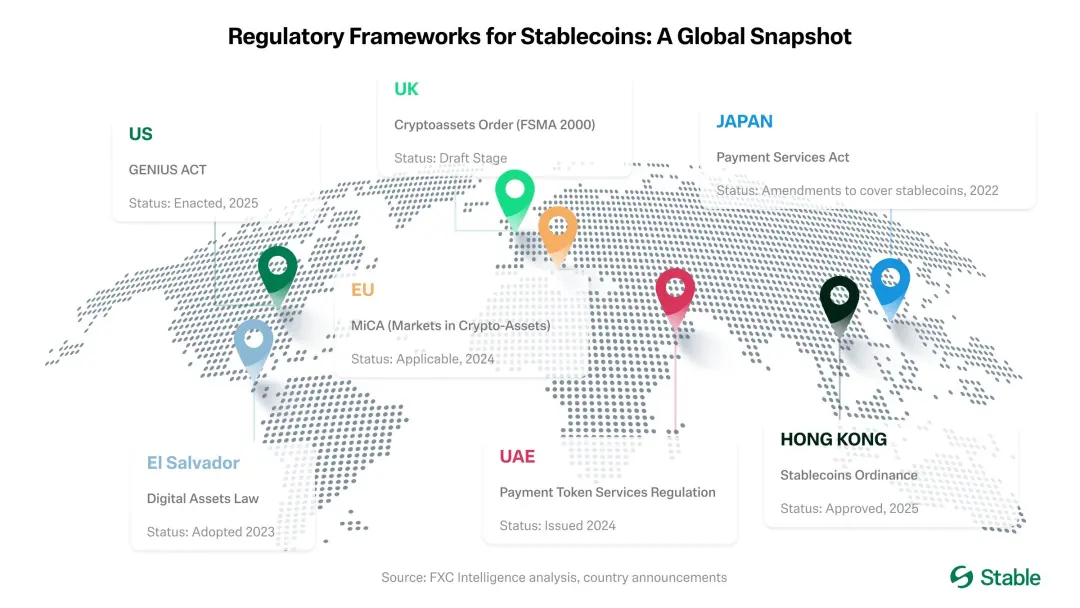

With the enactment of the US "GENIUS Act" and Hong Kong's "Stablecoin Ordinance" providing a similar regulatory template, banks, card organizations, and fintech companies are moving from pilot stages to large-scale production applications. Banks are beginning to issue their own stablecoins or establish close partnerships with fintech companies; card organizations are incorporating stablecoins into their backend settlement systems; fintech companies are launching compliant stablecoin accounts, cross-border payment solutions, on-chain settlement with built-in KYC, and tax reporting features. Stablecoins are transforming from collateral within exchanges to standard payment "infrastructure."

▲ source: Stable

The remaining shortcoming is user experience. Current wallets still assume users are proficient in crypto knowledge; fee differences across networks are significant; users often need to hold a highly volatile token before transferring a USD-pegged stablecoin. However, "gasless" stablecoin transfers enabled by sponsored fees and account abstraction will eliminate this friction. Supplemented by predictable costs, smoother fiat on/off ramps, and standardized compliance components, stablecoins will no longer feel like "cryptocurrency"—the experience will truly converge with "money."

Core viewpoint: Public chains centered on stablecoins have achieved the necessary scale and stability. To become daily-use currencies, they still need: consumer-grade user experience, programmable compliance, and transactions with imperceptible fees. As these aspects—especially gasless transfers and better fiat ramps—are improved one by one, the competitive focus will shift from "charging for moving funds" to "the value provided around fund transfers," including: yield, liquidity, security, and simple, trustworthy tools.

The following will provide a quick overview of outstanding projects in the stablecoin/payment public chain track. This article will mainly focus on Plasma, Stable, and Arc, and delve into their issuers, market dynamics, and other participants, presenting a panoramic view of this "stablecoin rail war."

Plasma

Plasma is a blockchain built specifically for USDT, aiming to become its native settlement layer and optimized for high-throughput, low-latency stablecoin payments. It entered private testnet in late May 2025, moved to public testnet in July, and successfully launched its mainnet beta on September 25 of the same year (UTC+8).

In the stablecoin payment public chain track, Plasma is the first project to conduct a TGE and has achieved a successful market launch: it has captured strong mindshare, set records for first-day TVL and liquidity, and established solid partnerships from the outset.

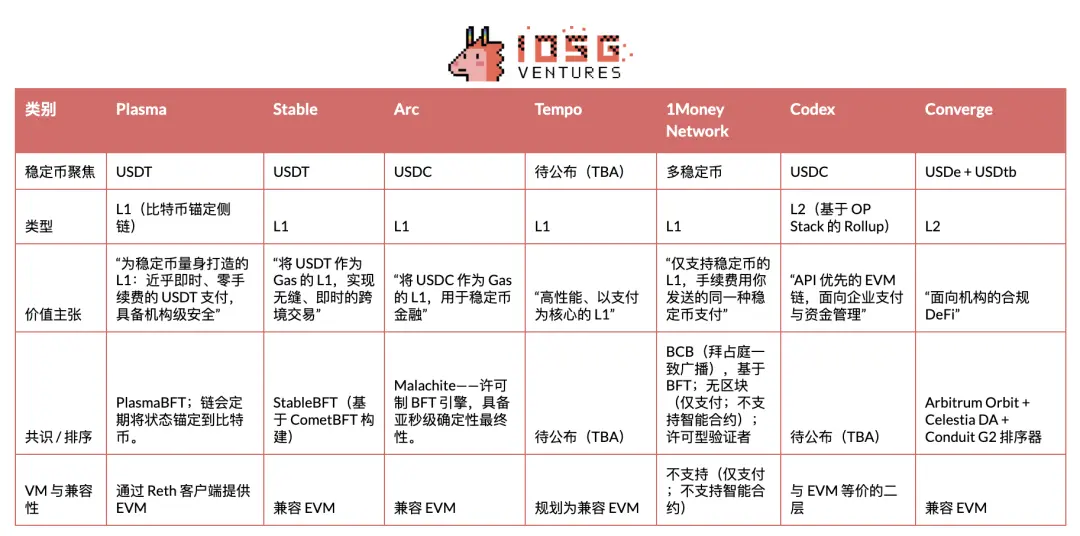

Since the launch of its mainnet beta, its growth momentum has been remarkable. As of September 29 (UTC+8), Aave deposits on the Plasma chain have exceeded $6.5 billion, making it the second largest market; by September 30 (UTC+8), more than 75,000 users had registered for its ecosystem wallet, Plasma One. Currently, according to DeFiLlama data, Aave TVL on Plasma is $5.7 billion—down from its peak but still firmly in second place (behind Ethereum's $58.7 billion and Linea's $2.3 billion). Projects such as Veda, Euler, Fluid, and Pendle also have significant TVL, thanks to the successful deployment of mainstream DeFi projects on the first day (UTC+8) of launch.

▲ source: DeFiLlama

Of course, there is also commentary that its early growth is mainly driven by incentives rather than being fully organic. As CEO Paolo emphasized, relying solely on crypto-native users and incentives is not a sustainable model; the real test will be future real-world applications—this will be a key area of ongoing attention.

Go-To-Market Strategy

Plasma focuses on USDT, emphasizing emerging markets, particularly Southeast Asia, Latin America, and the Middle East. In these markets, USDT's network effects are already strongest, and stablecoins have become essential tools for remittances, merchant payments, and daily peer-to-peer transfers. To implement this strategy requires solid ground-level distribution: advancing corridor by corridor, building agent networks, localized user onboarding, and precise regulatory timing. It also means defining clearer risk boundaries than Tron.

Plasma regards developer experience as a moat and believes USDT needs to offer a developer-friendly interface, just as Circle did for USDC. In the past, Circle invested heavily to make USDC easy to integrate and develop, while Tether has lagged in this area, leaving a huge opportunity for USDT's application ecosystem—provided the payment rails are properly packaged. Specifically, Plasma provides a unified API on top of the payment tech stack, so payment developers do not need to assemble the underlying infrastructure themselves. Behind this single interface are pre-integrated partners as plug-and-play base modules. Plasma is also exploring confidential payments—privacy protection within a compliance framework. The ultimate goal is clear: "Make USDT extremely easy to integrate and develop."

In summary, this corridor-driven go-to-market strategy and API-centric developer strategy ultimately converge on Plasma One—the consumer-facing frontend, the product that brings the entire plan to everyday users. On September 22, 2025 (UTC+8), Plasma released Plasma One, a "stablecoin-native" digital bank and card product for consumers, integrating storage, spending, earning, and sending digital dollars in one app. The team positions it as: the missing unified interface for hundreds of millions already relying on stablecoins but still facing local friction (such as clunky wallets, limited fiat ramps, and dependence on centralized exchanges).

Access to this product is being opened in phases via a waitlist. Its main features include: direct payments from interest-bearing (target APY over 10%) stablecoin balances, up to 4% cashback on spending, instant zero-fee USDT transfers within the app, and card services usable in over 150 countries and about 150 million merchants.

Business Model Analysis

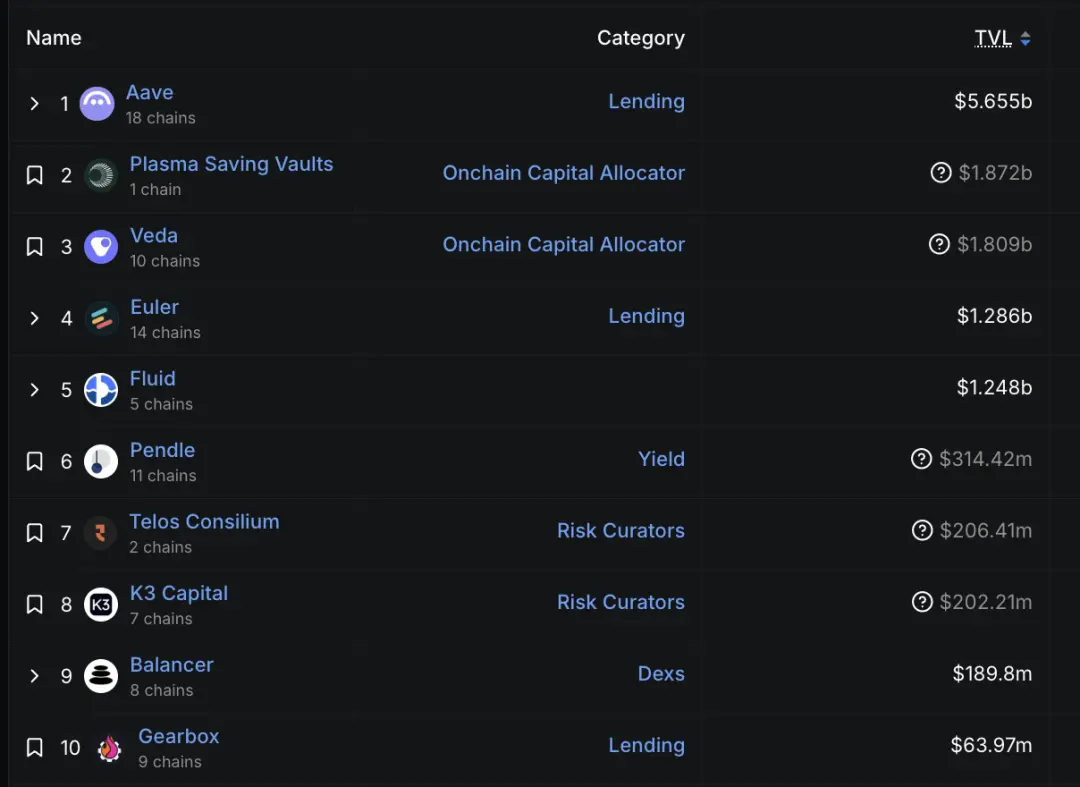

Plasma's core pricing strategy aims to maximize daily usage while maintaining economic returns through other channels: simple USDT transfers are free, while all other on-chain operations incur fees. From a "blockchain GDP" perspective, Plasma intentionally shifts value capture from a "consumption tax" on each transaction (i.e., gas fees for basic USDT transfers) to application-layer revenue. The DeFi layer corresponds to the "investment" segment in this framework: cultivating liquidity and yield markets. While net exports (i.e., USDT bridging in/out) remain important, the economic focus has shifted from consumption fees to service fees for applications and liquidity infrastructure.

▲ source: Fidelity

For users, zero fees are not just about saving costs—they unlock new use cases. When sending $5 no longer requires a $1 fee, micropayments become feasible. Remittances can arrive in full, without deductions by intermediaries. Merchants can accept stablecoin payments without giving up 2-3% of their revenue to invoice/billing software and card organizations.

On the technical side, Plasma runs an EIP-4337-compliant paymaster. The paymaster sponsors gas fees for official USDT transfer() and transferFrom() function calls on the Plasma chain. The Plasma Foundation has pre-funded this paymaster with its native token XPL and uses a lightweight verification mechanism to prevent abuse.

Stable

Stable is a Layer 1 optimized for USDT payments, aiming to solve current infrastructure inefficiencies—including unpredictable fees, slow settlement times, and overly complex user experiences.

Stable positions itself as a "payment-dedicated L1 born for USDT", with a market strategy of directly partnering with payment service providers (PSPs), merchants, business integrators, vendors, and digital banks. PSPs favor this because Stable eliminates two operational headaches: managing volatile gas tokens and bearing transfer costs. Given that many PSPs face high technical barriers, Stable currently operates as a "service workshop"—handling various integrations itself—and will later solidify these models into an SDK for self-service integration by PSPs. To provide production-grade guarantees, they introduced "enterprise-grade block space", a subscription service ensuring VIP transactions are prioritized at the top of blocks for guaranteed, first-block settlement and smoother cost prediction during network congestion.

Geographically, its market entry follows USDT's existing usage trajectory, implementing an "Asia-Pacific first" strategy—later expanding to Latin America, Africa, and other USDT-dominated regions.

On September 29 (UTC+8), Stable released a consumer-facing app targeting new, non-DeFi users. The app is positioned as a simple USDT payment wallet for daily needs (P2P transfers, merchant payments, rent, etc.), offering instant settlement, gasless P2P transfers, and transparent, predictable fees in USDT. The app is currently accessible via a waitlist only. Initial promotion in Korea proved its market appeal: Stable Pay attracted over 100,000 user registrations directly through offline booths (data as of September 29, UTC+8).

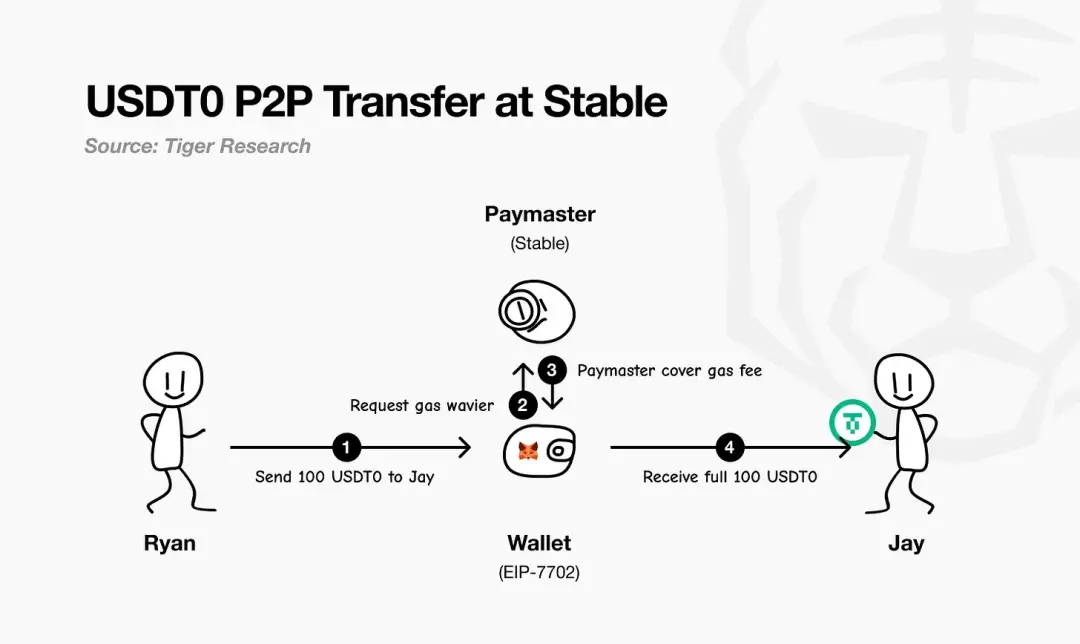

Stable achievesgasless USDT payments using EIP-7702. This standard allows users' existing wallets to temporarily become "smart wallets" for a single transaction, enabling custom logic and fee settlement,without any separate gas token—all fees are denominated and paid in USDT.

As shown in Tiger Research's flowchart, the process is: the payer initiates payment; the EIP-7702 wallet requests a gas fee exemption from Stable's paymaster; the paymaster sponsors and settles network fees; finally, the recipient receives the full amount with no deductions. In practice, users only need to hold USDT.

▲ source: Tiger Research

In its business model, Stable adopts amarket share first, revenue second strategy, using gasless USDT payments to win users and establish payment flows. In the long term, profitability will mainly come from within its consumer app, supplemented by select on-chain mechanisms.

Beyond USDT, Stable also sees major opportunities with other stablecoins. With PayPal Ventures investing in Stable at the end of September 2025 (UTC+8), as part of the deal, Stable will natively support PayPal's stablecoin PYUSD and promote its distribution, allowing PayPal users to "use PYUSD directly" for payments, with gas fees also paid in PYUSD. This means PYUSD will also be gasless on the Stable chain—bringing the same operational simplicity that attracts PSPs to USDT payment rails to PYUSD as well.

▲ source: PayPal

Architecture Analysis

Stable's architecture starts with its consensus layer—StableBFT. This is a custom-developed proof-of-stake protocol based on CometBFT, designed for high throughput, low latency, and high reliability. Its development path is pragmatic and clear: short-term optimization of this mature BFT engine, with a long-term roadmap pointing to aDAG-based design for even greater performance scalability.

Above the consensus layer,Stable EVM seamlessly integrates the chain's core capabilities into developers' daily work. Its dedicated precompiled contracts allow EVM smart contracts to securely and atomically call core chain logic. In the future, with the introduction of StableVM++, performance will be further enhanced.

Throughput also depends on data processing capacity.StableDB effectively solves the storage bottleneck after block production by separating state commitment from data persistence. Finally, its high-performance RPC layer abandons monolithic architecture and adopts a sharded path design: lightweight, specialized nodes serve different types of requests, avoiding resource contention, improving tail latency, and ensuring real-time response even as chain throughput surges.

Crucially, Stable positions itself as an L1, not an L2. Its core philosophy: real-world business applications should not have to wait for upstream protocol updates to launch payment features. By maintaining full-stack control over the validator network, consensus strategy, execution layer, data layer, and RPC layer, the team can prioritize the core guarantees needed for payment scenarios while retaining EVM compatibility, allowing developers to easily migrate existing code. The end result is an EVM-compatible Layer 1 blockchain fully optimized for payments.

Arc

On August 12, 2025 (UTC+8), Circle announced its stablecoin- and payment-focused Layer 1 blockchain—Arc—which will enter private testnet in the coming weeks and launch a public testnet in fall 2025, with the goal of launching a mainnet beta in 2026.

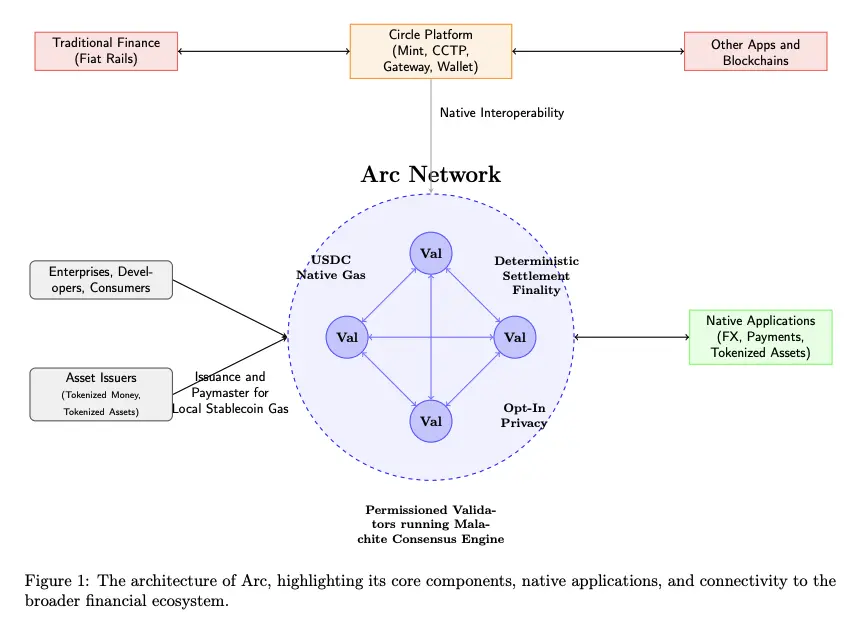

Arc's core features: it operates with a permissioned validator set (running the Malachite BFT consensus engine), provides deterministic finality; its native gas fees are paid in USDC; and it offers an optional privacy layer.

▲ source: Arc Litepaper

Arc is directly integrated into Circle's entire ecosystem platform—including Mint, CCTP, Gateway, and Wallet—enabling seamless value flow between Arc, traditional fiat payment rails, and other blockchains. Enterprises, developers, and consumers will transact via apps on Arc (covering payments, FX, asset tokenization, etc.), while asset issuers can mint assets on Arc and act as paymasters to sponsor gas fees for their users.

Arc uses a consensus engine called Malachite, adopting a permissioned Proof-of-Authority mechanism, with validator nodes operated by known authoritative institutions.

▲ source: Circle

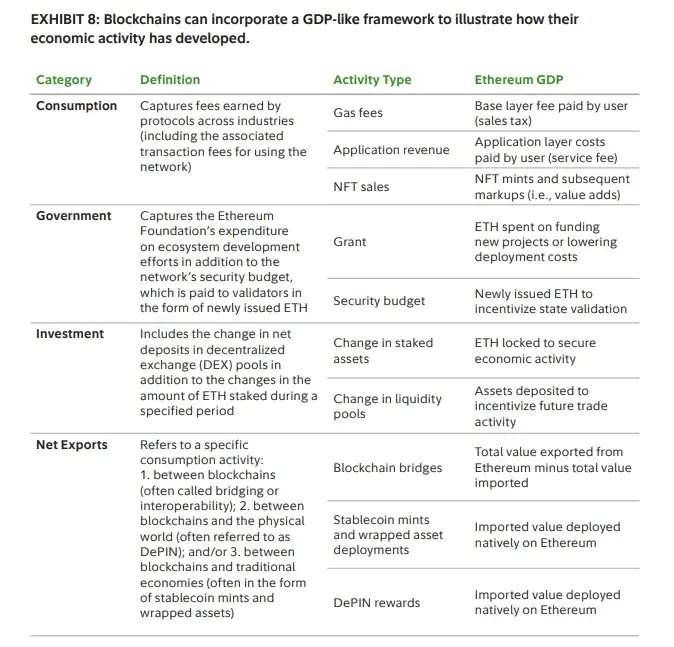

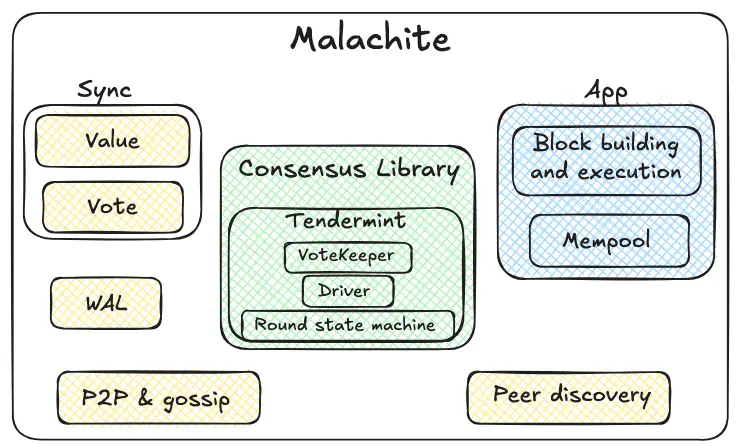

Malachite is a Byzantine Fault Tolerant consensus engine that can be embedded in applications to achieve strong consistency protocols and finality among many independent nodes.

The green-labeled consensus library is the core of Malachite. Its internal round state machine uses a Tendermint-style round mechanism (propose→prevote→precommit→commit). The vote guardian aggregates votes and tracks quorum. The driver coordinates these rounds over time, ensuring the protocol continues to make decisions even if some nodes are delayed or faulty. The consensus library is deliberately designed for generality: it handles "values" in an abstract way so that different types of applications can connect.

The core module is surrounded by yellow-labeled reliability and network infrastructure components. Peer-to-peer and gossip protocols transmit proposals and votes between nodes; node discovery establishes and maintains connections. The write-ahead log persistently stores key events locally, ensuring safety even if nodes crash and restart. The synchronization mechanism has dual paths for value and vote sync—lagging nodes can catch up by obtaining finalized outputs (values) or by filling in missing intermediate votes for ongoing decisions.

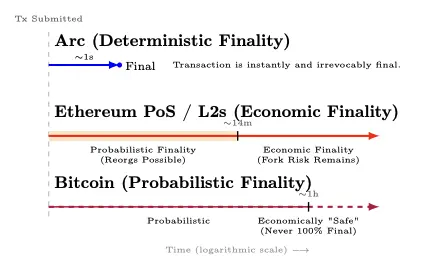

Arc provides about 1-second deterministic finality—when ≥2/3 of validators confirm, the transaction is irreversibly finalized (no reorg risk); Ethereum's proof-of-stake and its L2s reach economic finality after about 12 minutes, transitioning from an initial probabilistic phase with possible reorgs to an "economically final" state; Bitcoin offers probabilistic finality—security increases with more confirmations, reaching "economic safety" after about 1 hour, but mathematically never achieves 100% finality.

▲ source: Arc Litepaper

When ≥⅔ of validators confirm a transaction, it transitions from "unconfirmed" to 100% final (no "reorg probability tail"). This feature aligns with Principle 8 of the Principles for Financial Market Infrastructures (PFMI) regarding clear final settlement.

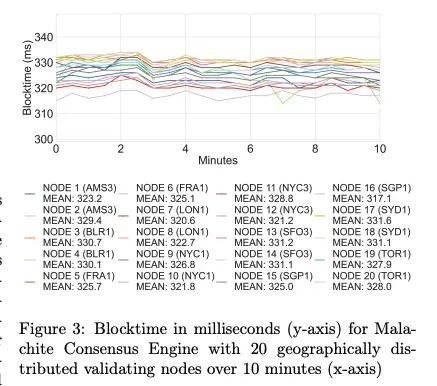

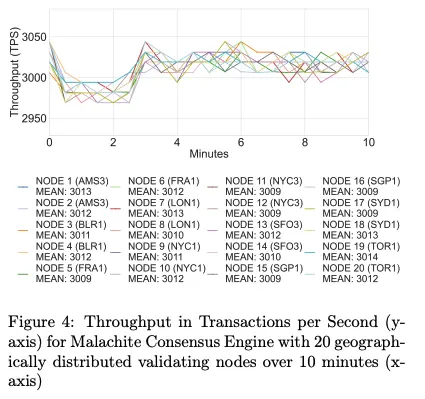

In terms of performance,Arc achieves about 3,000 TPS and sub-350ms finality latency on 20 geographically distributed validator nodes; on 4 geographically distributed validators, it achieves over 10,000 TPS and sub-100ms finality.

▲ source: Arc Litepaper

▲ source: Arc Litepaper

Upgrade plans for the Malachite consensus engine include: supporting multi-proposer mechanisms (expected to increase throughput by about 10x), and optional lower-fault-tolerance configurations (expected to reduce latency by about 30%).

Meanwhile, Arc has launched an optional confidential transfer feature for compliant payments: transaction amounts are hidden while addresses remain visible, and authorized parties can access transaction values via selectively disclosed "view keys." The goal is "auditable privacy"—suitable for banks and enterprises needing on-chain confidentiality without sacrificing compliance, reporting, or dispute resolution.

Arc's design choices focus on the predictability required by institutions and deep integration with the Circle tech stack—but these advantages come with trade-offs: permissioned PoA validator sets concentrate governance and censorship power in known institutions, and BFT systems tend to halt rather than fork in the event of network partitions or validator failures. Critics argue Arc is more like a walled garden or consortium chain for banks, rather than a credibly neutral public network.

But these trade-offs are clear and reasonable for enterprise needs: banks, payment service providers, and fintechs value deterministic finality and auditability over extreme decentralization and permissionlessness. In the long run, Circle has revealed plans to evolve toward permissioned proof-of-stake, opening participation to qualified stakers under slashing and rotation rules.

With USDC as the native fuel currency, institutional-grade pricing/FX engines, sub-second deterministic finality, optional privacy features, and deep integration with Circle's full-stack products, Arc packages the foundational capabilities enterprises truly need into a complete payment rail.

Stablecoin Rail Wars

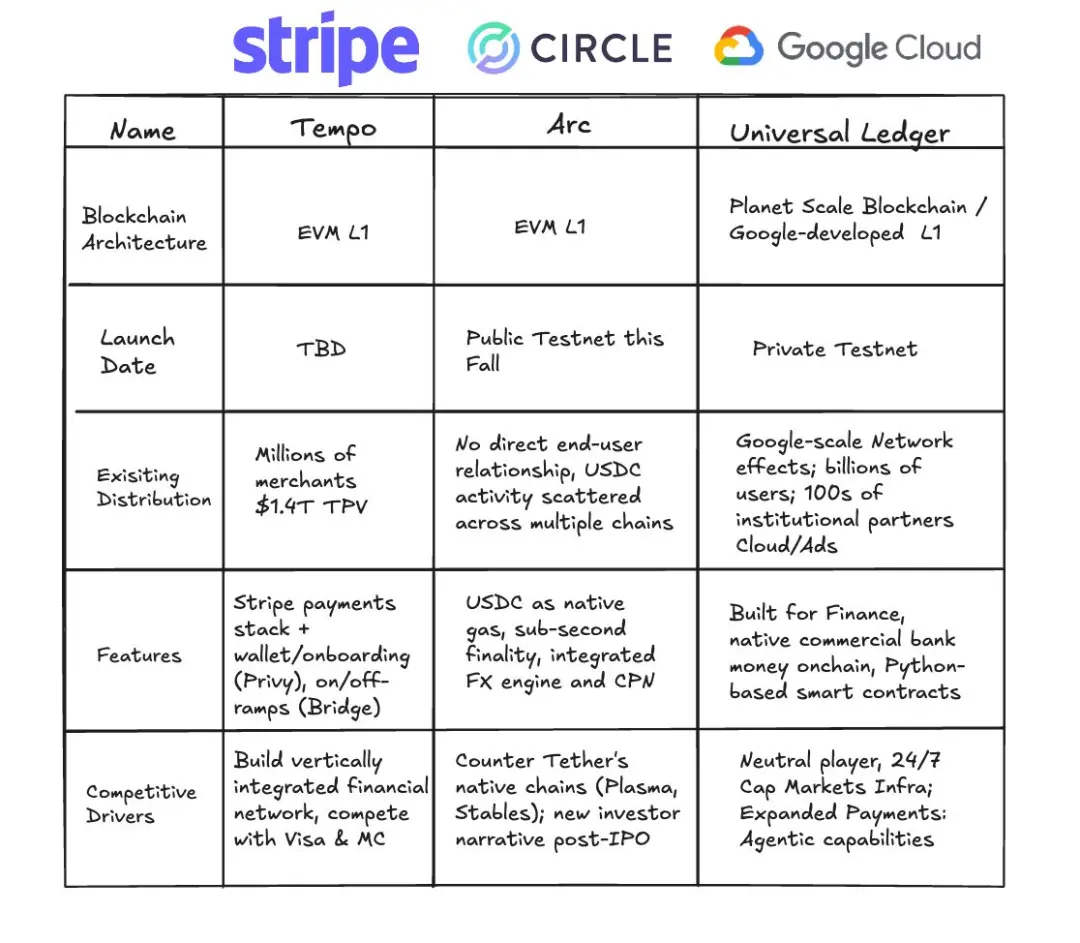

Plasma, Stable, and Arc are not simply three competitors in a race; they are different paths to the same vision—enabling dollars to flow as freely as information. Looking at the big picture, the real competitive focus emerges: the issuer camps (USDT vs. USDC), distribution moats on existing chains, and permissioned rails reshaping enterprise market expectations.

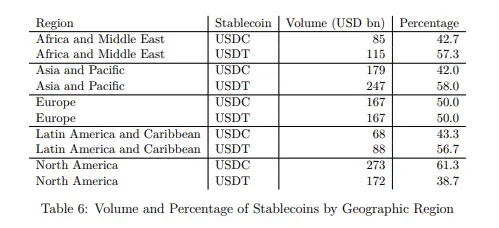

Issuer Camps: USDT vs. USDC

We are witnessing two races simultaneously: competition between public chains and between issuers. Plasma and Stable are clearly USDT-first, while Arc belongs to Circle (the USDC issuer). With PayPal Ventures investing in Stable, more issuers are entering—each vying for distribution channels. In this process, issuers will shape the market entry strategies, target regions, ecosystem roles, and overall direction of these stablecoin public chains.

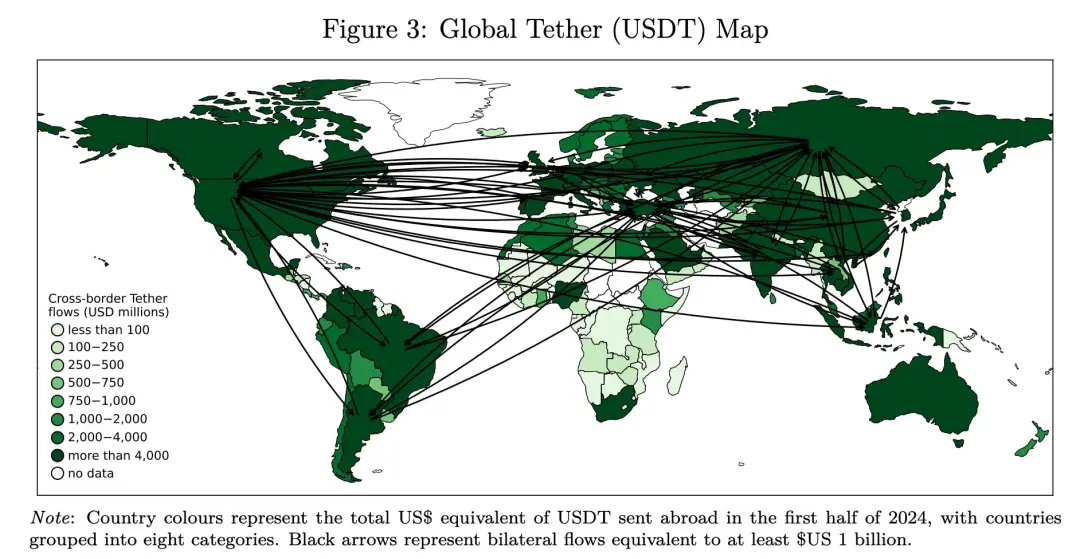

Plasma and Stable may have chosen different market paths and initial target regions, but their ultimate anchor should be markets where USDT is already dominant. The chart below shows global USDT flows in the first half of 2024. The darker the country, the more USDT sent abroad; black arrows indicate the main corridors. The image reveals a hub-and-spoke network, with routes across Africa, the Middle East, Asia-Pacific, and Latin America being especially dense.

▲ source: DeFiying gravity? An empirical analysis of cross-border crypto flows—not from Decrypting Crypto

Another study shows a similar pattern: Tether's USDT is stronger in regions with more emerging markets, while Circle's USDC is more prevalent in Europe and North America. Note that the study only covers EVM chains (Ethereum, BNB Chain, Optimism, Arbitrum, Base, Linea) and does not include Tron, where USDT usage is huge, so USDT's real-world footprint is likely underestimated.

▲ source: Decrypting Crypto: How to Estimate International Stablecoin Flows

In addition to different regional focuses, issuers' strategic choices are also reshaping their roles in the ecosystem—which in turn affects the priorities of stablecoin public chains.Historically, Circle has built a more vertically integrated tech stack (wallet, payments, cross-chain), while Tether has focused on issuance/liquidity and relied more on ecosystem partners. This divergence now creates space for USDT-focused public chains (such as Stable and Plasma) to build more of the value chain themselves. Meanwhile, for multi-chain expansion, USDT0 is designed to unify USDT liquidity.

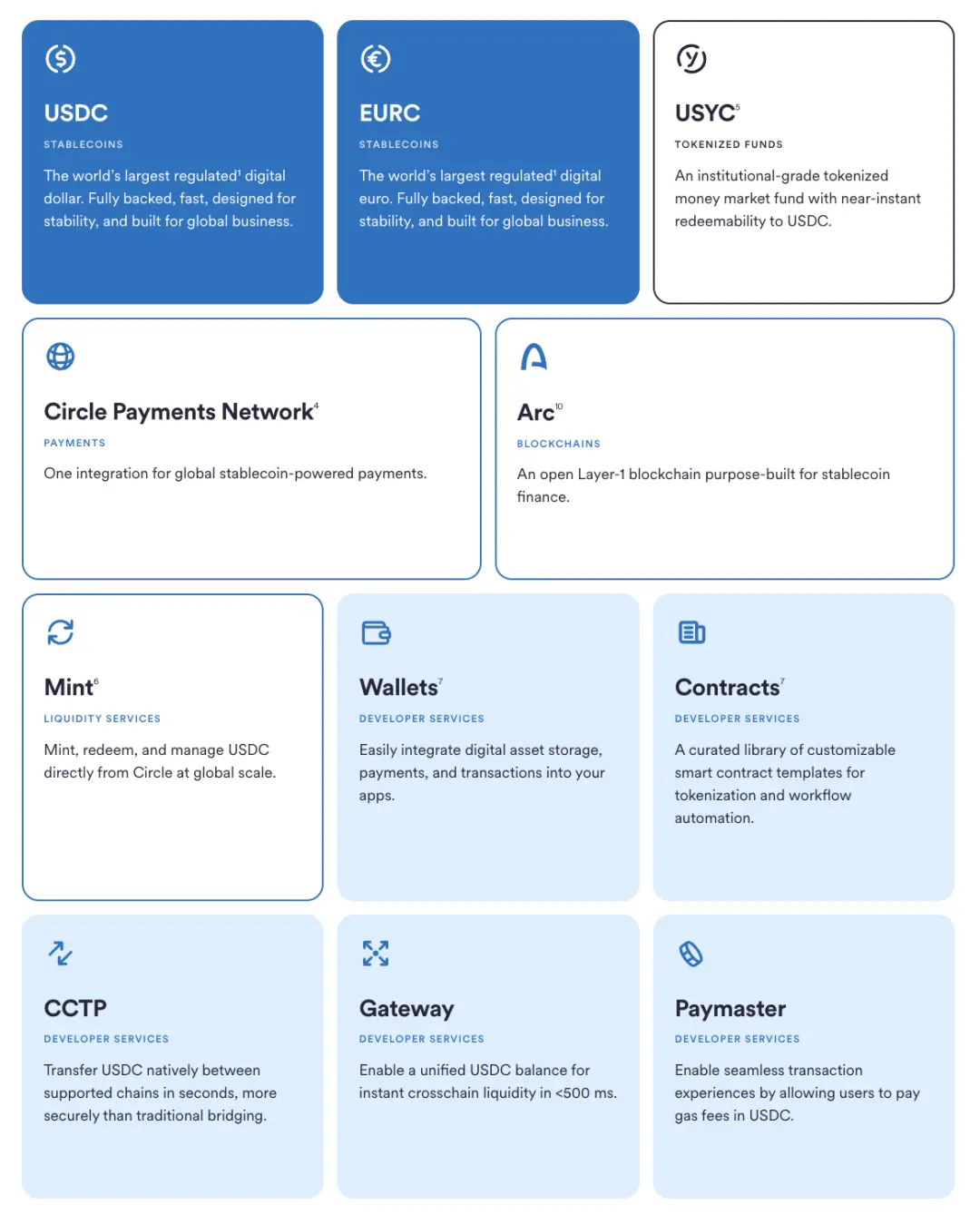

Meanwhile, Circle's ecosystem building has always been cautious and cumulative: starting with USDC issuance and governance, then dissolving Centre and launching programmable wallets to regain control. Next came CCTP, shifting from reliance on cross-chain bridges to nativeburn-and-mint transfers, unifying cross-chain USDC liquidity. With the launch of Circle Payments Network, Circle connects on-chain value with off-chain business. Arc is the latest move in this chess game. Flanking these core pillars are services for issuers and developers—Mint, Contracts, Gateway, and Paymaster (USDC-denominated gas fees)—which reduce third-party dependencies and tighten the feedback loop between product and distribution.

▲ source: Circle

Strategies of Existing Public Chains

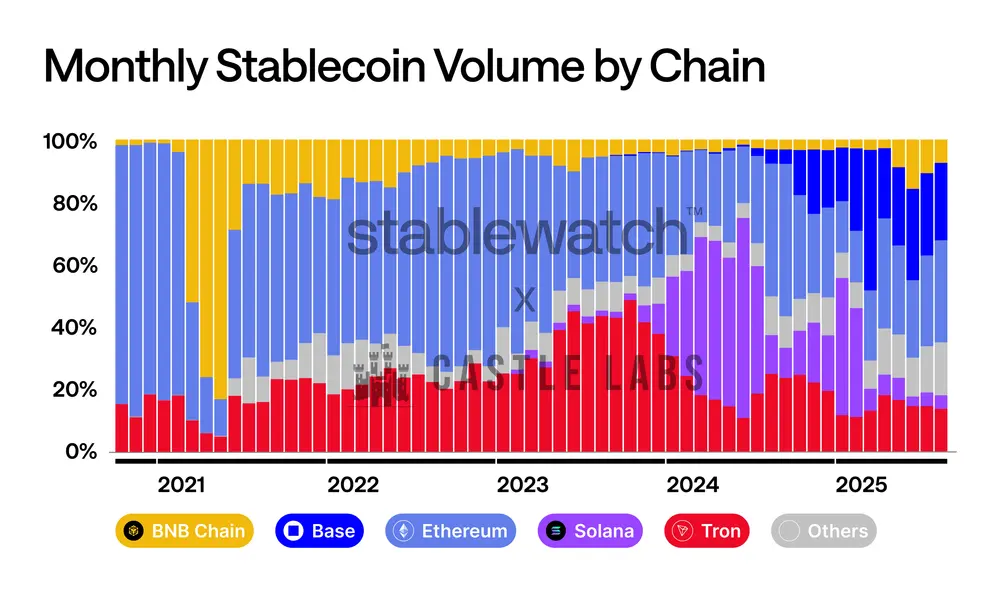

Competition for stablecoin transaction volume has always been fierce. The dynamic shifts in market structure are clear: Ethereum dominated early on, then Tron rose strongly, Solana surged in 2024, and recently Base has gained momentum. No chain can hold the top spot forever—even the deepest moats face monthly share battles. With specialized stablecoin public chains entering, competition will intensify, but incumbents will not easily cede market share; expect aggressive moves on fees, finality, wallet UX, and fiat ramp integration to defend and expand their stablecoin transaction volumes.

▲ source: Stablewatch

Major public chains have already taken action:

-

BNB Chain launched a "zero-fee carnival" at the end of Q3 2024, partnering with multiple wallets, centralized exchanges, and bridges to fully waive USDT and USDC transfer fees for users. The campaign has been extended to August 31, 2025 (UTC+8).

-

Tron has taken a similar approach: its governing body has approved lowering the network "energy" unit price and plans to launch a"gasless" stablecoin transfer solution in Q4 2024 (UTC+8), further cementing its position as a low-cost stablecoin settlement layer.

-

TON takes a different route, completely hiding complexity via the Telegram interface. When users transfer USDT to contacts, the experience is "zero-fee" (actual costs are borne or absorbed by Telegram Wallet within its closed system), and only withdrawals to open public chains incur normal network fees.

-

The core narrative of Ethereum L2s is structural upgrades, not short-term promotions.The Dencun upgrade introduced blob space, greatly reducing rollup data availability costs and enabling them to pass savings to users. Since March 2024 (UTC+8), major L2 fees have dropped significantly.

Permissioned Rails

A parallel track is accelerating: permissioned ledgers built for banks, market infrastructure, and large enterprises.

The most high-profile new entrant is Google Cloud Universal Ledger—a permissioned Layer 1. Google says its target is wholesale payments and asset tokenization. Though public details are limited, its lead positions it as a neutral, bank-grade chain, and CME Group has completed initial integration tests. GCUL is a non-EVM chain, developed by Google, running on Google Cloud infrastructure, and uses Python smart contracts. It is far from a public chain; its model is based on trust in Google and regulated nodes.

▲ source: Google Cloud Universal Ledger

If GCUL is a single cloud-hosted rail, Canton Network adopts a "network of networks" model. Built around Digital Asset's Daml smart contract stack, it connects independently governed applications, enabling assets, data, and cash to synchronize across domains, with fine-grained privacy and compliance controls. Participants include many banks, exchanges, and market operators.

HSBC Orion (HSBC's digital bond platform) has been live since 2023 and hosted the European Investment Bank's first GBP-denominated digital bond—issued under Luxembourg's DLT framework, combining private and public chains for a £50 million issuance.

On the payments side, JPM Coin has provided value transfer services for institutions since 2020, supporting programmable intraday cash flows on JPMorgan-operated rails. At the end of 2024 (UTC+8), the bank reorganized its blockchain and tokenization product lines into Kinexys.

The core throughout these efforts is pragmatism: retaining regulatory guardrails and clear governance while borrowing the best of public chain design. Whether via cloud services (GCUL), interoperability protocols (Canton), productized issuance platforms (Orion), or bank-operated payment rails (JPM Coin/Kinexys), permissioned ledgers converge on the same promise: faster, auditable settlement under institutional control.

Conclusion

Stablecoins have crossed the threshold from crypto niche to payment network scale, with profound economic implications: when the cost of moving a dollar approaches zero, the profit margin from charging for fund transfers disappears. The market's profit center shifts to the value provided around stablecoin transfers.

The relationship between stablecoin issuers and public chains is increasingly evolving into an economic tug-of-war over who captures reserve yield. As seen in Hyperliquid's USDH case, its stablecoin deposits generate about $200 million in annual Treasury yield, which flows to Circle, not its own ecosystem. By issuing USDH and adopting Native Markets' 50/50 split model—half for HYPE token buybacks via an aid fund, half for ecosystem growth—Hyperliquid "internalized" this revenue. This may be another direction beyond "stablecoin public chains": existing networks issuing their own stablecoins to capture value. The sustainable model will be an ecosystem where issuers and public chains share economic benefits.

Looking ahead,auditable privacy payments will gradually become standard for payroll, treasury management, and cross-border flows—not by building a "fully anonymous privacy chain," but by hiding transaction amounts while keeping counterparty addresses visible and auditable. Stable, Plasma, and Arc all adopt this model: providing enterprises with user-friendly privacy and selective disclosure, compliance interfaces, and predictable settlement experiences, achieving "concealment when needed, transparency when required."

We will see stablecoin/payment public chains launchmore features tailored to enterprise needs. Stable's "guaranteed block space" is a typical example: a reserved capacity channel ensuring payroll, treasury, and cross-border payments can be settled with stable latency and cost even during peak traffic. It's like reserved instances in cloud services, but for on-chain settlement.

With the emergence of next-generation stablecoin/payment public chains, this willunlock more opportunities for applications. We've already seen strong DeFi momentum on Plasma and consumer-facing frontends like Stable Pay and Plasma One, but a bigger wave is ahead: digital banks and payment apps, smart agent wallets, QR code payment tools, on-chain credit, risk tranching, and a new class of yield-bearing stablecoins and financial products built around them.

The era when dollars flow as freely as information is coming.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

COC the Game Changer: When Everything in GameFi Becomes "Verifiable", the Era of P2E 3.0 Begins

The article analyzes the development of the GameFi sector from Axie Infinity to Telegram games, pointing out that Play to Earn 1.0 failed due to the collapse of its economic model and trust issues, while Play for Airdrop was short-lived because it could not retain users. COC Game has introduced the VWA mechanism, which verifies key data on-chain in an attempt to address trust issues and build a sustainable economic model. Summary generated by Mars AI. This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively updated.

BTC Volatility Weekly Review (November 17 - December 1)

Key metrics (from 4:00 PM HKT on November 17 to 4:00 PM HKT on December 1): BTC/USD: -9.6% (...

When all GameFi tokens have dropped out of the TOP 100, can COC reignite the narrative with a Bitcoin economic model?

On November 27, $COC mining will be launched. The opportunity to mine the first block won't wait for anyone.

Ethereum's Next Decade: From "Verifiable Computer" to "Internet Property Rights"

Fede, the founder of LambdaClass, provides an in-depth explanation of anti-fragility, the 1 Gigagas scaling goal, and the vision for Lean Ethereum.