Vitalik Buterin receives $1.01M worth of STRK from token unlock

On-chain sleuths discover Vitalik Buterin recently received an 6.29 million STRK from an airdrop that just unlocked after a year. The tokens are now worth $1.01 million.

- Vitalik Buterin received a token unlock from Starknet, amounting to 6.29 million STRK from an airdrop that rewarded early supporter with locked token allocations last year.

- STRK now occupies the second largest portion of Buterin’s portfolio, representing $1.01 million of his crypto wallet holdings.

Ethereum co-founder Vitalik Buterin has recently been rewarded for being one of the early supporters of the Starknet project. On Oct. 9, on-chain analyst Ai Yi revealed that Buterin’s wallet had received around 6.20 million STRK in an airdrop unlock that took place a year after the tokens were allocated.

According to Ai Yi’s post , the airdrop likely originates from a seed financing round for the project back in January 2018. This was when Starknet ( STRK ) was still in its early phases, therefore Buterin is considered one of its early supporters. A year ago, upon receiving the locked tokens, Buterin deposited them into Binance.

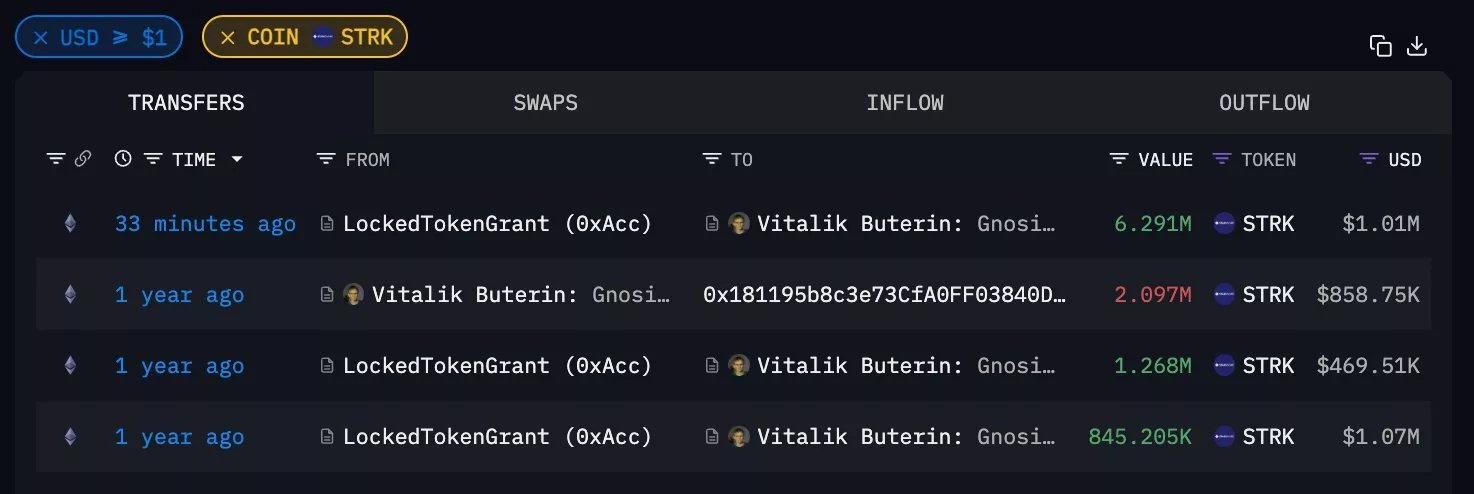

Vitalik Buterin’s crypto wallet receives 6.29 million STRK from an airdrop unlock | Source: Arkham Intelligence

Vitalik Buterin’s crypto wallet receives 6.29 million STRK from an airdrop unlock | Source: Arkham Intelligence

The unlocked tokens are currently worth around $1.01 million. Compared to the previous year, STRK has gone down in value by nearly 60% according to CoinGecko . In February 2024, the token reached its last all-time high at $4.41. However, it has yet to return to such heights following several downtrends over the year.

According to data from Arkham Intelligence, STRK represents the second largest holdings on Vitalik Buterin’s wallet. Valued at $0.16, the token has yielded a value of $1.01 million. Meanwhile, most of Buterin’s crypto wealth is stored in Ethereum ( ETH ). On Oct. 9, Buterin’s ETH holdings have reached around 240,000 ETH, valued at $1.06 billion.

Vitalik Buterin’s history with Starknet

In January 2018, Vitalik Buterin participated as an individual investor in StarkWare’s Starknet project seed financing round. The seed round amounted granted the project $6 million in funding, which was enough to get the project off the ground.

Starknet is a zero knowledge-rollup Layer2 solution built on Ethereum, aiming to improve scalability and reduce transaction costs by batching transactions off-chain and using STARK proofs for validity.

Over the years, Vitalik Buterin has been publicly supportive of Starknet, having praised the project on its technical progress. For example, last year he complimented Starknet on its efforts to improve data-efficiency, such as its v0.13.3 update which significantly reduced “blob” gas costs, a major factor in L2 scaling.

Aside from the current airdrop, Buterin has also participated in other past STRK token unlocks and events. In September 2024, he withdrew 1.26 million STRK, which pushed his total holdings to more than 2.11 million STRK at the time.

In May 2024, Buterin unlocked 2.11 million STRK, which was valued at around $1.07 million. He is also known to have moved STRK around to other wallets and deposit them into exchanges, possibly for custody or privacy reasons.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Increasing Economic Strain of Alzheimer’s Disease and Its Effects on Healthcare Systems and Long-Term Care Industries

- Alzheimer's disease's global economic burden is projected to surge from $1.6 trillion in 2023 to $14.5 trillion by 2050, straining healthcare systems and public infrastructure. - The Alzheimer's therapeutics market is growing at 23.4% CAGR, driven by disease-modifying therapies and tech innovations like AI-driven care platforms. - Strategic investments in dementia infrastructure include $3.9B U.S. NIH funding and startups like Isaac Health securing $10.5M for in-home memory clinics. - Public-private part

Building Robust Investment Portfolios: Insights Gained from Economic Crises and Policy Actions

Hyperliquid (HYPE) Price Rally: The Role of DeFi Advancements and Investor Sentiment in Driving Recent Market Fluctuations

- Hyperliquid (HYPE) surged to $59.39 in 2025 before retreating, driven by DeFi innovations and volatile market sentiment. - Technical advancements like HyperBFT consensus and USDH stablecoin attracted 73% of decentralized trading volume, while institutional partnerships stabilized the ecosystem. - Despite short-term volatility near $36, bullish RSI patterns and $3 trillion trading volume suggest potential for a $59 rebound, though sustained momentum above $43 is critical. - Analysts project HYPE could rea

The Driving Forces Behind Economic Growth in Webster, NY

- Webster , NY, transformed a 300-acre Xerox brownfield into a high-tech industrial hub via a $9.8M FAST NY grant, boosting industrial and real estate growth. - Public-private partnerships enabled infrastructure upgrades, attracting $650M fairlife® dairy projects and 250 high-paying jobs by 2025. - Industrial vacancy rates dropped to 2%, while residential values rose 10.1% annually, highlighting synergies between infrastructure and economic development. - The model underscores secondary markets' potential