Lista DAO Jumps 20% Despite Brief Outage as BNB Ecosystem Rallies

Lista DAO saw its token jump in volume by 20%, retaining these gains despite a technical setback. The firm’s diligence and responsiveness to this issue yielded a positive response from the community.

Moreover, this BNB-based project is benefiting from the bullish momentum in that ecosystem. YZi Labs apparently made a brief comment in favor of the protocol, encouraging waves of new investors.

Lista DAO’s Chaotic Day

Lista DAO, a DeFi protocol with lending and staking abilities, is a moderate success with its $130 million market cap. However, a few recent events have shown a remarkable level of confidence from retail investors, which may suggest that there’s more to this project than meets the eye.

A few hours ago, Lista DAO reported an abnormality on its platform. There were strange price fluctuations with the YUSD stablecoin, which caused the security team to preemptively shut down all activity.

Our security team has detected abnormal price movement in one of the collaterals on Lista Lending ($YUSD).

— Lista DAO (@lista_dao) October 8, 2025

As a precaution, the Lista platform has been temporarily paused to ensure that all users’ funds remain fully protected.

We are conducting a detailed investigation and will… pic.twitter.com/XCDYpkgAmu

This outage lasted less than an hour before the firm resumed operations, prompting celebrations from the community. Considering that some crypto platforms are slow or actively hostile to performing basic due diligence during possible scams, Lista DAO’s energetic responses have earned a lot of trust.

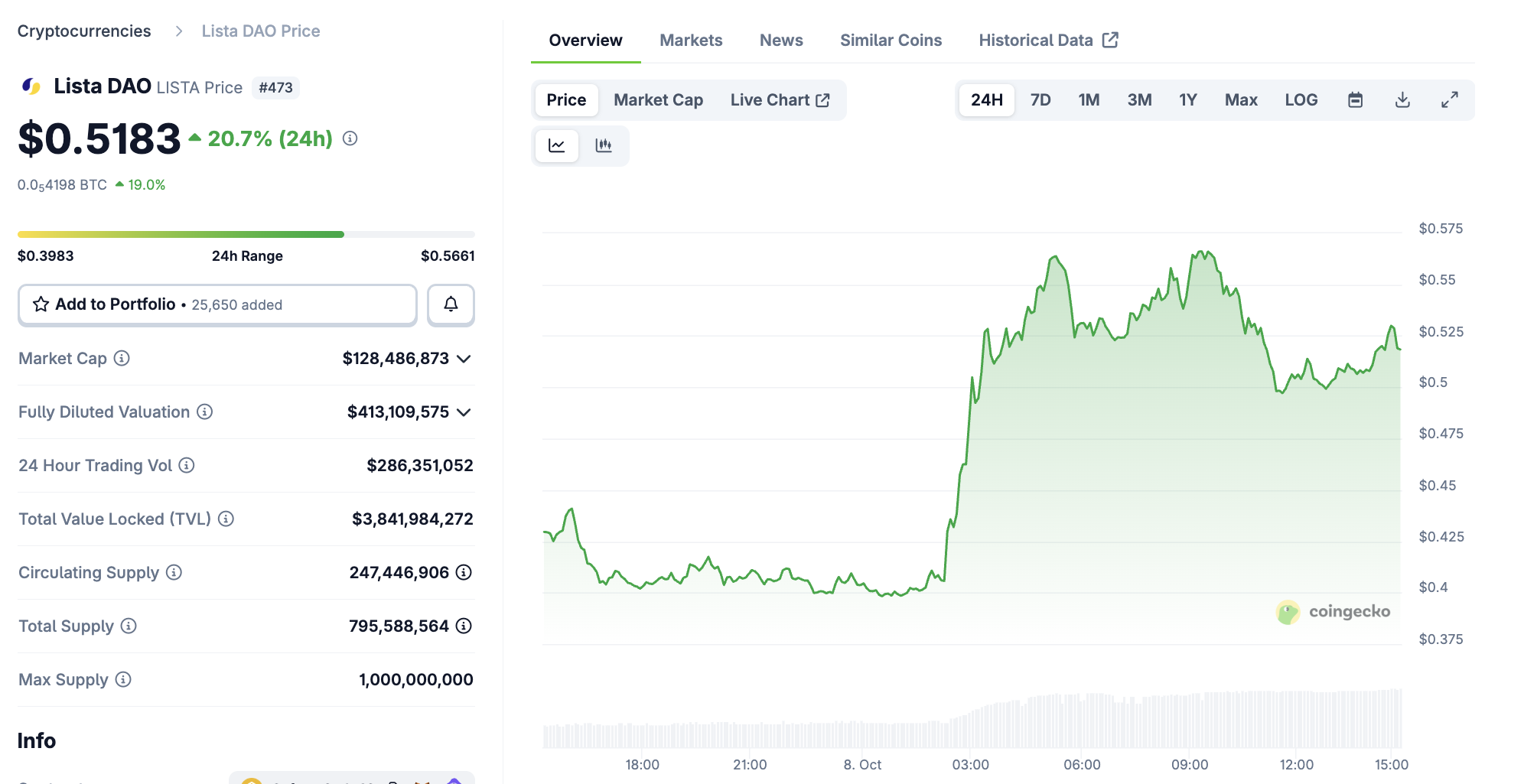

Still, it’s hard to quite quantify this sentiment with social media posts alone. Instead, a price graph might be more useful; Lista DAO underwent its largest price spike in 2025 a few hours before this outage, and the LISTA token maintained most of these huge gains anyway.

The BNB Ecosystem Keeps Rising

So, the firm’s ability to hold onto these gains despite the incident is pretty remarkable. What caused it, though? YZi Labs, a major player in the skyrocketing BSC token ecosystem, recently announced a $1 billion investment into promising projects.

Analysts noticed that this report put Lista DAO in the second spot in its list of Most Valuable Builders (MVBs), which suggests a firm level of confidence.

For the record, at the time of this writing, YZi Labs has evidently edited this announcement, removing all references to specific firms in its MVB program. Apparently, favoritism wasn’t part of its agenda.

Still, this brief mention has attracted a lot of attention. Lista DAO has a healthy market cap and $2.5 billion in TVL, and it’s based on the BNB Smart Chain. This entire ecosystem is rallying, and YZi Labs’ offhand or accidental endorsement has evidently boosted LISTA even more so.

It’ll be interesting to see how much longevity this rally has. Still, Lista DAO made a good showing of itself today, building community trust and quickly responding to problems. Hopefully, it’ll be able to turn this fortune into durable momentum.

The post Lista DAO Jumps 20% Despite Brief Outage as BNB Ecosystem Rallies appeared first on BeInCrypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Abercrombie's Resurgence Fueled by Nostalgia: Surpassing Sales Expectations and Leaving Doubters Behind?

- Abercrombie & Fitch's Q2 2025 $1.2B sales and $2.32 EPS exceeded forecasts, driven by customer-centric strategies and a Taco Bell collaboration. - Analysts show mixed reactions: BTIG lowers price target to $118 while maintaining "Buy," JPMorgan downgrades to "neutral" over growth concerns. - The Hollister x Taco Bell capsule collection (11 styles) targets Gen Z with "future vintage" nostalgia, aligning with CEO Fran Horowitz's retail expertise expansion. - Despite 6.6% YoY revenue growth and consistent e

ECB Raises Concerns Over Systemic Threats While Canada Develops Stablecoin Rules

- Canada's 2025 budget introduces stablecoin regulations requiring reserves, redemption policies, and risk frameworks, overseen by the Bank of Canada with $10M allocated for implementation. - ECB warns $280B stablecoin market risks destabilizing finance by draining bank deposits, triggering reserve asset fire sales, and threatening U.S. Treasury markets during "runs." - Industry advocates like Coinbase argue reserve-backed stablecoins enhance stability, while firms like Republic Technologies invest $100M i

Ethereum Updates Today: Institutional Interest in Ethereum Rises Despite Negative Technical Indicators

- Ethereum faces conflicting short-term volatility and long-term institutional adoption growth, with $7.4B real-world assets tokenized and major banks expanding Ethereum-based frameworks. - Upcoming Dencun upgrade (2026) aims to boost scalability via EIP-4844, but governance risks persist as 10.4% of ETH is controlled by nine firms, warns co-founder Vitalik Buterin. - Bearish technical indicators show ETH below key moving averages, with $2,850 support level critical; quantum computing threats could break E

The Federal Reserve's Change in Policy and Its Impact on Solana and the Wider Cryptocurrency Market

- Fed's 2025 rate cut and QT end boosted risk assets, with Solana ETFs seeing $37.33M inflows amid Bitcoin outflows. - Solana's DEX volume surpassed $1T, driven by institutional confidence post-Coinbase acquisition. - Policy uncertainty caused short-term Solana price dips, but growing institutional interest highlights its macro-hedging appeal. - Anticipated 2026 QE could further boost Solana's ecosystem as liquidity expands and fiscal flows increase.