Shiba Inu Price Prediction: SHIB Coin Drops 5% as Bitcoin Price Adjusts

Shiba Inu Price Analysis: A Sharp Dip Amid Bitcoin’s Correction

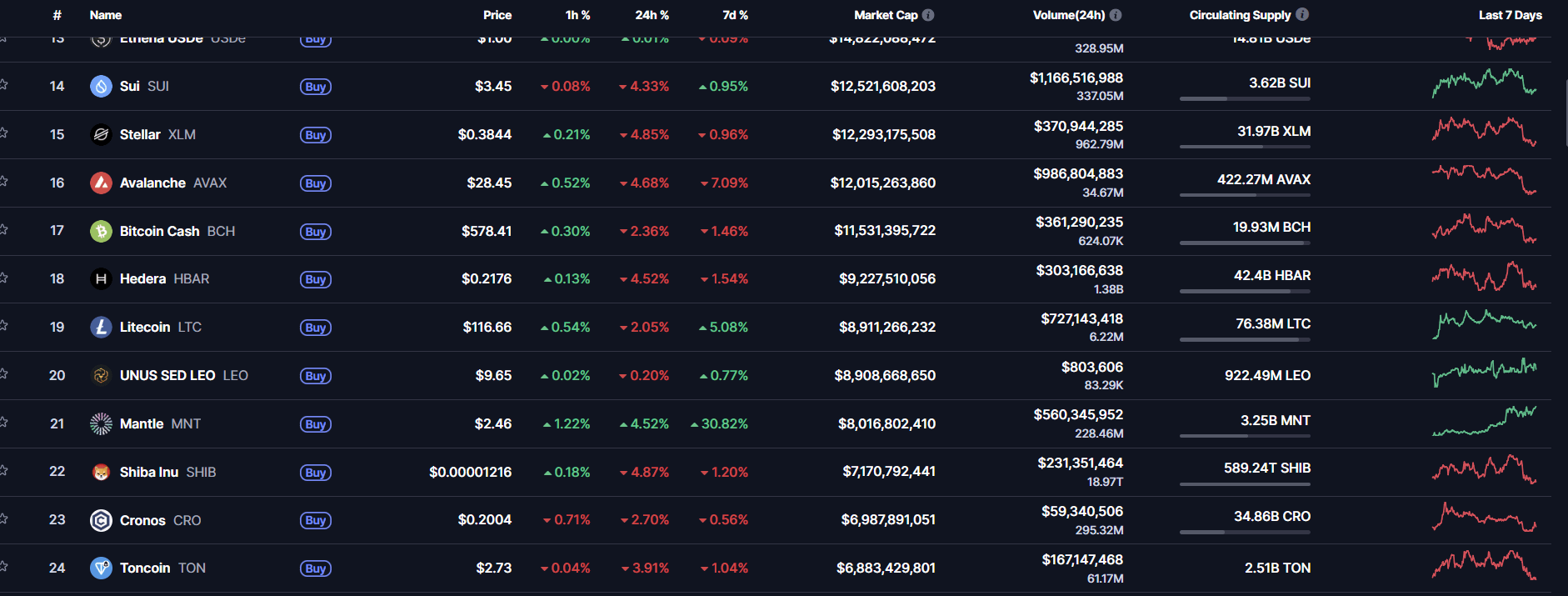

The latest data shows that Shiba Inu ( $SHIB ) has dropped nearly 5% in the past 24 hours, trading around $0.00001216, as seen on the attached chart. This decline follows Bitcoin’s pullback from its recent all-time high of $126K to around $122.5K, which triggered short-term volatility across the memecoin market.

SHIB/USD 1-day chart with BTC/USD performance - TradingView

On the charts, SHIB is struggling below both its 50-day and 200-day moving averages (SMA at $0.00001261 and $0.00001293), signaling resistance pressure. The recent attempt to break above these levels was rejected, marked by a downward candle formation—highlighting that bearish sentiment remains active.

Shiba Inu Falls to the 22nd Spot by Market Cap

According to the latest rankings , Shiba Inu has now slipped to #22 among the largest cryptocurrencies by market capitalization, sitting below projects like Mantle (MNT) and UNUS SED LEO (LEO). With a market cap of $7.17 billion, SHIB’s position reflects investor rotation toward stronger-performing assets during Bitcoin’s retracement phase.

Despite its massive community and ecosystem developments, SHIB continues to experience high volatility—a common trait among memecoins, where sentiment shifts rapidly based on Bitcoin’s trajectory and broader market momentum.

Memecoins: The Volatility Factor

Memecoins like $SHIB, $DOGE, and $PEPE thrive on hype cycles and often move faster than the broader crypto market. When Bitcoin rallies, memecoins tend to outperform briefly—but corrections usually hit them harder. SHIB’s 5% daily drop is a reminder of how sensitive such tokens remain to Bitcoin’s price action and speculative trading volume.

For SHIB, the key short-term support level is around $0.00001200. A breakdown below this could open the path toward $0.00001150, while a recovery above $0.00001290 (200-day SMA) could reignite bullish momentum.

SHIB Price Prediction: What’s Next If Bitcoin Recovers?

If Bitcoin rebounds above $125K, Shiba Inu could easily retest the $0.00001300–$0.00001350 range, supported by renewed optimism across altcoins. In a stronger bull continuation scenario, SHIB could push toward the $0.00001500 resistance zone—its next major target seen on the chart.

However, if Bitcoin consolidates or extends its decline toward $120K, SHIB might remain range-bound between $0.00001200 and $0.00001270, with traders awaiting clearer signals.

Shiba Inu Future: Patience Amid Pressure

Shiba Inu’s recent performance reflects the broader crypto correction phase. While it has slipped in rankings, its strong community, upcoming ecosystem utilities, and exposure to Bitcoin cycles suggest potential recovery if the market regains momentum.

For now, the key lies in Bitcoin’s direction—its next move will likely determine whether $SHIB rebounds or continues consolidating near its current levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hotcoin Research | Fusaka Upgrade Approaching: Analysis and Outlook on Ethereum Long and Short Positions

This article will review Ethereum's recent performance, provide an in-depth analysis of the current bullish and bearish factors facing Ethereum, and look ahead to its prospects and trends for the end of this year, next year, and the medium to long term. The aim is to help ordinary investors clarify uncertainties, grasp trends, and provide some reference to support more rational decision-making during key turning points.

Crypto Market Surges as Bitcoin Rebounds and Privacy Coins Shine

In Brief Bitcoin rebounded over the weekend, testing the $86,000 mark. Privacy-focused altcoins Monero and Zcash showed notable gains. Total market value surged, crossing the $3 trillion threshold again.

Crypto Markets Rebound as Traders Signal Seller Fatigue

In Brief Crypto markets rebounded amid significant liquidations and oversold RSI signals. Weekend trading conditions with thin liquidity influenced rapid price shifts. The rebound's sustainability remains uncertain, prompting scrutinous investor attention.

Cardano : Network security questioned after a major incident