Healthy Reset or Early Warning? Bitcoin Slips from All-Time Highs as Realized Profits Spike

Bitcoin’s dip to $121,000 marks a healthy reset, not a reversal. On-chain data shows strong fundamentals that could fuel the next leg higher.

Bitcoin’s price has taken a brief step back after an impressive rally that pushed it to a new all-time high earlier this week. The crypto king now trades near $121,000, slightly below recent peaks.

Despite this dip, market analysts note that the pullback appears healthy, suggesting continued investor confidence in the long-term outlook.

Bitcoin Investors Book Profits

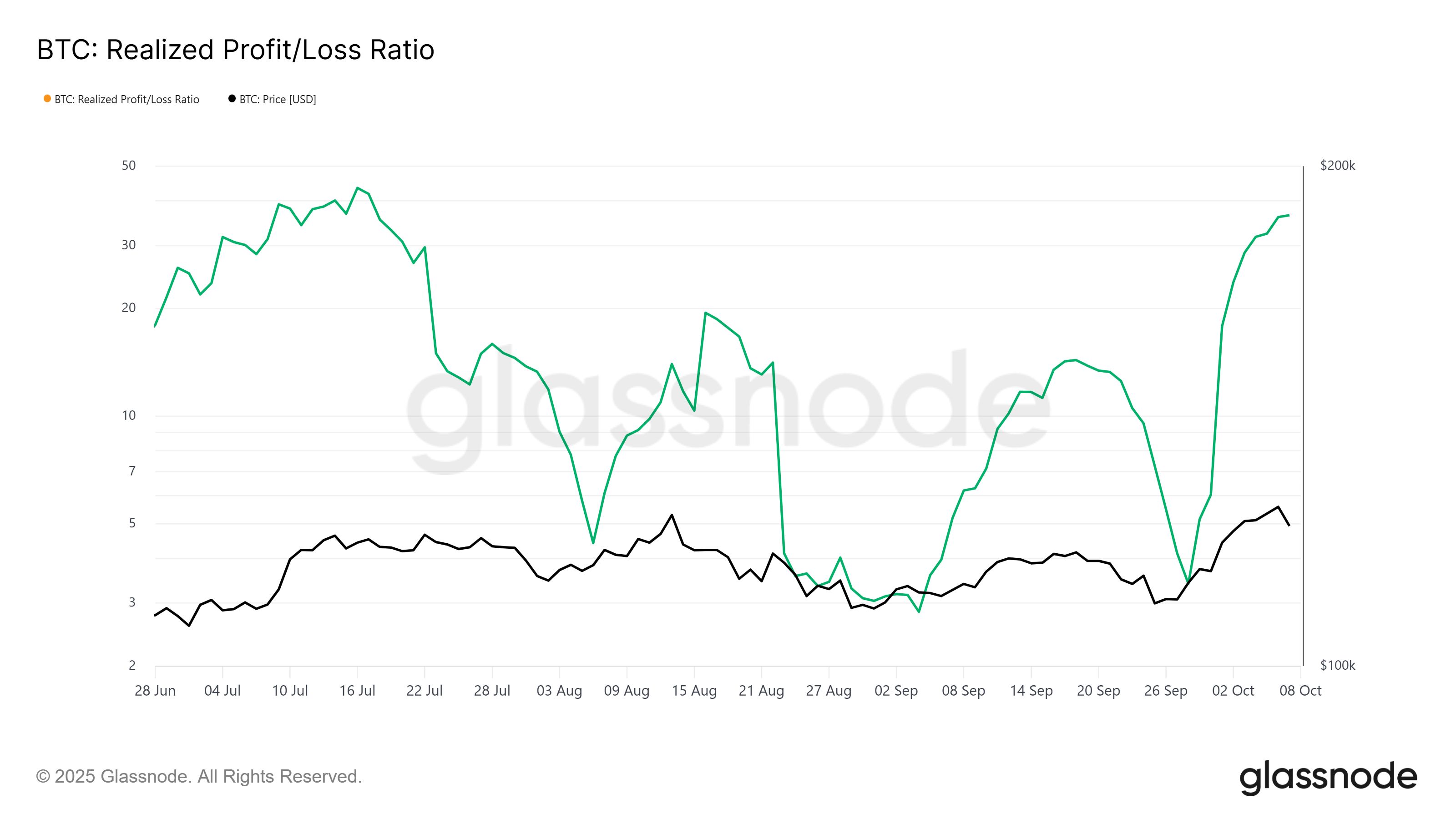

The Realized Profit/Loss ratio, a key on-chain metric, reveals that Bitcoin investors have been selling over the past several days. The indicator recently reached a three-month high, confirming that profit-taking has intensified after the asset’s strong price surge. This pattern is typical following an extended bullish run.

While selling has been visible, it doesn’t necessarily indicate weakening confidence. Instead, it reflects a natural correction phase as traders lock in profits. With Bitcoin’s value climbing consistently since the start of the month, a short-term cooldown allows the market to stabilize before potentially resuming its upward trajectory.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin Realized Profit/Loss Ratio. Source:

Glassnode

Bitcoin Realized Profit/Loss Ratio. Source:

Glassnode

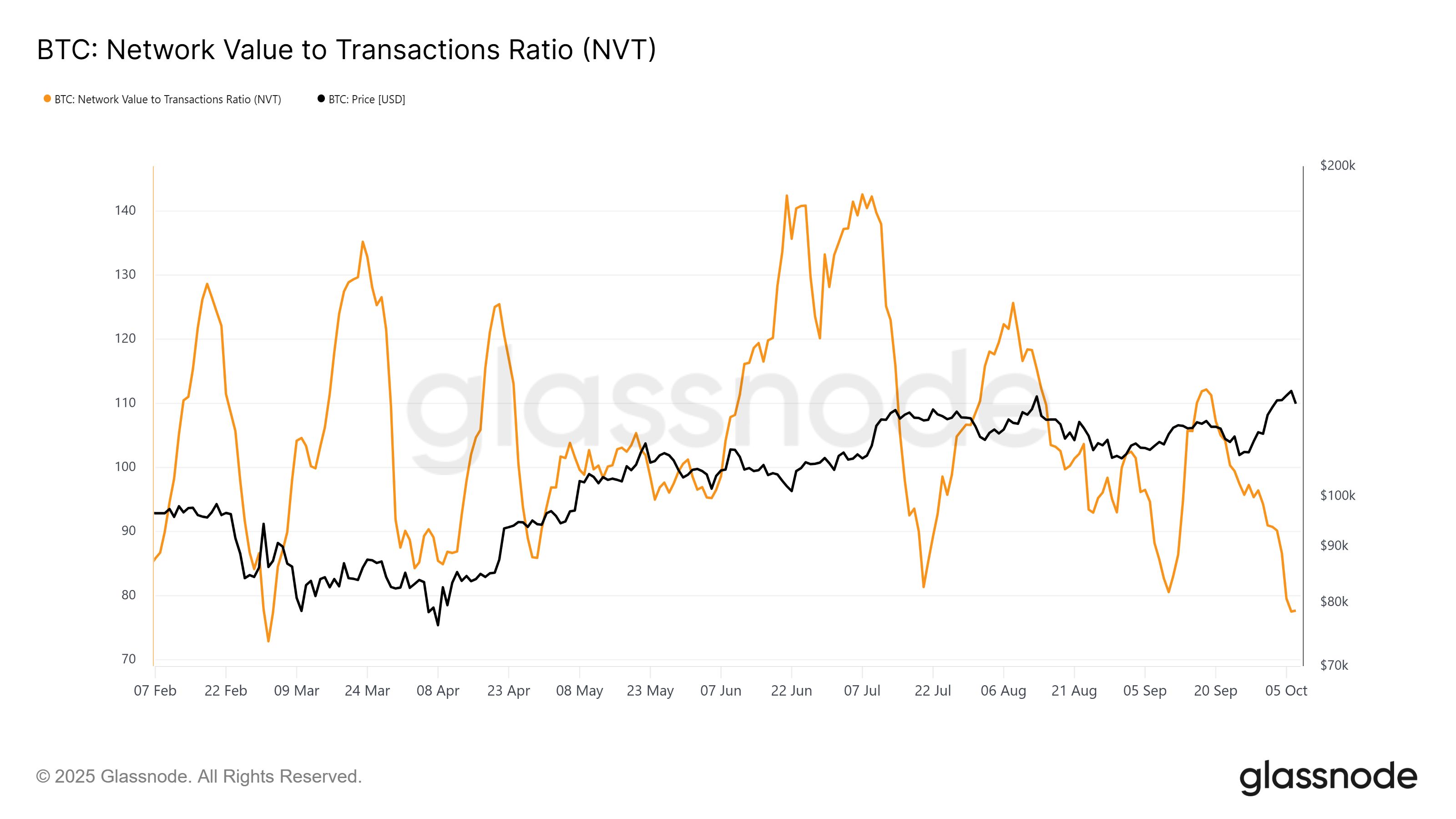

From a broader perspective, Bitcoin’s macro momentum remains positive. The Network Value to Transactions (NVT) Ratio, a long-term valuation metric, shows that BTC is still significantly undervalued. The indicator has fallen to a seven-month low, suggesting that transaction volume is expanding faster than Bitcoin’s market capitalization.

This dynamic indicates strong network activity, often viewed as a bullish signal. Rising transaction levels paired with relatively slower market cap growth highlight continued user engagement and institutional adoption.

Bitcoin NVT Ratio. Source:

Glassnode

Bitcoin NVT Ratio. Source:

Glassnode

BTC Price Is Not Losing Too Much

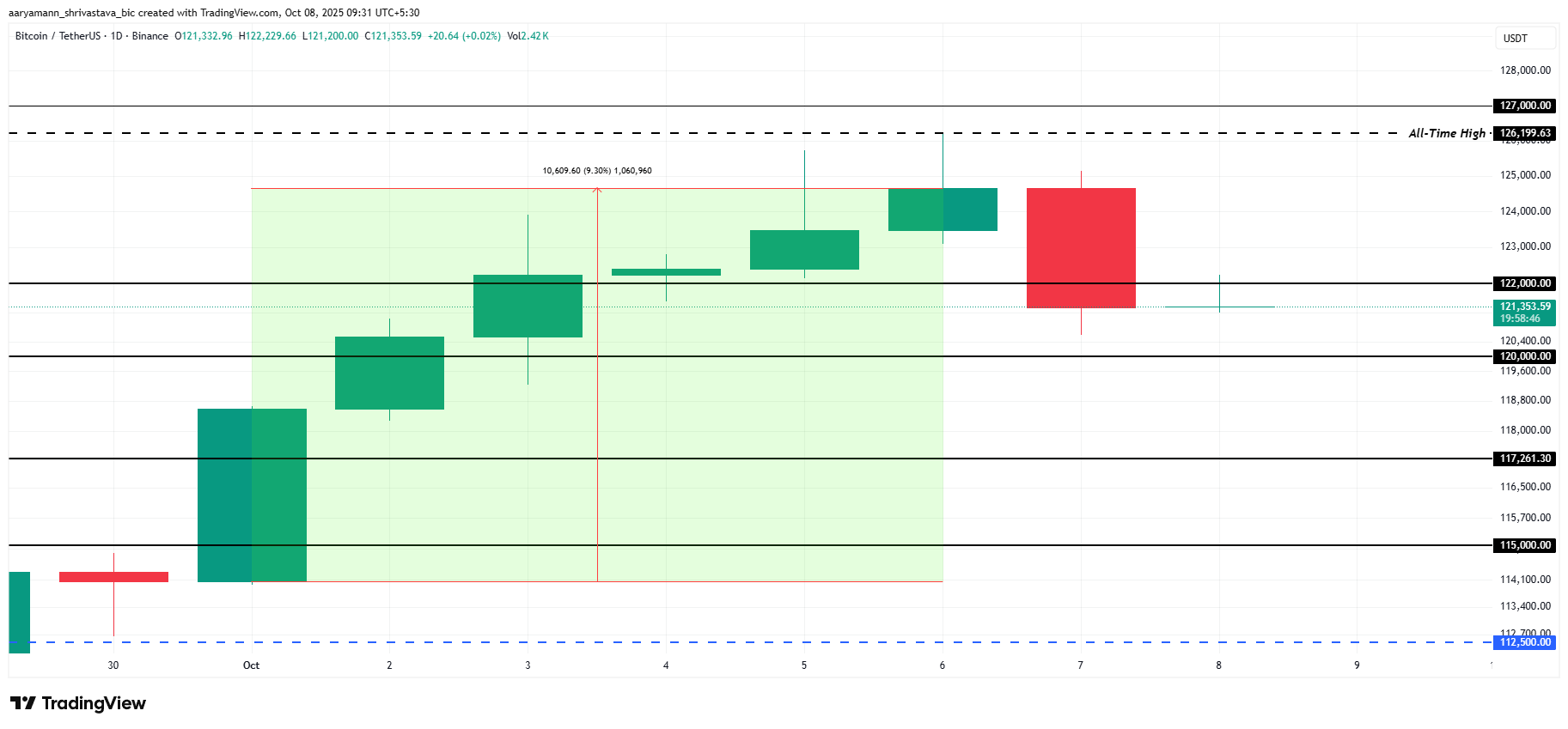

At the time of writing, Bitcoin trades at $121,353, holding firm above the $120,000 support level. The asset sits just below the $122,000 resistance, which has become a key short-term threshold for traders watching potential breakout signals.

The recent decline can largely be attributed to profit-taking after Bitcoin reached its current all-time high of $126,199. Given the strength of current technical and on-chain indicators, BTC is likely to reclaim $122,000 and consolidate within a stable range before attempting another upward push.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

However, if selling pressure intensifies and investors take additional profits, Bitcoin could slip below $120,000. In that case, a decline toward $117,261 remains possible, temporarily invalidating the prevailing bullish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cobie: Long-term trading

Crypto Twitter doesn't want to hear "get rich in ten years" stories. But that might actually be the only truly viable way.

The central bank sets a major tone on stablecoins for the first time—where will the market go from here?

This statement will not directly affect the Hong Kong stablecoin market, but it will have an indirect impact, as mainland institutions will enter the Hong Kong stablecoin market more cautiously and low-key.

Charlie Munger's Final Years: Bold Investments at 99, Supporting Young Neighbors to Build a Real Estate Empire

A few days before his death, Munger asked his family to leave the hospital room so he could make one last call to Buffett. The two legendary partners then bid their final farewell.

Stacks Nakamoto Upgrade

STX has never missed out on market speculation surrounding the BTC ecosystem, but previous hype was more like "castles in the air" without a solid foundation. After the Nakamoto upgrade, Stacks will provide the market with higher expectations through improved performance and sBTC.