The "Singularity Moment" of Perp DEX: Why Can Hyperliquid Kick Open the Door to On-Chain Derivatives?

The story of Perp DEX is far from over—Hyperliquid may be just the beginning.

"Derivatives are the holy grail of DeFi." As early as 2020, the market had already reached a consensus that on-chain perp protocols are the ticket to the second half of DeFi.

But in reality, over the past five years, whether due to performance or cost constraints, perp DEXs have always faced a tough trade-off between "performance" and "decentralization." During this period, the AMM model represented by GMX achieved permissionless trading, but struggled to match CEXs in terms of trading speed, slippage, and depth.

It wasn't until the emergence of Hyperliquid, with its unique on-chain order book architecture, that a CEX-like smooth experience was achieved on a fully self-custodial blockchain. The recently passed HIP-3 proposal has further broken down the barriers between Crypto and TradFi, opening up infinite possibilities for trading more assets on-chain.

This article will take you deep into the operational mechanism and revenue sources of Hyperliquid, objectively analyze its potential risks, and explore the revolutionary variables it brings to the DeFi derivatives sector.

The Cycle of the perp DEX Track

Leverage is the core primitive of finance. In mature financial markets, derivatives trading far surpasses spot trading in terms of liquidity, capital volume, and trading scale. After all, through margin and leverage mechanisms, limited funds can move larger market volumes, meeting diverse needs such as hedging, speculation, and yield management.

The Crypto world has also validated this rule, at least in the CEX sector. As early as 2020, derivatives trading represented by contract futures began to replace spot trading on CEXs, gradually becoming the market leader.

According to Coinglass data, in the past 24 hours, the daily trading volume of leading CEX contract futures has reached tens of billions of dollars, with Binance surpassing $130 billion.

Source: Coinglass

In contrast, on-chain perp DEXs have been on a long five-year journey. During this time, dYdX explored a more centralized experience through on-chain order books but faced challenges balancing performance and decentralization. The AMM model represented by GMX achieved permissionless trading, but still lagged far behind CEXs in terms of trading speed, slippage, and depth.

In fact, the sudden collapse of FTX in early November 2022 temporarily stimulated a surge in trading volume and new users for on-chain derivatives protocols like GMX and dYdX. However, due to the overall trading experience—market environment, on-chain trading performance, trading depth, and variety—the entire sector soon fell silent again.

To be fair, once users realize that trading on-chain comes with the same liquidation risks but cannot provide CEX-level liquidity and experience, their willingness to migrate naturally drops to zero.

So the key issue is not "whether there is demand for on-chain derivatives," but rather the persistent lack of a product that can both provide irreplaceable value over CEXs and solve performance bottlenecks.

The market gap is very clear: DeFi needs a perp DEX protocol that can truly deliver a CEX-level experience.

It is in this context that Hyperliquid has brought new variables to the entire sector. What is less known is that although Hyperliquid only gained mainstream attention this year, it was actually launched as early as 2023 and has been continuously iterating and accumulating over the past two years.

Is Hyperliquid the Ultimate Form of "On-chain CEX"?

Facing the long-standing "performance vs. decentralization" dilemma in the perp DEX sector, Hyperliquid's goal is straightforward—to directly replicate the smooth experience of CEXs on-chain.

To achieve this, it chose an aggressive path: instead of relying on the performance constraints of existing public chains, it built its own dedicated L1 application chain based on the Arbitrum Orbit tech stack, and deployed a fully on-chain order book and matching engine on top of it.

This means that from order placement, matching, to settlement, all trading processes occur transparently on-chain, while still achieving millisecond-level processing speeds. Architecturally, Hyperliquid is more like a "fully on-chain version" of dYdX, no longer relying on any off-chain matching, aiming directly at the ultimate form of an "on-chain CEX."

The effect of this aggressive approach was immediate.

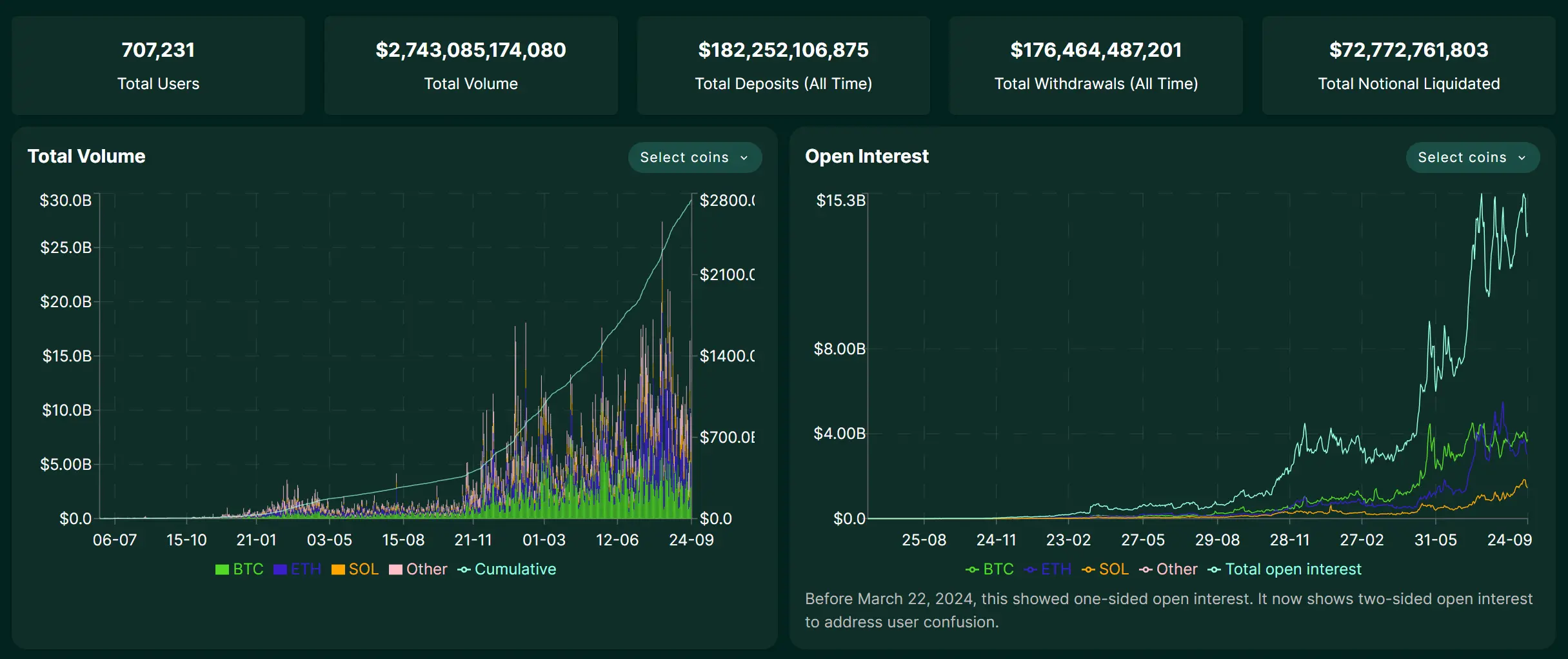

Since the beginning of this year, Hyperliquid's daily trading volume has been climbing, once reaching $20 billion. As of September 25, 2025, the cumulative total trading volume has exceeded $2.7 trillion, and its revenue scale even surpasses most second-tier CEXs. This fully demonstrates that on-chain derivatives do not lack demand, but rather lack a product form truly suited to DeFi characteristics.

Source: Hyperliquid

Of course, such strong growth has quickly brought it ecological gravity. Not long ago, the USDH issuance rights bidding war initiated by HyperLiquid attracted heavyweight players like Circle, Paxos, and Frax Finance to publicly compete (see also: "Starting from HyperLiquid's USDH Becoming a Hot Commodity: Where Is the Fulcrum of DeFi Stablecoins?"), which is the best example.

However, simply replicating the CEX experience is not Hyperliquid's end goal. The recently passed HIP-3 proposal introduced a permissionless, developer-deployed perpetual contract market into the core infrastructure. Previously, only the core team could list trading pairs, but now any user who stakes 1 million HYPE can directly deploy their own market on-chain.

In short, HIP-3 allows for the permissionless creation and listing of derivatives markets for any asset on Hyperliquid. This completely breaks the previous limitation of Perp DEXs only being able to trade mainstream cryptocurrencies. Under the HIP-3 framework, in the future we may see the following on Hyperliquid:

- Stock markets: Trading top global financial assets such as Tesla (TSLA), Apple (AAPL), etc.;

- Commodities and Forex: Trading traditional financial products such as gold (XAU), silver (XAG), or EUR/USD;

- Prediction markets: Betting on various events, such as "Will the Federal Reserve cut interest rates next time?" or "The floor price of a certain blue-chip NFT," etc.;

This will undoubtedly greatly expand Hyperliquid's asset classes and potential user base, blurring the boundaries between DeFi and TradFi. In other words, it allows any user worldwide to access core assets and financial instruments of the traditional world in a decentralized, permissionless manner.

What Is the Other Side of the Coin?

However, while Hyperliquid's high performance and innovative model are exciting, there are also significant risks that cannot be ignored, especially since it has not yet undergone a major crisis "stress test."

The cross-chain bridge issue is the most discussed in the community. Hyperliquid connects to the mainnet through a cross-chain bridge controlled by a 3/4 multisig, which constitutes a centralized trust node. If these signatories encounter problems due to accidents (such as lost private keys) or malice (such as collusion), the security of all users' assets in the cross-chain bridge will be directly threatened.

Secondly, there is treasury strategy risk, as HLP treasury yields are not guaranteed. If the market maker's strategy incurs losses under certain market conditions, the principal deposited in the treasury will also decrease. While users enjoy high yield expectations, they must also bear the risk of strategy failure.

As an on-chain protocol, Hyperliquid also faces common DeFi risks such as smart contract vulnerabilities, oracle price feed errors, and users being liquidated in leveraged trades. In fact, in recent months, the platform has experienced several large-scale liquidation events due to malicious price manipulation of some small-cap tokens, exposing its need for improvement in risk control and market supervision.

Moreover, objectively speaking, there is another issue that many have not considered: as a rapidly growing platform, Hyperliquid has not yet undergone major compliance reviews or severe security incidents. During a platform's rapid expansion phase, risks are often masked by the halo of rapid growth.

Overall, the story of perp DEXs is far from over.

Hyperliquid is just the beginning. Its rapid rise not only proves the real demand for on-chain derivatives but also demonstrates the feasibility of breaking through performance bottlenecks through architectural innovation. HIP-3 further expands the imagination to stocks, gold, forex, and even prediction markets, truly blurring the boundaries between DeFi and TradFi for the first time.

Although high returns and high risks always go hand in hand, from a macro perspective, the attractiveness of the DeFi derivatives sector will not fade due to the risks of a single project. In the future, it is possible that new projects will emerge to take the lead from Hyperliquid/Aster as the new flagship of on-chain derivatives. Therefore, as long as we believe in the charm and imagination of the DeFi ecosystem and the derivatives sector, we should give enough attention to such seed players.

Perhaps, looking back in a few years, this will be a brand new historical opportunity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bloomberg: As the crypto market crashes, the Trump family's and their supporters' wealth is shrinking significantly

The Trump family's wealth has shrunk by 1.1 billions US dollars, with ordinary investors becoming the biggest losers.

Why are most treasury DATs trading at a discount?

Is the DAT model truly a bridge connecting TradFi, or is it a "death spiral" for the crypto market?

Powell’s allies make a major statement: Is a December rate cut “reversal” now highly likely?

Economists point out that three of the most influential officials have formed a strong coalition in support of interest rate cuts, which will be difficult to challenge.

How We Build: Boundless Product Engineering and the Post-TGE Era

Now, thanks to the team's efforts, Boundless has become the first truly decentralized and permissionless protocol capable of handling any general-purpose ZKVM proof request.