TAO Snaps Its Sideways Streak as Bulls Regain Control After Two Weeks

Bittensor’s TAO ends its two-week lull with a 6% rally backed by surging volume and strong long positioning, hinting at a possible climb toward $373 if buying pressure holds.

Bittensor’s native token, TAO, has surged 6% in the past 24 hours, breaking out of a two-week-long horizontal channel that had kept prices consolidating since September 23.

The rally comes as crypto market liquidity improves, with capital inflows rising across risk assets amid a weakening US dollar and uncertainty in traditional finance markets. As bullish sentiment spreads across the broader crypto market, TAO could be gearing up for new local highs if current momentum holds.

Traders Pile In as TAO Flips Bullish

TAO traded within a horizontal channel between September 23 and October 7, keeping its price performance muted. However, as broader market sentiment improved, the altcoin closed above the upper line of its consolidation range yesterday, suggesting that bulls may have regained short-term control.

As its price has climbed over the past day, its daily trading volume has also spiked sharply, validating the strength behind the upward move. Currently at $212 million, TAO’s trading volume is up 108% in the past 24 hours.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

TAO Price/Trading Volume. Source:

TAO Price/Trading Volume. Source:

When an asset’s price and trading volume rise simultaneously, the upward movement is driven by genuine market demand rather than isolated or speculative large trades. This trend validates TAO’s breakout and suggests that new capital is flowing into the market, increasing the potential for a sustained rally.

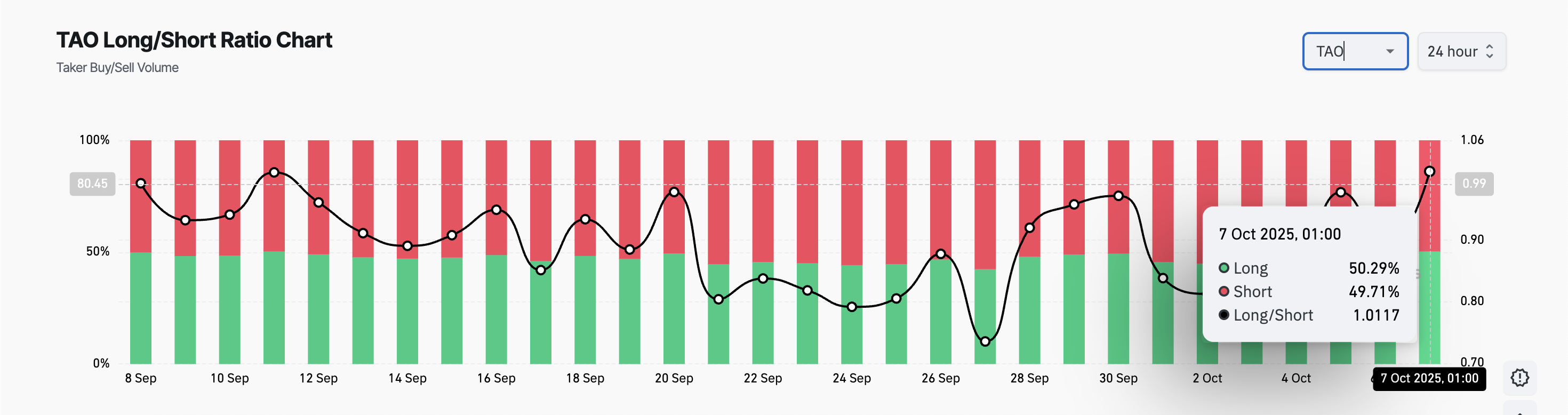

Furthermore, TAO’s climbing long/short ratio supports the positive momentum. At press time, this was at 1.01, indicating that market participants lean heavily toward long positions.

TAO Long/Short Ratio. Source:

TAO Long/Short Ratio. Source:

The long/short ratio measures the proportion of traders holding long positions (bets that an asset’s price will rise) against those holding short positions.

A ratio below one signals that most participants are betting on further downside. Conversely, as with TAO, a ratio above one indicates that more traders expect upward momentum, reflecting a bullish sentiment in the derivatives market.

TAO’s Next Stop Could Be $373 — If Buyers Keep the Pressure On

TAO’s recent breakout, combined with its healthy on-chain sentiment and rising spot demand, suggests that traders are positioning for a potential continuation of the uptrend. If buying pressure persists, TAO could retest its early-September highs and climb to $373.31.

TAO Price Analysis. Source:

TAO Price Analysis. Source:

However, if demand wanes, the token could lose momentum and fall to $333.9. If this support floor weakens, TAO’s price may attempt to fall back within its sideways pattern, and break below $320.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?