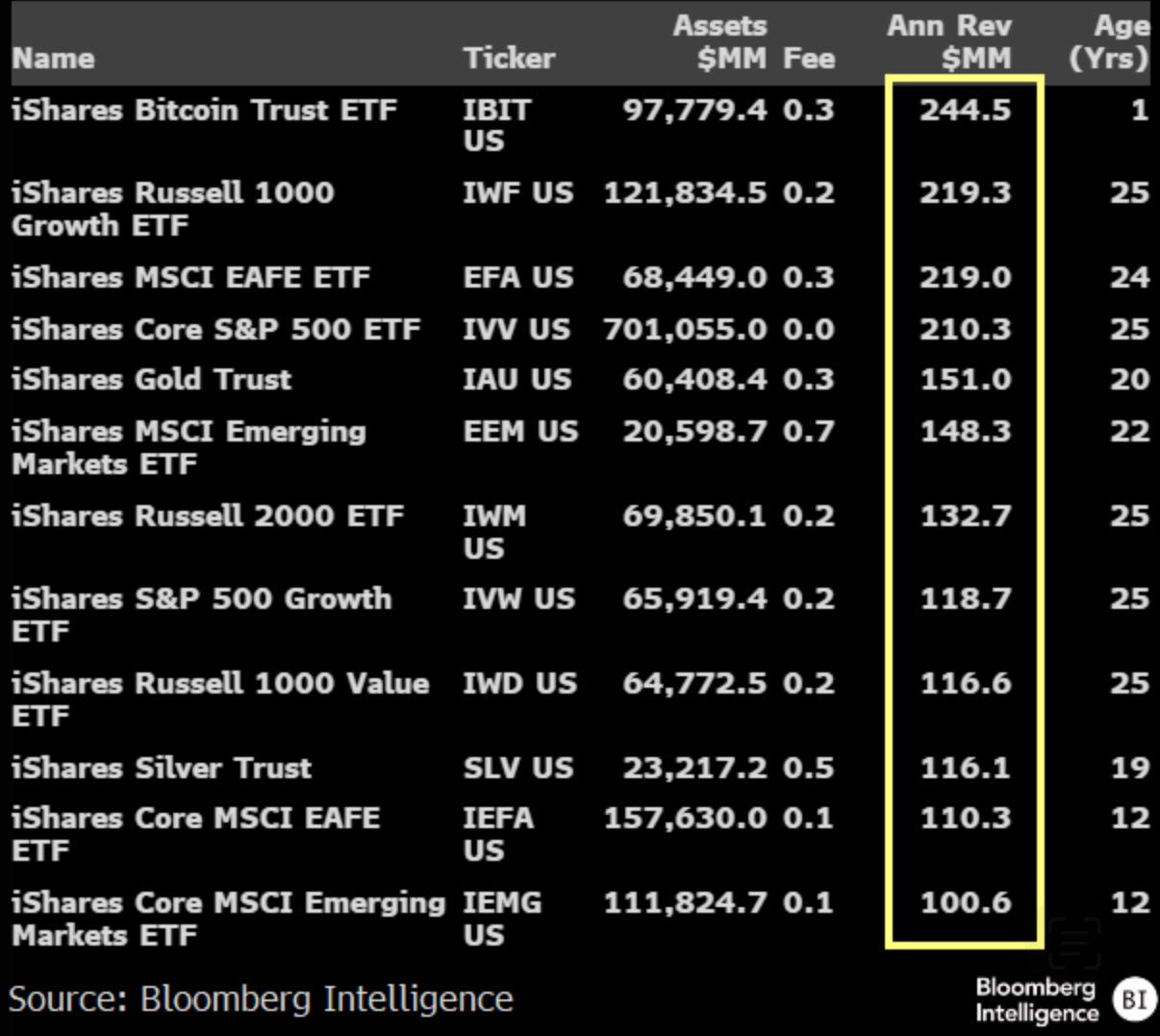

The iShares Bitcoin Trust ETF (IBIT) is BlackRock’s highest‑earning fund, generating roughly $245 million in fees over the past year and approaching $100 billion in net assets; it collects a 0.25% management fee and has become the dominant U.S. spot Bitcoin ETF.

-

IBIT is the top revenue‑generating BlackRock ETF, led by a 0.25% fee.

-

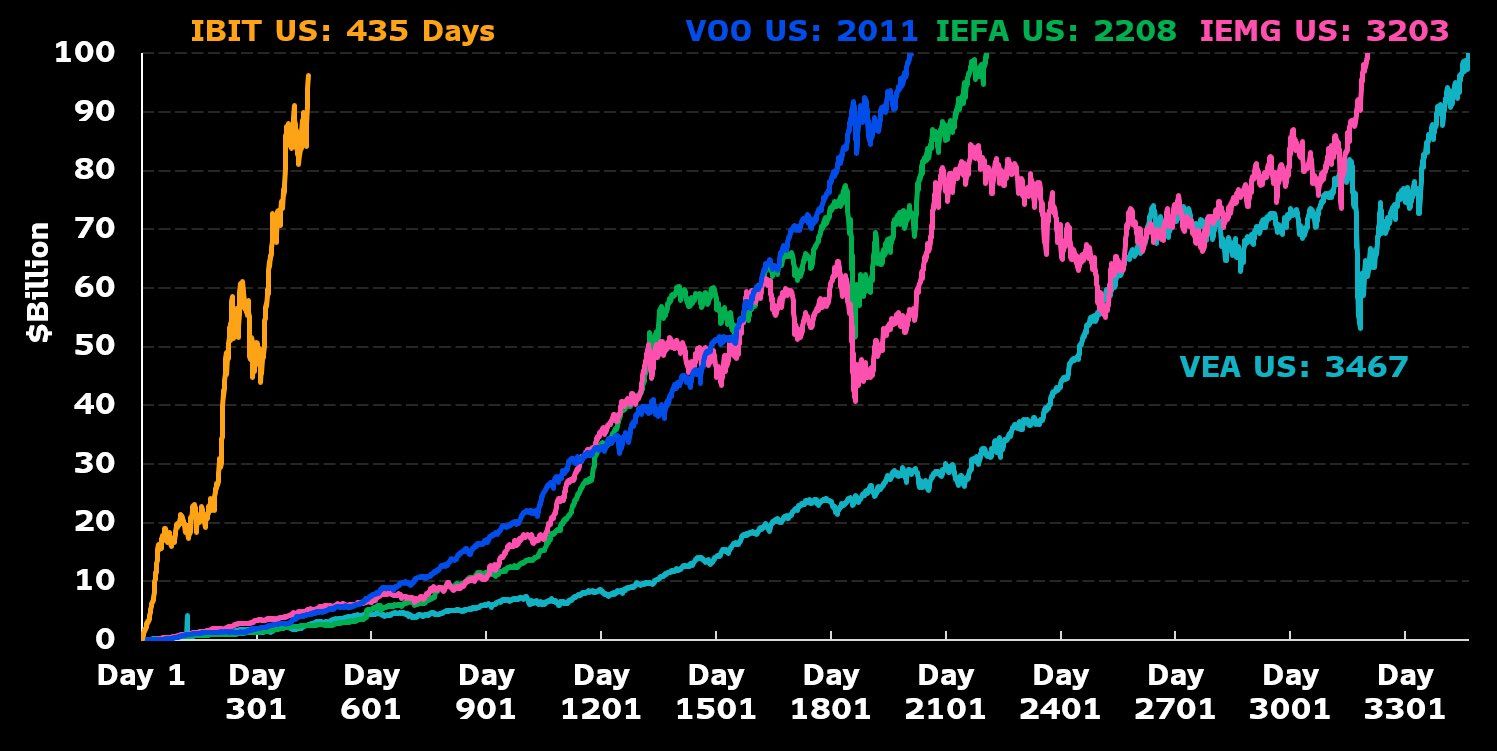

IBIT reached $97.8B AUM in 435 days, closing in on the $100B milestone.

-

IBIT accounted for $1.8B of $3.2B US spot Bitcoin ETF inflows in a single week.

iShares Bitcoin Trust ETF (IBIT) leads BlackRock ETF revenue, nearing $100B AUM; read performance, fees, and what new Bitcoin products mean for investors. Learn more.

What is the iShares Bitcoin Trust ETF (IBIT)?

iShares Bitcoin Trust ETF (IBIT) is a spot Bitcoin exchange‑traded fund managed by BlackRock that tracks Bitcoin’s price by holding bitcoin or bitcoin exposures. It charges a 0.25% management fee, has become BlackRock’s most profitable ETF, and is approaching $100 billion in net assets.

How much revenue has IBIT generated for BlackRock?

Over the past 12 months IBIT generated about $245 million in management fees, outpacing long‑established funds like IWF and EFA by roughly $25 million. Fee revenue scales with assets under management and Bitcoin price movements.

Source: Eric Balchunas

Source: Eric Balchunas

Why is IBIT growing so quickly?

IBIT’s growth is driven by large institutional and retail flows into spot Bitcoin ETFs, favorable regulatory clarity, and strong investor appetite for direct Bitcoin exposure within a familiar ETF wrapper. BlackRock’s distribution reach accelerated adoption compared with earlier crypto funds.

How close is IBIT to $100 billion and why does it matter?

IBIT reached $97.8 billion in net assets in 435 days — a speed record relative to legacy funds such as Vanguard’s VOO, which took about 2,011 days to cross $100 billion. Hitting $100 billion would mark an ETF milestone and further cement spot Bitcoin ETFs as mainstream allocation vehicles.

Source: Eric Balchunas

Source: Eric Balchunas

What new Bitcoin products is BlackRock exploring?

BlackRock filed to register a Delaware trust company for a proposed Bitcoin Premium Income ETF that would sell covered call options on Bitcoin futures to collect premiums and produce yield. This approach offers income but reduces upside participation compared with IBIT’s spot exposure.

Industry commentary (Eric Balchunas), market inflows, and filings indicate BlackRock plans additional Bitcoin and Ether products while avoiding broad altcoin ETF pushes for now. The U.S. Securities and Exchange Commission has paused reviews on some crypto ETF filings pending federal actions.

Frequently Asked Questions

How does IBIT charge fees and how much is the management fee?

IBIT charges a 0.25% annual management fee on assets under management. Fee revenue rises as AUM grows and as Bitcoin’s market price increases, producing significant annual revenue for BlackRock.

Is IBIT the fastest ETF ever to reach near $100B?

Yes. At 435 days to $97.8B, IBIT is on track to be the fastest ETF to $100B, far quicker than Vanguard’s VOO, which reached $100B in about 2,011 days.

Will BlackRock offer income-focused Bitcoin ETFs?

BlackRock has filed for a Bitcoin Premium Income ETF that would sell covered calls on Bitcoin futures to collect premiums and deliver distributions, trading away some upside potential for regular income.

Key Takeaways

- Revenue leadership: IBIT generated ~ $245M in fees last 12 months, now BlackRock’s top earner.

- Rapid AUM growth: $97.8B in 435 days, approaching a $100B milestone.

- Product expansion: BlackRock is pursuing income-oriented Bitcoin ETFs via covered‑call strategies.

Conclusion

The iShares Bitcoin Trust ETF (IBIT) has quickly become BlackRock’s most profitable ETF, driven by high inflows, a 0.25% fee, and strong investor demand for spot Bitcoin exposure. Watch for new income‑focused Bitcoin products and regulatory developments as IBIT nears the $100 billion milestone.

Author: COINOTAG • Published: 2025-10-06 • Updated: 2025-10-06

Sources: Eric Balchunas (data and commentary), BlackRock filings, US Securities and Exchange Commission, Harvard endowment (reported investment), industry market inflow data.