Bitcoin’s 2021 Playbook Shows The Final Price Target For This Bull Cycle

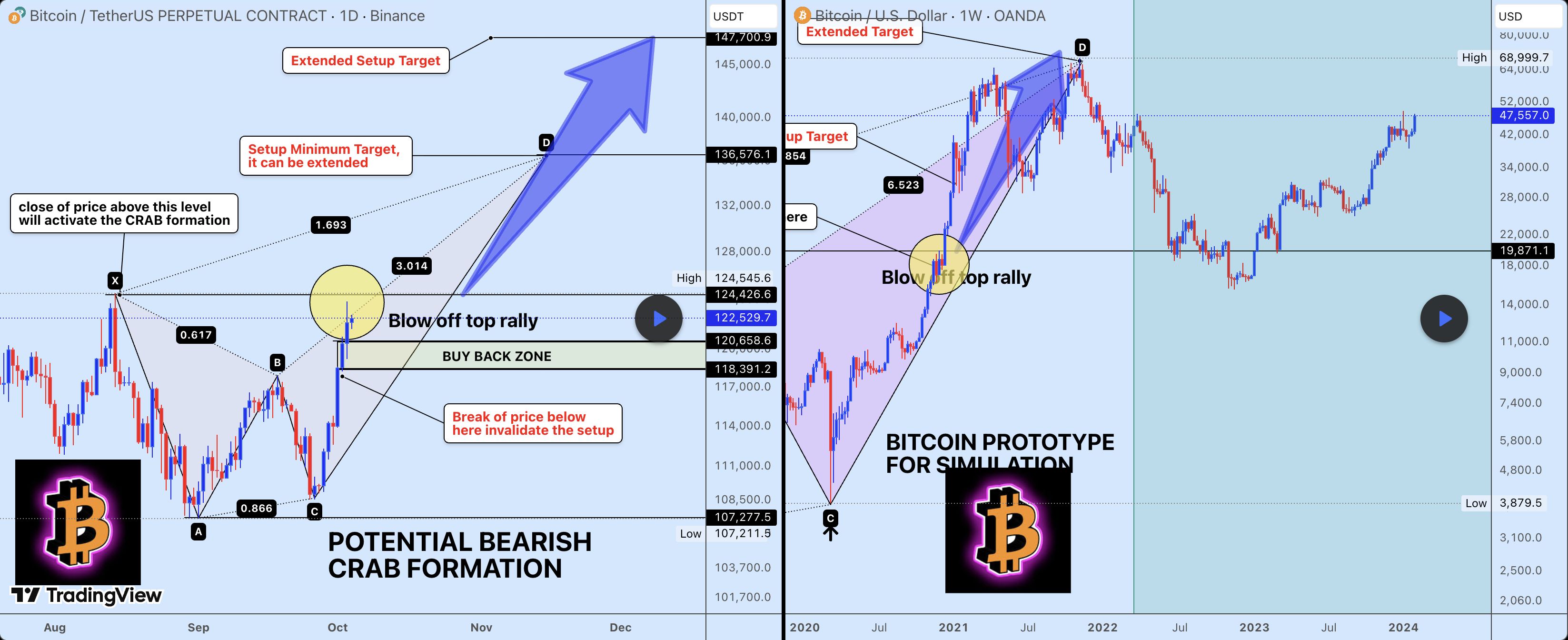

While the Bitcoin price seems to have deviated completely from the four-year cycle that dictated the previous bull and bear markets, there are still some similarities that remain that suggest that it could still play out in a similar way. The major similarity that has emerged is the formation of a bearish crab pattern back in 2021, and now, the same pattern has reappeared. Thus, taking a look at the direction of the 2021 formation could give an insight into where the Bitcoin price is headed next from here.

The Pattern That Triggered The Bitcoin Price Explosion

In an analysis, crypto analyst Weslad was the one who pointed out that the Bearish Crab Pattern had returned, and this was formed on the daily chart as well. Interestingly, the current formation looks eerily similar to the way it formed back in 2021, suggesting that the resulting trend could play out the same.

Back in 2021, when the Bearish Crab Pattern came up, the result was a price explosion that sent the Bitcoin price toward its $69,000 all-time high. This “Blow-off top” rally is usually the last rally in a bull market, and its end often signals the start of the next bear market.

With this pattern, though, there are a number of targets to watch out for that could show where the price is headed next. The first of these is that the Bitcoin price would need to complete a daily close above the $124,545 level, and this is known as the Activation Trigger.

Next in line is what Weslad refers to as the “Buy The Dip Zone”. This would be the ideal price range to enter Bitcoin in the case of a retrace, and this lies between $118,000 and $120,000. A dip toward these levels is nothing to worry about, as it means that the bulls are still in control.

Both of the zones outlined above, if held, would see the Bitcoin price continue its bullish rally. If the final, explosive leg does play out as it did back in 2017-2021, then the Crab pattern suggests that the Bitcoin price will at least go to $136,000, with an extended target of $147,000, and the possibility that it goes further toward $160,000.

However, the final target is the bearish one that could send the Bitcoin price crashing back downward, and it lies at $107,000. According to the crypto analyst, a break below this level would invalidate the entire bullish thesis, calling it the “line in the sand.” Weslad explains that “The invalidation level at $107K is crucial. A break below there means the setup is broken, and we must re-assess.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How a Query from an Office Supplies Specialist Transformed a $12 Billion Trucking Approach

- A non-trucking board member's question prompted Ryder System to shift focus from leasing to targeting 80-85% of companies owning their own trucks. - The strategic pivot aligns with growing demand in long-haul freight driven by e-commerce, trade agreements, and tech innovations like IoT fleet management. - Industry consolidation and sustainability trends, including electric trucks, are reshaping competition as firms expand specialized services like temperature-controlled logistics. - Ryder's experience hi

Ethereum News Update: Disorder or Planning? Apeing's Early Sale Breaks the Typical Meme Coin Mold

- Apeing ($APEING) emerges as a structured meme coin contender with a verified whitelist presale offering 10,000% projected gains, contrasting chaotic market norms. - Bitcoin and Ethereum show mixed recovery signals while Pepe ($PEPE) and Bonk ($BONK) dominate headlines amid growing institutional interest in meme coins. - Apeing's hybrid model combines meme virality with AI-driven utilities and audited infrastructure, drawing comparisons to Ethereum's blockchain evolution. - Risks persist due to market vol

Bitcoin Updates: Major Institutions Increase Bitcoin Holdings During Price Drops While Solana ETFs Resist Market Downturn: Opportunity or Crisis?

- Institutional investors and presale participants are buying dips in Bitcoin , Solana , and BNB as market volatility creates accumulation opportunities. - Hyperscale Data (GPUS) boosted its Bitcoin treasury to $70.5M (77% of market cap), aiming to expand to $100M via dollar-cost averaging. - Solana ETFs defied broader outflows with $568M net inflows, contrasting Bitcoin's $3.7B ETF exodus and signaling shifting institutional risk appetite. - Market dynamics hinge on Fed policy, ETF stabilization, and tech

Bitcoin Updates: IMF Warns of Widespread Risks Amid Growing Popularity of Tokenized Finance

- IMF highlights tokenized finance's efficiency gains but warns of systemic risks like smart contract interdependencies and liquidity vulnerabilities. - Upcoming Chainlink ETFs signal growing institutional adoption, with Grayscale and Bitwise advancing regulated exposure to $100B+ oracle network assets. - Analysts predict over 100 new crypto ETFs in six months, but XRP's 18% price drop underscores market volatility despite regulatory approvals. - IMF anticipates regulatory frameworks to address cross-platf