Key Notes

- Bitcoin reached a new record price of $125,559.

- The global crypto market cap touched a new ATH of over $4.26 trillion.

- Long-term holders have been selling Bitcoin since mid-June.

The volatile crypto market has been rising alongside gold, which is a preferred investment choice in times of uncertainty, with Bitcoin ( BTC ) reaching a new all-time high.

The US government shutdown triggered a shift from the US dollar to safe-haven assets, such as gold and Bitcoin, as investors anticipated a declining USD value.

Gold reached a record high of $3,897 per ounce on Oct. 2. Similarly, Bitcoin broke to a new ATH of $125,559 early on Oct. 5, with a market cap of almost $2.5 trillion.

Bitcoin currently has a 58.5% market dominance over the sector’s $4.26 trillion market capitalization, according to data from CoinMarketCap. The CMC fear and greed index is still hovering in the neutral zone.

Are Long-Term Holders Selling?

Bitcoin’s rise was mainly triggered by short-term investors. For instance, the US-based spot BTC exchange-traded funds recorded $3.24 billion in net inflows last week.

This pushed the total inflows of these investment products above the $60 billion mark.

Another catalyst could be the expectations of what the community calls “Uptober” — referring to a potentially bullish October , triggering FOMO among investors.

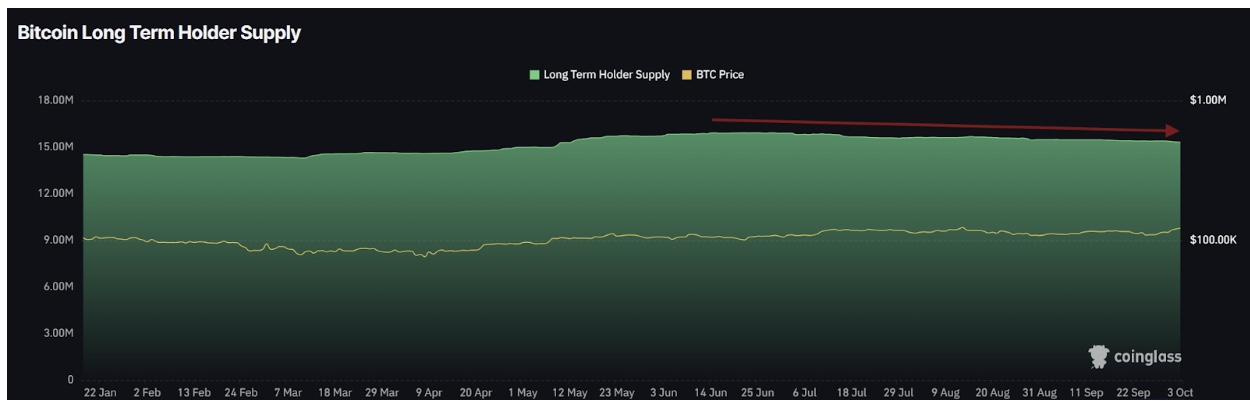

On the other hand, the Bitcoin long-term holder supply has been on a downtrend since mid-June. According to data from Coinglass, the LTH supply fell from 15.92 million BTC on June 15 to 15.32 million BTC on Oct. 3.

Long-term Bitcoin holders have been selling since mid-June | Source: Coinglass

The LTH supply shows that the market confidence in Bitcoin’s future value has been decreasing, as some investors might be expecting a major price correction.

Moreover, Coinglass data shows that the Bitcoin Net Unrealized Profit/Loss indicator rose from 0.51 to 0.56 last week.

While the NUPL is still in the neutral zone, its rise to the 70 mark could trigger profit-taking among investors, leading to a market correction.