Key Notes

- WLFI price slipped 3% to $0.20 on Saturday despite bullish crypto market sentiment.

- Treasury token sale to Trump-backed Hut8 sparked skepticism over pricing and use of “locked” tokens.

- Technical indicators confirm short-term pressure with WLFI pinned below a triple SMA cluster.

World Liberty Financial (WLFI) price fell 3% on Saturday, October 4, hitting $0.20 while the broader crypto market turned higher. The downturn came just hours after WLFI announced a treasury token sale to Trump-backed Hut8 .

WLFI recently sold tokens at $0.25 to Hut8 for their treasury. The locked tokens sent from the WLFI treasury were simply to satisfy that sale — not new issuance, not dilution. We appreciate Hut8’s support as a long-term partner. 🦅

— WLFI (@worldlibertyfi) October 3, 2025

According to the project team, Hut8 purchased WLFI tokens directly from treasury reserves at a negotiated rate of $0.25. WLFI clarified that the tokens sold were “locked” reserves and not fresh issuance, stressing that there was no dilution.

I'll be honest, nothing about this post makes much sense

firstly, how are you able to sell "locked tokens"?

secondly, why buy at $0.25 when market price is $0.20?quite a precedent you've set here

— agents301 (@agents301) October 4, 2025

Still, the market response turned negative, with community members questioning why Hut8 would buy tokens at $0.25 when the market price traded near $0.20. Others raised concerns about how “locked” reserves could be offloaded without clarity on the terms of unlocking.

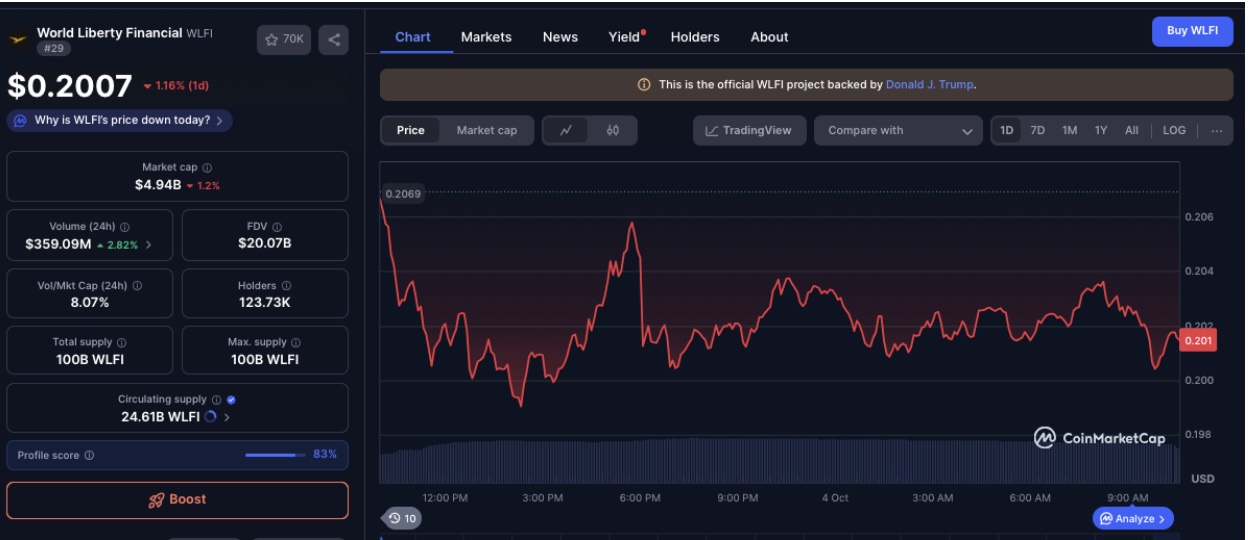

WLFI volume rises 4% as price declines to $0.20 after token sale to Trump-backed Hut8 | Source: Coinmarketcap, October 4, 2025

CoinMarketCap data showed WLFI trading volumes rose 4% on Saturday, even as the price slipped 3%. This suggests the active sell-offs from existing WLFI holders outpacing new demand, reinforcing bearish sentiment around the treasury deal.

Price Forecast: Will Bears Capitalize on Triple SMA Cluster?

On the daily chart, the WLFI price is trading below all key short-term moving averages, including the 5-day SMA ($0.2023), the 8-day SMA ($0.2050), and the 13-day SMA ($0.2038).

The triple-SMA cluster now forms key resistance zones, with sellers repeatedly defending the $0.2050 ceiling over the past week.

WLFI Technical Price Analysis | Source: TradingView

The Relative Strength Index (RSI) comes in at 44.46, confirming subdued buying pressure. Unless RSI breaks above 50, WLFI could struggle to generate upward momentum.

Volume analysis also shows Saturday’s candle was accompanied by 51.6M WLFI traded on Binance, showing significant sell-side pressure.

If WLFI bulls manage to clear the $0.2050 resistance cluster, the next upside target lies at $0.2150. Conversely, failure to hold the current $0.20 support could accelerate losses toward $0.1950 last tested in late September.

In summary, the WLFI price outlook leans cautiously bearish as it struggles under triple SMA resistance and a weak RSI. Bulls need a breakout above $0.2050 to regain footing; otherwise, rising volumes on WLFI sell-candles could drag prices to September lows.

next