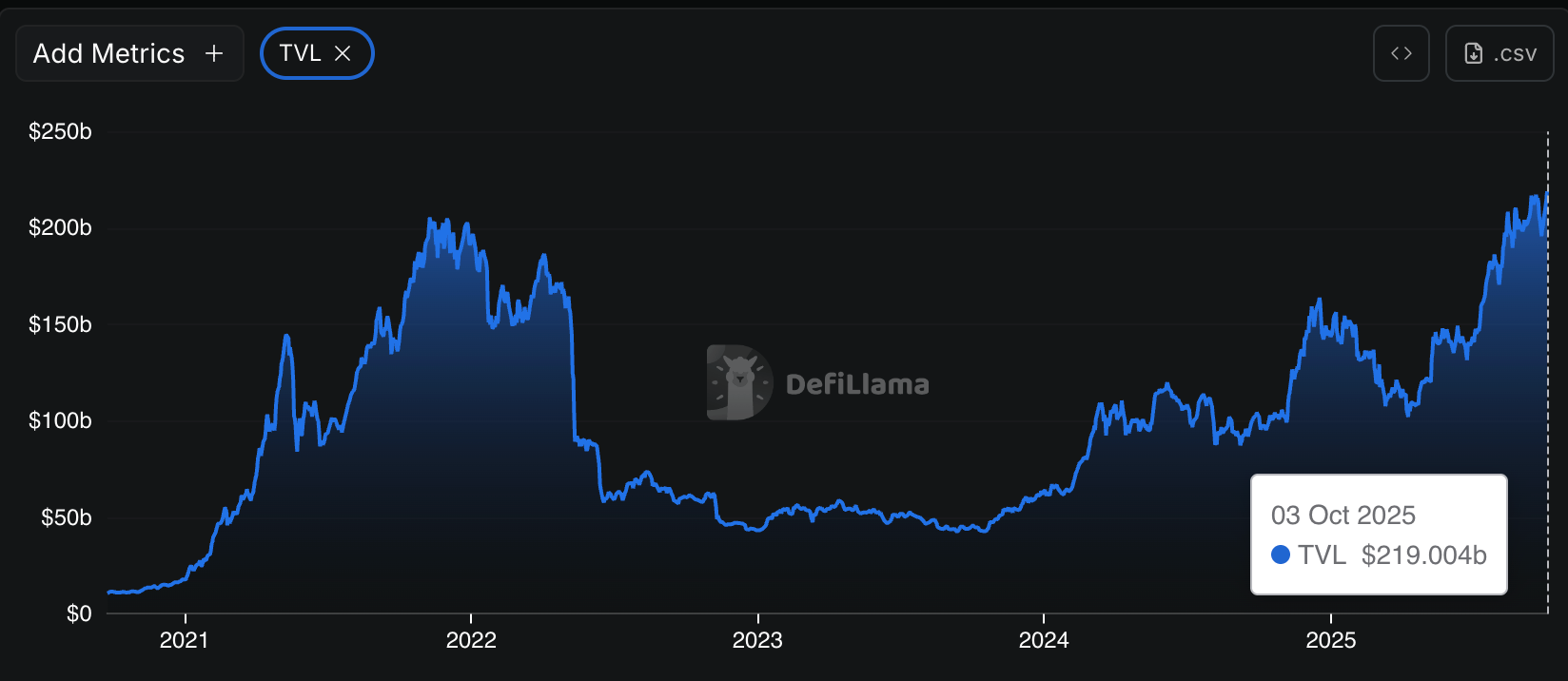

AAVE Breaks Resistance as DeFi Market Hits Record $219B Size

Aave AAVE$289.01, the native token of the largest decentralized finance (DeFi) lending protocol, strongly rebounded from last week's lows breaking through key resistance levels on Friday afternoon.

The token gained another 2% over the past 24 hours and is up 6% this week. It has established support at the $284-$285 levels, while it's currently consolidating around $290.

The move occurred as the broader crypto market rallied, with gains across the board and bitcoin BTC$122,334.34 breaking above $122,000, inching closer to its August record high. The broader DeFi market also accelerated, hitting a $219 billion in assets across protocols, a fresh record level, DeFiLlama data shows.

Deposits on Aave also climbed to a record $74 billion, cementing its top position among DeFi protocols, per DeFiLlama data. The platform enjoyed fresh inflows due to a recent partnership with up-and-coming stablecoin-focused chain Plasma. The Plasma lending market on Aave swelled above $6 billion in less than a week.

Technical Analysis Shows Strong Momentum

Technical indicators point to upside potential despite short-term profit-taking pressure at current levels, the CoinDesk Data research model shows. However, resistance levels hold firm between $290-$294 following repeated rejections.

- Price gains 2.33% in 24-hour session.

- Trading range spans $15.17 between $279.16 and $294.33 extremes.

- Volume spikes to 143,188 units, well above 37,000 average.

- Support level confirmed at $284-$285.

- Resistance zone established between $290-$294.

- Intraday high reaches $290.37 before reversal.

- Consolidation pattern develops at current levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.