Surprisingly, Shiba Inu’s (SHIB) crypto exchange reserves just broke through $1 billion, despite dropping below this mark on September 25. At first glance, this could hint at Shiba Inu custodians taking profits or depositing the dog-embossed meme coin to swap for other coins.

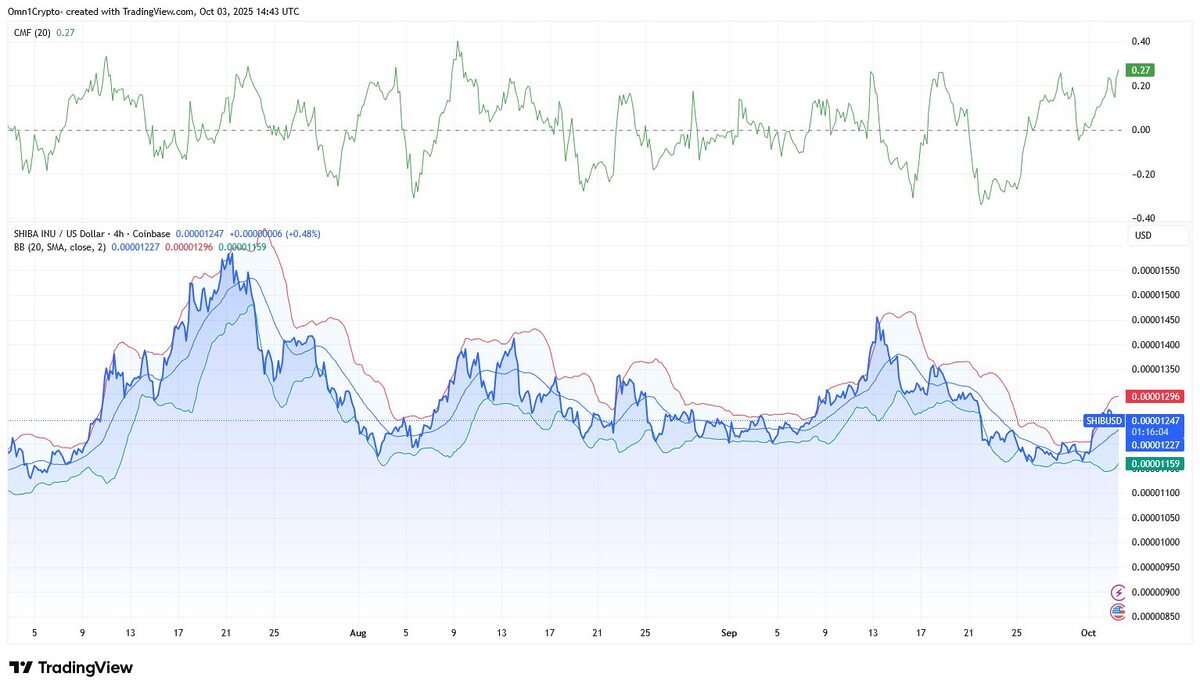

Conversely, the crypto whale metrics paint a completely different image, with the Chaikin Money Flow (CMF) sitting at 0.27 on the 4-hour technical price charts. This defies the long-term trend of SHIB’s exchange reserves gradually, or sometimes drastically, decreasing. Yesterday, nearly 248 billion SHIB coins entered crypto platforms, raising some eyebrows among the SHIB Army .

Shiba Inu’s Exchange Stash Spikes: Two Sides Of The Story

Starting with 191 trillion available on exchanges in October, 2022, the figures were slashed in half, now with approximately 84 trillion tokens on-hand, in comparison to the overall left supply of SHIB 584.7 trillion, according to Shiba Inu’s burn tracker. One of the most notable drops occurred at the beginning of this year.

Back in December, 2024, Shiba Inu coin (SHIB) tacked on the yearly high of $0.000033, but the market dynamics took nearly a month to respond. Coming into the New Year festivities, SHIB’s reserves quickly plummeted from 104 trillion to 106 trillion, while reserves dropped below 100 trillion for the first time ever later in March.

All in all, it’s fair to say that pouring tokens into exchanges typically results in a price short-fall. On the contrary, SHIB’s rally in September, 2024 acted opposite, as portrayed in CryptoQuant’s charts. Given that the crypto whale support sustains at these levels, the demand of the asset can overshadow any profit-taking action.

Explore DailyCoin’s popular crypto news:

Illuvium, Immutable Launch $20K Tournament to Bring Web3 Games to Esports

HBAR ETF On Ice: SEC’s Bare-Bones Squad Battles Shutdown Blues

People Also Ask:

Holders withdrew 284 billion+ SHIB tokens yesterday to self-custody or stake, slashing reserves from 190 trillion in 2023 to 84.5 trillion now.

They tighten available supply on exchanges, reducing sell pressure and signaling strong holder conviction.

Reserves hit 2-year lows, often preceding accumulation and rallies; analysts eye an “Uptober” breakout above $0.000013.

Yes, recent 284 billion SHIB inflows signal potential sell-offs, capping gains near $0.000012 resistance.

Past drops fueled 25%+ surges; expect similar if SHIB breaks resistance amid Q4 optimism.