Crypto Traders Are Buying These 3 Low-Cap Perp DEX Tokens In Early October

Perp DEX trading volumes are surging to record highs, fueling investor interest in low-cap tokens like ADX, PERP, and BLUE. With whale accumulation and buyback programs in play, these altcoins may see strong rallies in October.

The October market has recorded a series of remarkable milestones in the Perp DEX sector. Several altcoins from Perp DEX platforms, including Hyperliquid (HYPE), Aster (ASTER), and Avantis (AVNT), have posted strong gains. If this trend persists, capital may continue to rotate into smaller-cap altcoins.

On-chain data shows that a few low-cap Perp DEX altcoins are experiencing strong accumulation. This is reflected in whale wallet balances and exchange reserves.

Perp DEX Records Fuel Interest in Low-Cap Altcoins

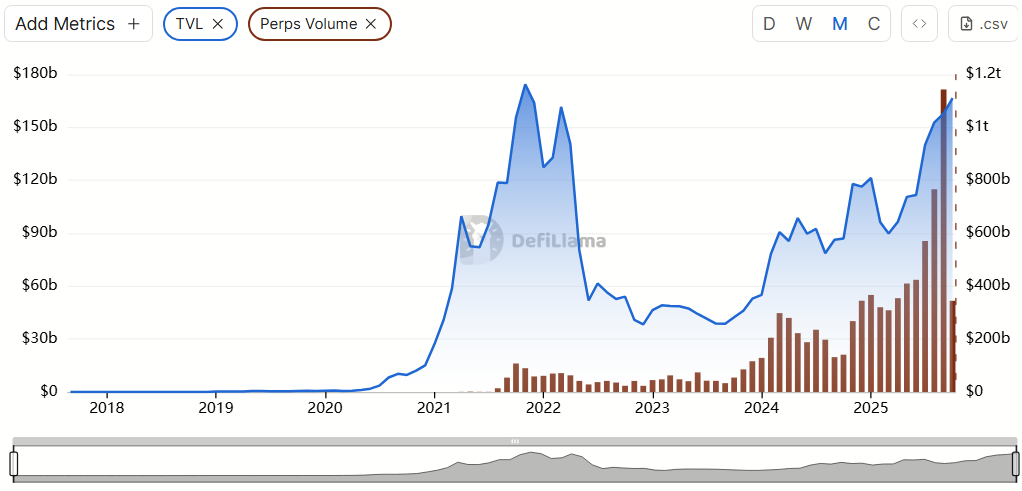

DefiLlama data reveals that Perps trading volume surpassed $1.1 trillion in September, marking the highest level in DeFi history.

Volume has already increased by more than $340 billion in the first three days of October alone. This growth signals the possibility of setting an even higher record this month.

DeFi TVL And Total Perps Volume. Source:

DefiLlama.

DeFi TVL And Total Perps Volume. Source:

DefiLlama.

A large wave of investors has flocked to derivatives trading on DEXs, attracted by airdrop programs and encouragement from industry leaders.

If this trend continues, several low-cap altcoins could see strong price rallies. These tokens have market capitalizations below $50 million and are already showing signs of early accumulation.

1. Adrena (ADX)

Adrena is an open-source, peer-to-peer, decentralized perpetual exchange built on Solana.

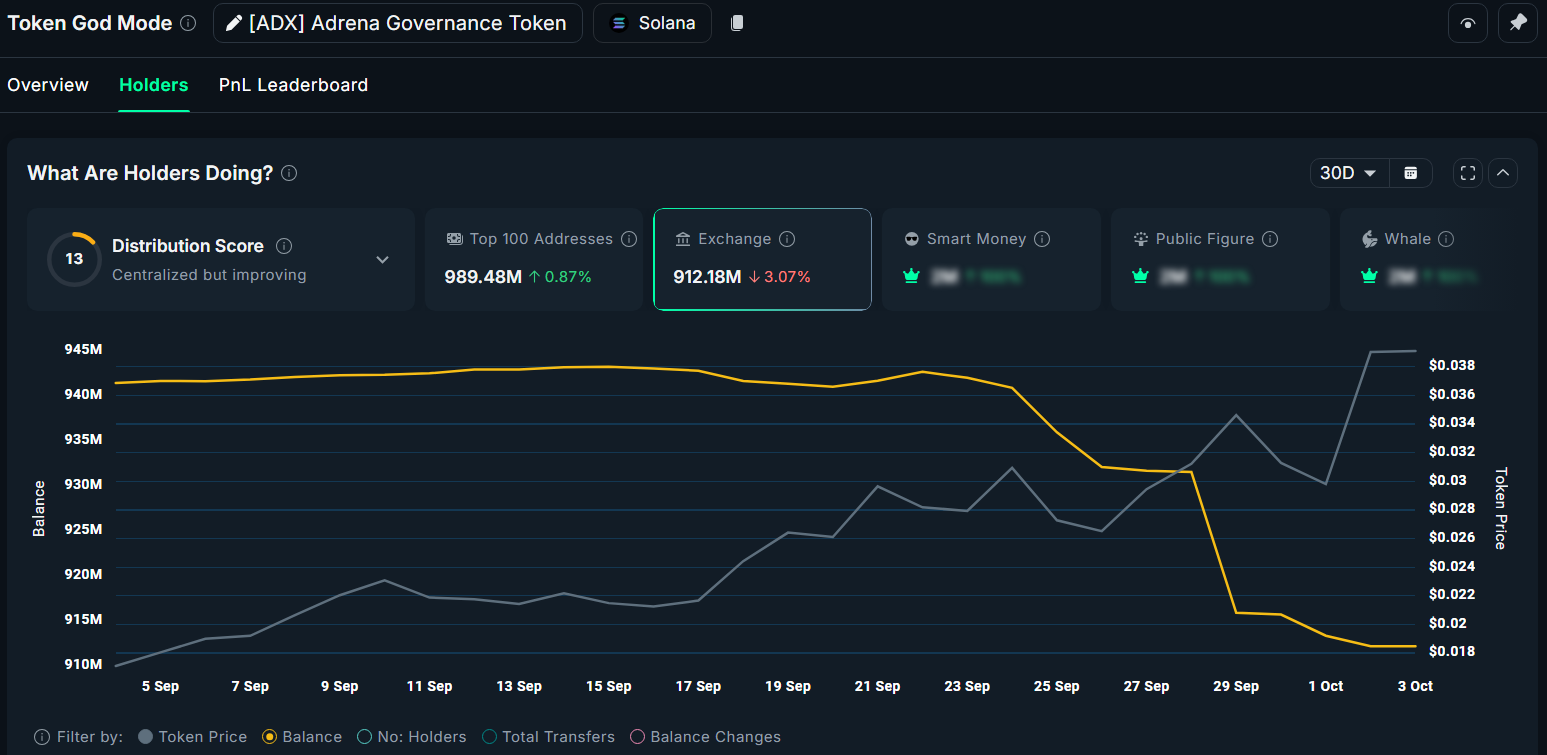

ADX currently holds a market capitalization of under $40 million. Nansen data shows that exchange reserves dropped by more than 3% in the last week of September, while ADX’s price climbed from $0.028 to $0.038. Meanwhile, top whale wallets increased their balances by 0.87%.

Adrena (ADX) Exchanges Reserve. Source:

Nansen

Adrena (ADX) Exchanges Reserve. Source:

Nansen

Although these changes are modest, several factors could support further potential for ADX.

First, DefiLlama data shows that the exchange’s Perps volume recovered to over $600 million in the past month, the highest level since June.

Second, as of October 3, Adrena ranked second in daily trading fees among Solana-based derivative DEXs, only behind Jupiter.

Third, the project appeared on Coingecko’s trending list. These signs suggest Adrena is attracting new traders.

2. Perpetual Protocol (PERP)

Perpetual Protocol is a decentralized futures exchange built on Ethereum. PERP has been listed on Binance since 2020, but its price has dropped nearly 99%. This decline left its market capitalization at just around $22 million.

Renewed investor enthusiasm for Perp DEX narratives has brought attention back to this token.

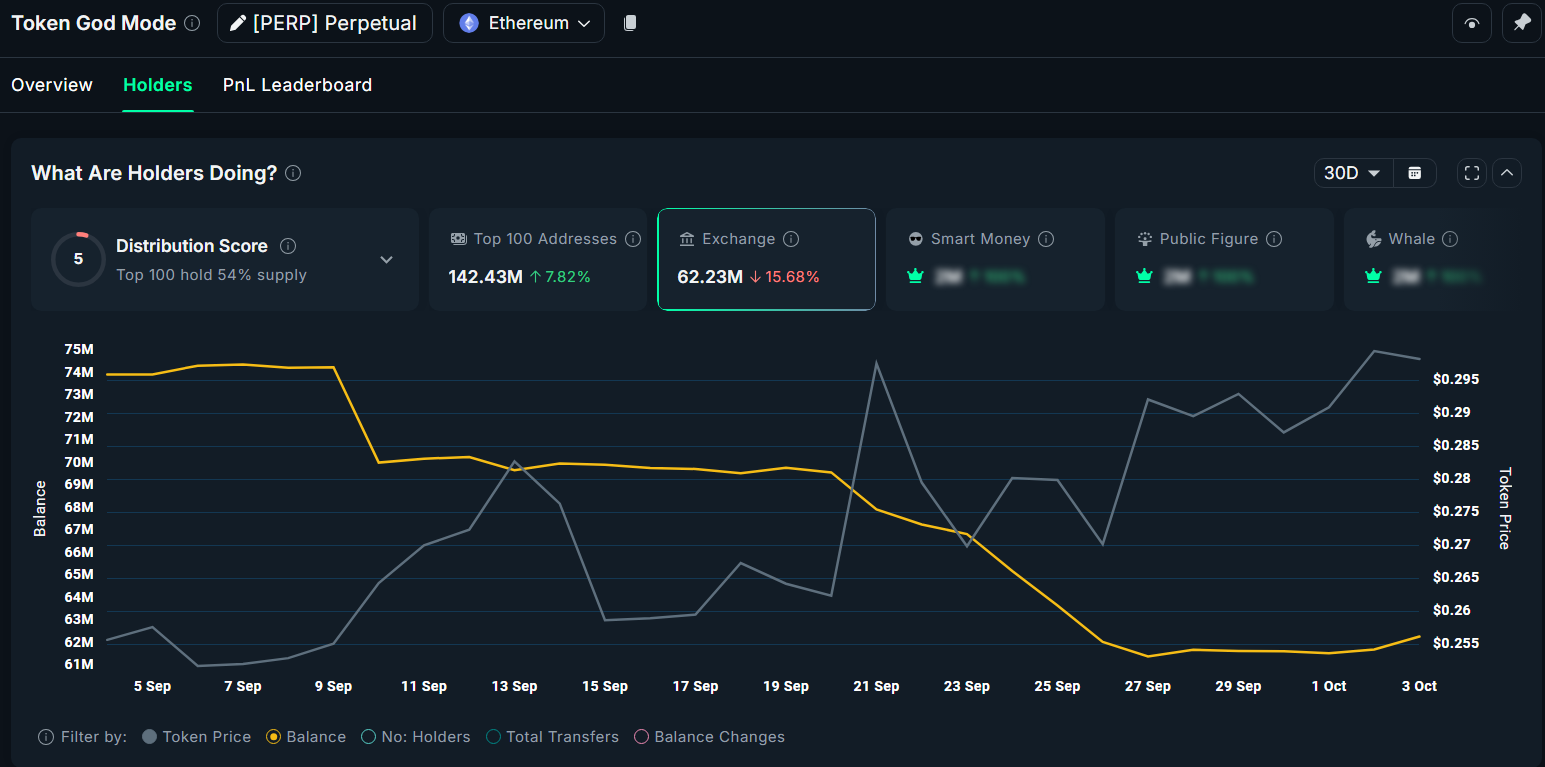

Nansen data shows that PERP’s exchange reserves decreased by more than 15.6% in the past month, while balances in top wallets rose 7.8%.

Perpetual Protocol (PERP) Exchanges Reserve. Source:

Nansen

Perpetual Protocol (PERP) Exchanges Reserve. Source:

Nansen

Some technical analysts highlight PERP’s price structure in 2025. The token is no longer making lower lows and is forming a bullish pattern, suggesting potential gains of more than 130% by year-end.

The combination of on-chain accumulation signals and technical structure could support a bullish scenario for PERP.

3. Bluefin (BLUE)

Bluefin is currently the leading perpetuals platform on Sui. A recent BeInCrypto report pointed to positive signs suggesting the project may attract more investor interest in October.

BLUE’s market capitalization stands at approximately $39 million. DefiLlama data indicates that the DEX generates more than $13.6 million in annual revenue. Bluefin has pledged to use 25% of that revenue, about $3.4 million, to buy back BLUE.

This planned buyback amount equals nearly 10% of the market capitalization. As a result, it could serve as a strong price catalyst and encourage more investors to accumulate BLUE.

Notably, the buyback program began in October. Many analysts expect BLUE’s price to break above $0.20 this month.

$BLUE chart looks really bullish, super clean uptrend with higher highs followed by higher lows.Seems ready for a fresh leg up from here, also because the governance proposal to introduce buyback recently passed, so buybacks will commence today!

— Sjuul | AltCryptoGems (@AltCryptoGems) October 1, 2025

Low-cap altcoins can provide significant profit opportunities but also carry two key risks.

First is liquidity risk. These tokens often have low trading volumes and poor market depth, which can easily lead to large fluctuations.

Second is sentiment risk. If the Perp DEX trend fades, projects lacking real utility may fail to retain users, causing token prices to decline again.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Major Investors Place Significant Bets on Solana ETFs Amid 30% Price Drop, Challenging the Strength of $130 Support

- Solana's ETFs (BSOL/FSOL) drew $476M in 17 days despite SOL's 30% price drop to $130, signaling institutional confidence. - $130 support level shows buying pressure with RSI rising to 50, though $160 EMA remains a key reentry target for bulls. - On-chain growth (18% active address rise) and projects like GeeFi reinforce Solana's infrastructure, but $140 resistance remains fragile. - Mixed futures signals (5% higher OI, positive funding rates) highlight uncertainty, with $120 as next potential downside ri

PEPE Balances on a Fine Line: Key Support at $0.0547 and Resistance at $0.05504 Under Scrutiny

- PEPE cryptocurrency stabilized above $0.0547 support, trading within a narrow range as of mid-November 2025. - Technical indicators show neutral sentiment with RSI at 50.62 and MACD near zero, per xt.com and BitGet analyses. - Whale movements and exchange flows drive volatility, while long-term forecasts range from 140,000% to 28.6 million% gains by 2030-2050. - Market depends on meme culture relevance, institutional adoption, and broader crypto trends like Ethereum's price and ETF regulations.

Bitcoin Updates Today: Kiyosaki Turns Bitcoin Profits into Ongoing Income, Living by His Own Advice

- Robert Kiyosaki sold $2.25M in Bitcoin at $90,000/coin, reinvesting in surgical centers and billboards for tax-free income. - He aims for $27,500 monthly cash flow by 2026, aligning with his passive-income strategy while maintaining Bitcoin's $250K/2026 price target. - Bitcoin's 33% drop from $126K peaks reflects broader market slump driven by Fed rate uncertainty and offshore trading pressures. - Kiyosaki advocates gold/silver and warns of systemic risks, contrasting with analysts who see intact fundame

Bitcoin Updates: Abu Dhabi and Major Institutions Drive Bitcoin Accumulation Strategy for 2025

- Max Keiser argues Bitcoin is entering a critical accumulation phase, with institutional ETF inflows and Abu Dhabi’s strategic buy-ins signaling potential for a 2025 all-time high. - Technical analysis highlights $84,243 support and $86,700–$89,900 resistance, with sustained ETF inflows potentially pushing BTC past $90,000. - Over 95% of Bitcoin ETF assets are held by investors aged 55+, stabilizing the market during corrections and cushioning declines. - Despite short-term volatility, ETF-driven liquidit