Bitcoin ETF Inflows Remain Green, BlackRock Leads With $177M

Bitcoin exchange-traded funds (ETFs) are riding a positive streak as inflows continue to stay green. Data shows the last recorded outflows were on September 26. With strong momentum carrying into October. BlackRock once again stood out as the leader, injecting $177 million on October 2 alone. It keeps sentiment upbeat in what traders call “Uptober.”

Consistent Inflows Signal Strong Demand

Since the end of September, U.S.-listed Bitcoin ETFs have seen steady inflows. The reversing concerns after a brief period of outflows earlier that month. According to data, the combined inflows on October 2 reached $307.1 million across major issuers. BlackRock iShares Bitcoin Trust (IBIT) led the charge with $177.1 million. It is followed by Fidelity Wise Origin Bitcoin Trust (FBTC) with $60.7 million.

Ark Invest ARKB pulled in $46.5 million, while smaller inflows came from Bitwise, Valkyrie, and others. This wave of positive activity has brought total net inflows since launch to over $14.2 billion. Investors are showing renewed confidence in the crypto market. With ETFs serving as a regulated, institutional-friendly entry point to Bitcoin exposure.

BlackRock’s IBIT Strengthens Its Position

BlackRock has continued to dominate the spot Bitcoin ETF market. Its flagship IBIT now holds assets worth $93.28 billion, according to Blockworks’ Bitcoin ETF tracker. Daily volumes remain strong, with $4.26 billion traded in the last 24 hours. Fidelity FBTC follows with $23.95 billion in assets. While Grayscale has converted GBTC, it still carries a sizable $21.37 billion.

ARKB, Bitwise BITB, and other issuers round out the market with smaller but steady flows. The total Bitcoin ETF market capitalization now stands at $160.85 billion. It reflects the rapid institutionalization of Bitcoin as a mainstream financial asset. Daily trading volumes across all funds reached nearly $6 billion. This signals high liquidity and active participation.

Market Confidence Grows Ahead of Q4

Investors have often referred to October as “Uptober.” A month historically associated with stronger Bitcoin performance. This year, the momentum appears to be repeating. With no outflows recorded since late September. The consistent streak of inflows reflects optimism about Bitcoin price outlook and the broader macroeconomic picture.

Institutions continue to show growing interest in Bitcoin ETFs because they offer regulated access. The custody is handled by trusted providers, and simplified trading through traditional brokerages. As more pension funds, asset managers and corporate treasuries explore digital assets. ETF flows are expected to remain a key signal of market sentiment.

The Bigger Picture

The surge in Bitcoin ETF demand comes at a time when the crypto market is stabilizing after a volatile summer. Rising inflows suggest that investors see long term value in Bitcoin. Even as global markets remain cautious about inflation, interest rates and regulatory changes. BlackRock strong inflows underscore the role of traditional financial giants in shaping the digital asset landscape.

Meanwhile, the diversity of issuers from Fidelity and Ark to Bitwise shows growing competition in the Bitcoin ETF space. With Bitcoin ETFs now holding over $160 billion in assets. Their influence on the market is undeniable. Continued inflows could help sustain Bitcoin momentum through Q4. Especially if institutional adoption accelerates further.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?

21Shares XRP ETF Set to Launch on 1 December as ETF Demand Surges

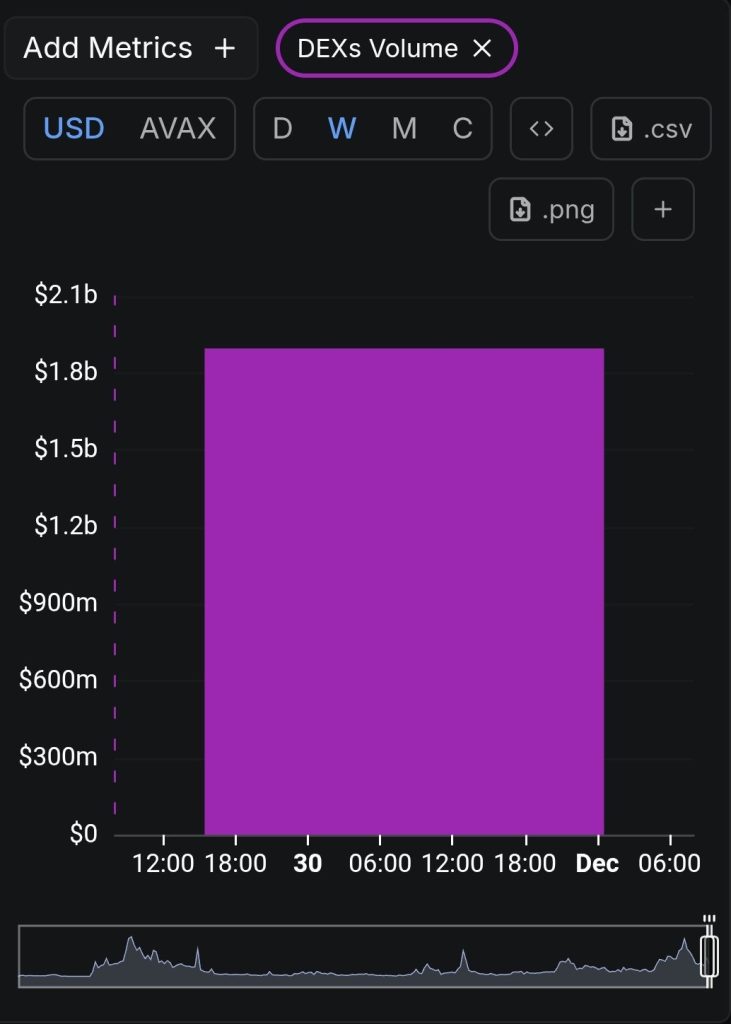

Avalanche (AVAX) Sees DEX Volume Surge as Price Rebounds From Key Support—Is a Major Breakout Near?

CZ Issues Market Warning as Crypto Exits Longest ‘Extreme Fear’ Streak