Uptober rally builds as on-chain data confirm crypto market strength

The crypto market is rallying after a turbulent week that erased billions from the total market cap and left traders on edge.

- The crypto market kicked off October on a strong note, lifting total value to $4.17 trillion.

- Bitcoin is up $118,000 on the day with a 4% gain, while Ethereum rose 6% to $4,400.

- Other altcoins rallied as well, with the likes of Zcash and Zora posting stronger double-digit gains.

- Analysts believe the bull cycle is still underway, with room for more upside in Uptober.

The uptrend comes as the crypto market stages a broad rebound, with several coins climbing back from recent lows.

Bitcoin ( BTC ) is leading the rebound, surging past $118,000 and gaining roughly 4% in the past 24 hours. Ether ( ETH ) is also back in focus, jumping over 6% to briefly touch $4,400 after sinking to $3,900 during the latest market pullback.

Other major altcoins like Solana ( SOL ) and Binance Coin ( BNB ) rose as well, with SOL climbing 7% to $225, and BNB trading near $1,040. Some smaller-cap altcoins posted even stronger double-digit gains, with Zcash ( ZCASH ) jumping 73% and Zora ( ZORA ) surging nearly 33%.

This rebound is fueled by both price action and renewed sentiment. The total crypto market capitalization is up 4.6% to $4.17 trillion on the day, turning the broader mood from caution to confidence. The ongoing rally comes as anticipation for “Uptober” picks up among traders and market participants, with hopes high for the momentum to hold and push prices to new highs.

On-chain data back Uptober crypto market rally

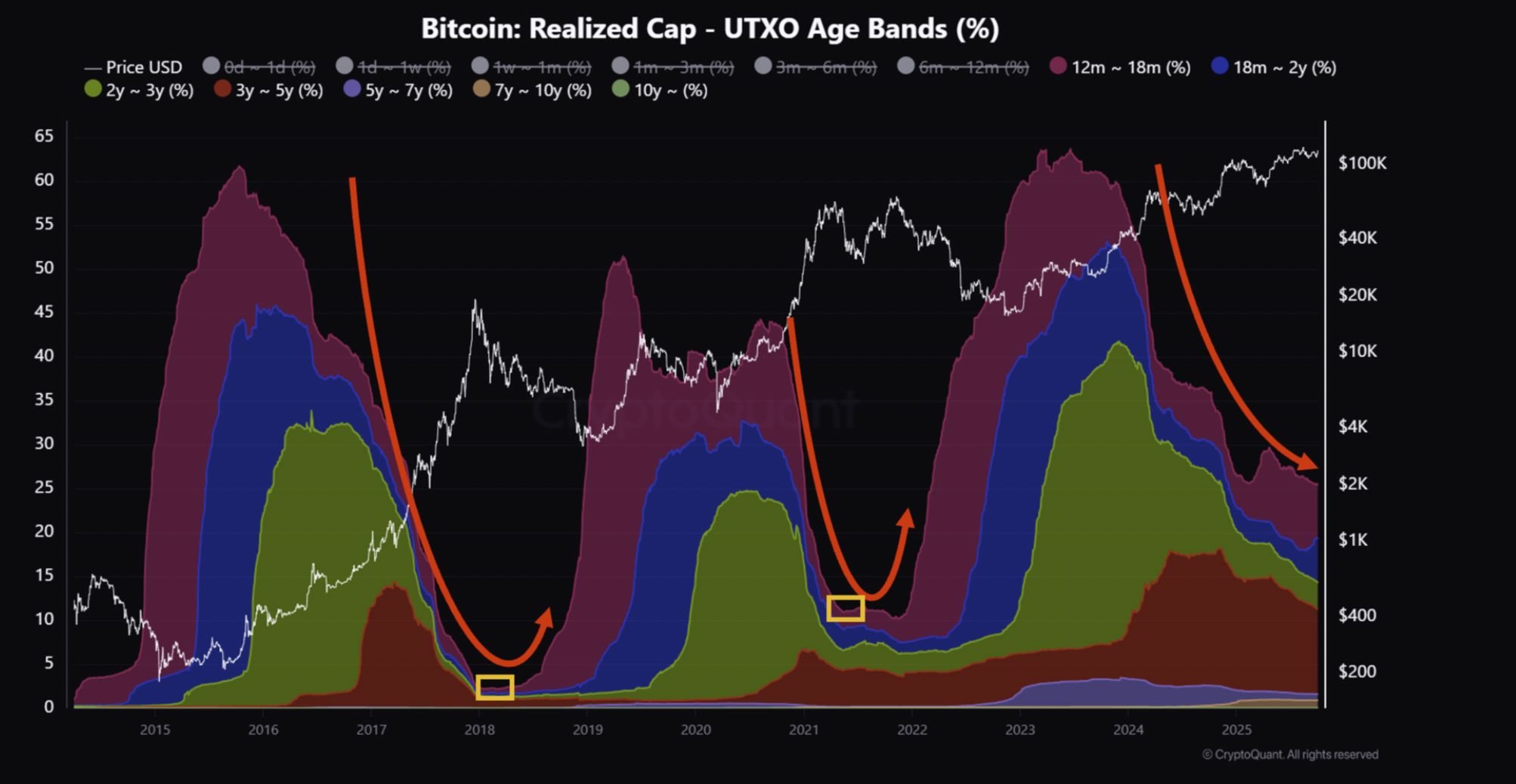

Supporting the outlook, a new CryptoQuant analysis suggests that the crypto market rally may still have room to run. Per the report , the current bull cycle is “slow but still in progress,” with long-term Bitcoin holders gradually reducing their positions but not yet signaling a market top.

Historically, the late stage of a bull run has been marked by a sharp drop in the share of BTC held for more than a year, as early investors sell into strength and new capital flows into the market. That shift has typically signaled the beginning of a transition from bullish momentum to the early stages of a bear cycle.

At present, the share of Bitcoin held long-term is declining at a much slower pace. This suggests the cycle is maturing but has not yet reached its peak.

Bitcoin Realized Cap chart | Source: CryptoQuant

Bitcoin Realized Cap chart | Source: CryptoQuant

“The current market is progressing slowly within the bull cycle, but there are no signs of an imminent end,” the report noted, adding that a stronger upward move could still be ahead.

Price action and on-chain trends together point to a market with more room to grow. While volatility is likely to persist, signals suggest October’s rally is supported by long-term strength rather than short-term speculation.

If history holds, this month could again prove to be a major one for Bitcoin and altcoins, with the potential to push the market toward new highs in the weeks ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Today: Ethereum’s Fusaka Update: Scaling Goals Face Challenges From Validator Compromises

- Ethereum's Fusaka upgrade (Dec 3, 2025) introduces PeerDAS to enhance scalability by verifying rollup data without full dataset downloads. - BPO forks enable incremental blob capacity increases (e.g., 14 blobs/block by Jan 7, 2026), avoiding disruptive hard forks while supporting 100k+ TPS via L2 solutions. - L2 data fees may drop 40%-60% with PeerDAS, but validators face trade-offs between reduced storage demands and increased upload requirements as blob capacity grows. - Market reactions remain mixed:

Bitcoin Updates: Challenges in Blockchain Infrastructure Drive Growth of Mixed Sustainability Approaches

- Blockchain networks show mixed fee revenue, with only 11 surpassing $100K weekly thresholds, highlighting structural inefficiencies and speculative challenges. - Lumint's hybrid staking model combines AI-driven tools with decentralized rewards to address PoW/PoS flaws, aiming for sustainability and reduced energy waste. - Bitcoin rebounded to $87,000 amid 2% market growth, but extreme fear persists (index at 20), with $380M in liquidations and mixed retail sentiment. - Hybrid solutions like Lumint priori

DASH drops 4.37% within 24 hours following Australian wage agreement

- DoorDash's stock fell 4.37% in 24 hours amid a 25% wage hike agreement for Australian delivery workers, including mandatory accident insurance. - The deal raises near-term cost concerns as operating margins stand at 5.5%, but reflects improved labor standards and regional commitment. - Institutional ownership rose to 90.64% with major investors increasing stakes, signaling long-term confidence despite recent volatility. - Analysts maintain a "Moderate Buy" rating ($275.62 target) as DoorDash shows strong

Ethereum Updates Today: Privacy First: Buterin Backs Messaging’s Fundamental Transformation

- Vitalik Buterin donates 128 ETH ($390K) to Session and SimpleX to advance metadata privacy and permissionless design. - Platforms use decentralized infrastructure and cryptographic IDs to protect communication metadata, resisting censorship and AI surveillance risks. - Donation counters regulatory threats like EU's Chat Control while promoting privacy-focused innovation in encrypted communication. - Experts emphasize permissionless account creation as critical for digital freedom, despite trade-offs like