Digital asset treasuries (DATs) show early bubble signs as fast capital floods corporate crypto treasuries, but experts say consolidation—rather than a crash—will precede medium-to-long-term institutional capital inflows.

-

DATs are a new finance segment bridging TradFi and crypto, drawing both fast money and strategic investors.

-

Corporate treasuries now hold significant BTC and ETH allocations, prompting scrutiny and selective consolidation.

-

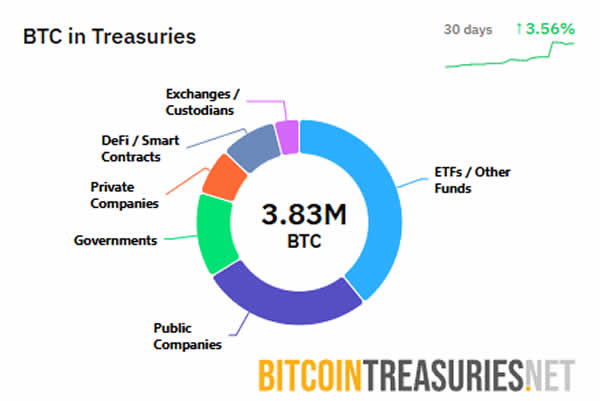

Over 1.3M BTC (~$157.7B, 6.6% supply) and 5.5M ETH (~$24B, 4.5% supply) reported in treasury accumulations.

Digital asset treasuries bubble signals: DATs face short-term consolidation; monitor liquidity, allocations, and governance. Read analysis & next steps.

TON Strategy’s CEO acknowledged there are early signs of a bubble, but medium and long-term capital will soon come in as the market matures.

What is causing the digital asset treasuries bubble?

Digital asset treasuries (DATs) have surged because corporate treasuries and startups rushed to add crypto as a treasury asset, driven by speculation and “fast money.” Short-term price momentum, high-profile bitcoin treasury pioneers, and easy issuance have amplified demand and created bubble-like indicators.

How did industry leaders shape the DAT model?

Strategy’s Michael Saylor popularized the DAT approach for Bitcoin; this year the model expanded to Ether, Solana, and Toncoin. TON Strategy CEO Veronika Kapustina said the model now demonstrates cross‑token viability. She told Cointelegraph at Token2049 that DATs differ from prior bubbles because they represent a new financial segment, not just speculative layering.

How will digital asset treasuries evolve over time?

DATs are likely to undergo consolidation where weaker treasuries fold or merge, while robust treasuries evolve into infrastructure providers or pursue regulated banking pathways. Over time, institutional and medium-to-long-term capital will evaluate DATs by functionality, network security contribution, and governance.

What do current treasury accumulation figures show?

Corporate treasuries continue to accumulate assets despite high price levels. Plain-text sources reporting these figures include and StrategicEthReserve. Current tallies indicate significant allocation percentages of circulating supply for major tokens.

| Bitcoin (BTC) | ~1.3M BTC | ~$157.7B | 6.6% | |

| Ether (ETH) | ~5.5M ETH | ~$24B | 4.5% | StrategicEthReserve |

| Toncoin (TON) | Company treasuries (growing) | Variable | — | TON Strategy reporting |

Bitcoin DATs continue to load up. Source:

Why might consolidation—not a crash—be the likely outcome?

Kapustina explained consolidation occurs when new DATs fail to meet targets and investors separate high‑quality treasuries from speculative ones. Smart capital then reallocates to treasuries demonstrating clear utility, security contributions to networks, and sustainable governance.

What are the realistic evolution paths for DATs?

Possible paths include:

- Infrastructure provision and custodial services.

- Pursuit of banking licenses and regulated product offerings.

- Mergers & acquisitions among treasury managers.

- Technology bridges that enable multi-chain treasury operations.

Frequently Asked Questions

Are digital asset treasuries a long‑term risk to crypto markets?

Corporate treasuries concentrate assets, which can amplify systemic risks, but long‑term risk depends on diversification, custody standards, and transparency. Proper governance and regulatory compliance reduce systemic exposure.

How can institutional investors evaluate DAT strength?

Assess treasury governance, custody providers, transparency of holdings, on‑chain proofs, and alignment with network security goals. Look for audited reserves and experienced treasury managers.

Key Takeaways

- DATs show bubble-like indicators: Rapid inflows and speculative issuance raise short-term risk.

- Consolidation expected: Weak treasuries may merge or exit while stronger models attract patient institutional capital.

- Long-term utility matters: DATs that provide network security, governance, and regulated services will likely capture sustainable capital.

Conclusion

Digital asset treasuries are at an inflection point: current signs resemble a bubble driven by fast money, but market maturation—through consolidation, infrastructure growth, and institutional due diligence—should attract medium-to-long-term capital. Monitor treasury governance, on‑chain allocations, and audited disclosures as leading indicators.