Crypto Analytics Firm Unveils Two Factors That Could Trigger ‘Historically Bullish Setup’ for Bitcoin – Here’s the Outlook

Crypto analytics platform Swissblock says two factors could combine to trigger a massive rally for Bitcoin ( BTC ).

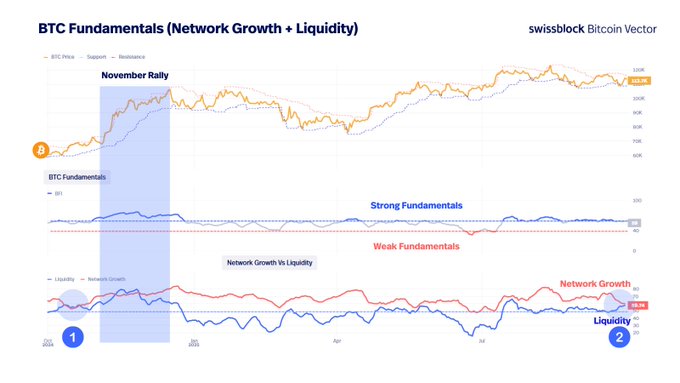

According to Swissblock, an increase in liquidity and the number of Bitcoin users are the ingredients necessary for the formation of a “historically bullish setup.”

“Liquidity remains strong. Unlike true bear markets, liquidity is not collapsing.

Network Growth dipped slightly while liquidity held up (2).

The last time this setup occurred? October 2024 (1), right before the big rally into November.”

Source: Swissblock

Source: Swissblock

According to Swissblock, Bitcoin is in the “process of finding a bottom,” a phenomenon which has historically been marked by the Aggregated Impulse Signal falling to zero.

The Aggregated Impulse Signal, an indicator calibrated from 0 to 100 that gauges market momentum and selling pressure, is used to identify potential bottoms.

“Markets move in cycles of stress and recovery.

When stress peaks, short-term traders are forced to sell at a loss.

Capitulation stress often mark the end of downside phases, setting the stage for recovery…

…At that exact point, the Impulse Signal collapses to zero.

That’s the moment panic exhausts and new buyers step in.

Since early 2024, this reset has only happened 3 times.

Each one marked a cycle bottom.

Each one was followed by a sustained recovery.

We are approaching that setup again.”

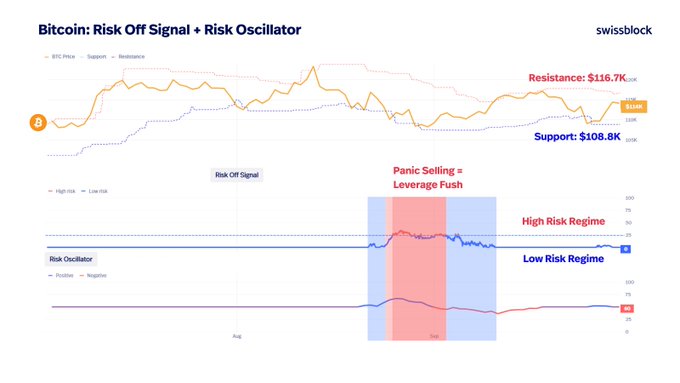

Swissblock further says that Bitcoin experienced the “sharpest wave of panic selling” this cycle from late August to early September.

“That flush cleared excess leverage and reset the market back to cost basis.

This is how bottoms are built.”

Source: Swissblock

Source: Swissblock

Bitcoin is trading at $116,592 at time of writing.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: BitMine’s Fresh Leadership Fuels Ethereum Growth, Striving to Connect Wall Street with the Crypto World

- BitMine appoints Chi Tsang as CEO amid strategic overhaul, adding 3 board members to strengthen governance. - Company boosts ETH holdings by 34% to $12.5B, aiming to control 5% of Ethereum's supply through aggressive accumulation. - Institutional Ethereum buying accelerates as exchange balances hit multi-year lows, with BitMine trailing only Bitcoin-focused rivals. - Despite 35% stock decline and 13.4% ETH price drop, $398M cash reserves signal long-term blockchain asset tokenization bets.

Democratizing Access to Private Markets: How AI and Tokenization Are Transforming Global Finance

- IPO Genie tokenizes pre-IPO assets via AI, bridging traditional finance and blockchain with $500M+ AUM. - BlackRock's BUIDL fund expands to BNB Chain, reaching $2.3B market cap as institutional confidence grows. - Tokenization reduces cross-border costs and democratizes access to $3T private markets via retail investor participation. - IPO Genie's presale sees $0.05 price projections, DAO governance, and Fireblocks/CertiK security partnerships. - Nebraska's digital asset bank charter highlights evolving

Altcoin Enthusiasm Meets Federal Reserve Prudence: DeFi Faces a Critical Turning Point

- Crypto market shows Altcoin Season optimism with DeFi growth, high-yield products like CoinW's 50% APY offering, and rising altcoin valuations. - Ethereum-based DeFi project secures $18.7M in presale, nearing 18,000 token holders, with 250% MUTM token price surge signaling confidence. - Fed's potential 2025 rate cut pause and inflation risks could disrupt altcoin momentum, per J.P. Morgan analysts, amid 58% priced-in December cut probability. - UK cashback program integrating crypto rewards highlights ma

EU Crypto Regulations Struggle to Balance Centralized Oversight with Regional Knowledge

- EU Commission proposes centralizing crypto oversight under ESMA, replacing MiCA's national regulator model and sparking industry concerns over legal uncertainty and implementation delays. - Critics warn centralized control risks destabilizing MiCA's 2026 rollout, with national regulators arguing they maintain closer firm engagement and ESMA requiring significant resource boosts. - France and ESMA Chair Verena Ross support centralization for regulatory consistency, but timing concerns persist as national