Memecoins lose their mojo as retail flocks to tokens touting utility

Quick Take The memecoin sector is being overlooked during the recent altcoin positioning surge, as traders increasingly gravitate toward projects with perceived fundamental value. The following is excerpted from The Block’s Data and Insights newsletter.

The GMCI memecoin index has remained relatively stagnant at around 220 over the past several months, representing a significant decline from its peak of 600 reached during the height of last year's speculative fervor when tokens like Fartcoin, BONK, and WIF captured the majority of retail trading attention.

This performance contrasts sharply with broader altcoin indexes, particularly the top 30 tokens, which have established new all-time highs since November, suggesting a clear divergence in investor preferences.

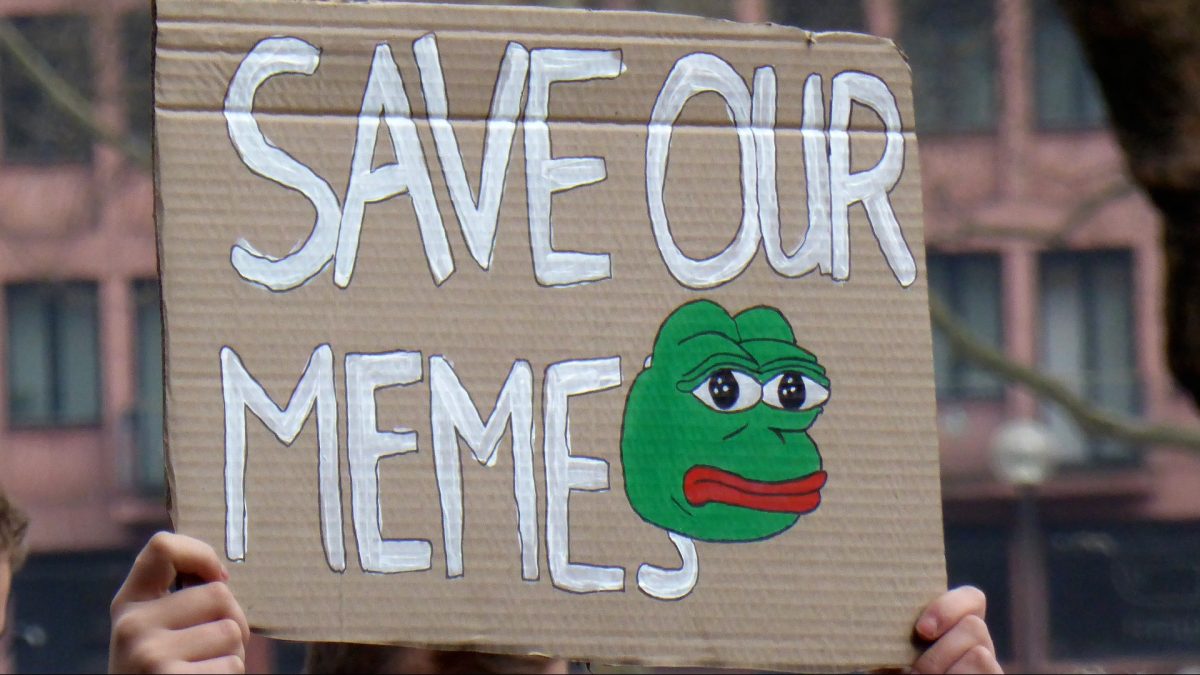

Even established memecoin names such as Dogecoin, Pepe, and Shiba Inu have failed to recapture their previous momentum, indicating the sector's struggles extend beyond newer, more speculative tokens.

The memecoin sector is being overlooked during the recent altcoin positioning surge, as traders increasingly gravitate toward projects with perceived fundamental value rather than purely speculative assets.

Recent project launches such as ASTER and XPL have demonstrated strong market reception, with investors showing preference for tokens associated with actual utility or development roadmaps. This suggests a shift in retail investor behavior, where participants are becoming more discerning about their investments, focusing on a project's ability to drive revenue — a revenue metric, if you will.

While memecoins served as a gateway for new retail participants entering crypto markets last year, the current environment appears to favor projects with clearer value propositions. We're seeing investors increasingly participate in token launches where the project is building tangible products, such as stablecoins, real-world asset tokenization, or DeFi.

This is an excerpt from The Block's Data Insights newsletter . Dig into the numbers making up the industry's most thought-provoking trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

WPAHash’s Stablecoin Mining Reduces Crypto Fluctuations to Deliver Consistent Returns

- WPAHash launches stablecoin mining service (USDT/USDC) for predictable returns in volatile crypto market. - Investors directly purchase contracts without token conversion, using global data centers and dynamic hashrate scheduling. - Tiered contracts ($100–$8,000) offer daily yields ($3–$128), targeting both retail and institutional investors. - Service addresses crypto volatility amid Bitcoin ETF outflows, with analysts predicting boosted stablecoin demand. - Upgraded XRP contracts and real-time dashboar

PENGU Price Forecast: Near-Term Fluctuations and Event-Driven Prospects in the Fourth Quarter of 2025

- Pudgy Penguins (PENGU) token faces critical support at $0.00122 amid technical bullish divergence and institutional accumulation in late 2025. - Pudgy Party game's August 2025 launch shifted PENGU from speculation to utility, attracting $9.4M in strategic on-chain inflows. - Whale activity and regulatory risks (USDT dependency, MiCA) create dual pressures, with potential 140% upside if $0.045 breakout succeeds. - Social media momentum and Bitcoin's 4.3% November rally highlight PENGU's macro sensitivity

Solana News Update: Sunrise Seeks to Resolve Solana's Liquidity Splintering through Immediate Listings

- Wormhole Labs launches Sunrise, a Solana-native listing platform enabling instant liquidity for new tokens like MON, addressing DeFi fragmentation. - The platform uses NTT framework to natively onboard cross-chain assets, retaining liquidity within Solana and integrating with DEXs like Orb and Jupiter. - MON's day-one trading demonstrates Sunrise's potential to solidify Solana as a hub for tokenized assets, with TVL rising 32.7% to $11.5B in Q3 2025. - Analysts highlight Sunrise's role in standardizing h

India’s Cryptocurrency Conundrum: Can Updated VDA Regulations Safeguard Progress or Hinder Expansion?

- India's VDA regulatory review aims to align crypto rules with global standards, addressing consumer protection gaps and market integrity risks. - Current fragmented regulations, including 30% profit tax and weak custody laws, have driven users to offshore platforms, stifling local innovation. - Proposed reforms include risk-based token classification, licensing for exchanges, and RWA frameworks to balance innovation with systemic risk mitigation. - A balanced approach could attract investment and strengt