Date: Wed, Oct 01, 2025 | 06:30 AM GMT

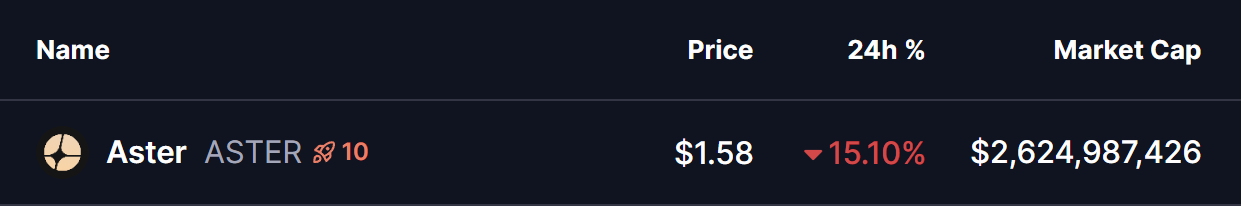

The cryptocurrency market is showing mixed signals today, with Bitcoin (BTC) trading in green while Ethereum (ETH) lags behind with a 1.40% drop. This uneven momentum has spilled over into the altcoin space, where several tokens are under pressure — and Aster (ASTER) has emerged as today’s top loser.

The ASTER token has plunged by over 15% in the last 24 hours. However, despite the sharp decline, the charts suggest that the token may be carving out a bullish reversal pattern that could shape its next significant move.

Source: Coinmarketcap

Source: Coinmarketcap

Falling Wedge Pattern in Play

On the 2-hour chart, ASTER is currently forming a falling wedge — a technical setup that often signals weakening selling pressure and the potential start of an upside reversal.

The latest correction dragged the token down toward the wedge’s lower boundary near $1.50, which has acted as a strong support zone in recent sessions. At the time of writing, ASTER is trading at around $1.58, showing signs that bulls are once again defending this key area.

Aster (ASTER) 2H Chart/Coinsprobe (Source: Tradingview)

Aster (ASTER) 2H Chart/Coinsprobe (Source: Tradingview)

The immediate obstacle for buyers is the 20-hour moving average, currently sitting near $1.74. A decisive close above this level could be the first sign of renewed strength, paving the way for a breakout attempt.

What’s Next for ASTER?

If ASTER continues to hold above wedge support and gathers upward momentum, the next logical step would be a rally toward the upper resistance trendline of the wedge. A confirmed breakout above this barrier — ideally supported by a retest — could open the door to further upside potential and possibly mark the start of a sustained bullish reversal.

On the other hand, if ASTER struggles to break higher and faces rejection near resistance, the token could once again revisit the lower support trendline before bulls attempt another push upward.

For now, ASTER appears to be at a critical turning point, with its wedge structure holding the key to whether the token breaks free from its downtrend or remains under pressure.