Metaplanet surges past 30,000 BTC creating 4th largest Bitcoin treasury

Metaplanet has cemented its position as one of the world’s largest corporate holders of Bitcoin, surpassing the 30,000 BTC mark after a string of aggressive purchases.

On Oct. 1, the Tokyo-based firm revealed that it had added 5,268 BTC to its balance sheet at an average price of $116,870, spending roughly $616 million. The transaction came less than 2 weeks after its late-September acquisition of 5,419 BTC, its biggest single buy.

Together, the back-to-back moves pushed Metaplanet’s total holdings to 30,823 BTC, accumulated at an average cost of $107,912.

The latest tally represents a dramatic expansion of the company’s initial vision, which began with a target of 10,000 BTC and later grew to 30,000.

With the milestone already exceeded, Metaplanet now sits above Bitcoin Standard Treasury in the rankings and holds the fourth-largest corporate stash of Bitcoin worldwide.

Doubles revenue forecast

Metaplanet’s aggressive treasury buildup is being matched by growth on the revenue side.

The firm reported that its Bitcoin Income Generation unit brought in ¥2.44 billion (~$16.5 million) in Q3 revenue, a 115.7% increase from the previous quarter.

Riding on this momentum, management doubled its full-year revenue forecast from ¥3.4 billion (~$23 million) to ¥6.8 billion (~$46 million). Operating profit projections were also revised upward from ¥2.5 billion (~$17 million) to ¥4.7 billion (~$32 million), marking an 88% increase from prior estimates.

Metaplanet President Simon Gerovich said:

“Q3 results demonstrate operational scalability and strengthen the financial foundation for our planned Metaplanet preferred share issuance, which supports our broader Bitcoin Treasury strategy.”

Institutional interest rises

Meanwhile, the company’s aggressive accumulation and strong financial performance have also drawn the attention of global asset managers.

Last week, Gerovich revealed that Capital Group, a US firm overseeing $2.6 trillion in assets, became Meaplanet’s largest shareholder, overtaking National Financial Services.

According to Gerovich, the firm owns 11.45% of Metaplanet shares, which is valued at approximately $500 million.

Other top 20 investors in Metaplanet include major US financial institutions, such as Vanguard, JPMorgan, Citigroup, State Street, and others.

These investments show that Metaplanet’s positioning as a central player in Bitcoin’s corporate adoption wave is attracting significant interest from institutional investors.

The post Metaplanet surges past 30,000 BTC creating 4th largest Bitcoin treasury appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ERC-8021: Ethereum’s ‘copy Hyperliquid’ moment, a new way for developers to make a fortune?

Morgan Stanley: The End of Fed QT ≠ Restart of QE, Treasury's Issuance Strategy Is the Key

Morgan Stanley believes that the end of the Federal Reserve's quantitative tightening does not mean a restart of quantitative easing.

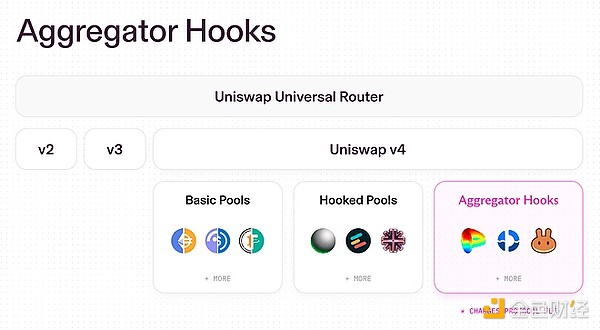

UNI surges nearly 50%: Details of the Uniswap joint governance proposal

Burning is Uniswap's final trump card

Hayden’s new proposal may not necessarily be able to save Uniswap.