Event Review 🚀

Within just half an hour, the Ethereum (ETH) market exhibited extremely dramatic fluctuations. Starting at 16:30, ETH began at $4165 and rapidly climbed to break through $4300, even briefly showing signs of being overbought. Multiple industry insiders, institutional fund movements, and on-chain data all pointed to a real contest between capital and sentiment. Meanwhile, high trading volumes, consecutive technical indicator breakthroughs, and large-scale liquidations all indicated that the market was at a critical turning point, with investor sentiment quickly shifting from optimism to caution.

Timeline ⏰

- 16:30: The market rally began, with ETH quoted at around $4165, and initial signs of sharp volatility appeared.

- 16:30–16:44: In just 14 minutes, ETH surged to $4251, a 2.08% increase, demonstrating strong upward momentum.

- 16:30–16:50: Further data showed ETH spiking from $4276 to $4329 (a 1.24% increase), successfully breaking through the key psychological barrier of $4300.

- 17:12: After a rapid surge, the market corrected, with the latest ETH quote falling back to $4287.87, reflecting short-term volatility.

Reason Analysis 🔍

This round of dramatic volatility can be attributed to the combined effect of two main factors:

Expectations of Easing Monetary Policy and Improved Macro Environment

As several central bank officials and policy institutions signaled interest rate cuts, along with positive statements from U.S. and international regulators, market liquidity expectations rose sharply. Ample capital flowed into risk assets, making ETH and other crypto assets the focus of both institutional and retail investors.Technical Breakthroughs and On-Chain Structural Adjustments

- From a technical perspective, both bitcoin and ethereum broke through several key moving averages (such as the 21-day and 55-day moving averages), sending optimistic signals to the market.

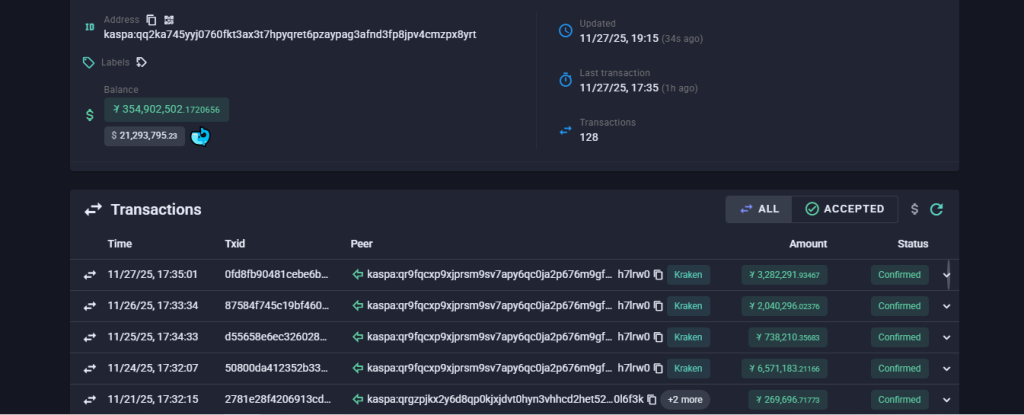

- On-chain data showed frequent position adjustments by institutions and large holders, an increase in liquidations, and further intensification of short-term buying and selling due to whale capital and large stablecoin transfers.

Technical Analysis 💹

Based on Binance USDT perpetual 45-minute candlestick data, technical analysis of the ETH/USDT trading pair shows:

- Overbought and Pullback Risk:

The J value is in an extremely overbought region, and the RSI shows the price is near the upper band, indicating a short-term risk of a pullback. - Momentum Indicators:

The KDJ indicator is diverging and the upward trend momentum is increasing, reflecting strong buying power; however, the appearance of a doji pattern suggests the market was briefly indecisive. - Moving Average System:

MA5, MA10, and MA20 are all in a bullish alignment, with the price firmly above EMA5/10/20/50/120, overall showing a clear upward trend. However, since the price is close to the upper band of key moving averages, the market may experience short-term consolidation. - Abnormal Trading Volume:

In the past hour, trading volume surged by 191.81%, far exceeding the 10-day and 20-day average volumes, indicating exceptionally active trading. At the same time, network-wide liquidation data shows that short positions accounted for as much as 97%, which may also signal panic selling by some investors.

Market Outlook 🔮

Looking ahead, investors should focus on the following aspects:

- Macro Policy and Market Liquidity

The policy moves of the Federal Reserve and other major central banks will continue to have a key impact on the crypto market. If expectations of interest rate cuts continue to heat up, market liquidity may keep expanding, but investors should also be wary of the risks of a pullback after overbought conditions. - Technical Indicators and Moving Average Changes

If ETH can hold above $4300 in the short term and maintain a sustained bullish alignment, further upward breakthroughs are possible. However, the current overbought state reminds investors to remain cautious and guard against the risk of sharp pullbacks. - On-Chain Large Fund Movements

The position adjustments of large holders and institutional funds in the current market may form new support or resistance in the future. It is recommended to monitor on-chain capital flows and position distributions, and adjust positions in a timely manner to avoid unexpected events.

In summary, the current dramatic volatility in ETH not only highlights the market's enthusiasm for chasing upward momentum but also serves as a reminder that risks and uncertainties coexist. While enjoying the benefits of ample liquidity, investors must pay attention to subtle changes in technical indicators and shifts in the macro environment, maintaining prudent operations and risk control awareness.