Institutions Anticipating Potential XRP and Solana ETFs Amid Strong Product Inflows: CoinShares

Leading digital asset research manager CoinShares says institutional investors are pouring money into altcoin exchange-traded products (ETPs) in anticipation of XRP and Solana ( SOL ) exchange-traded funds (ETFs).

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that Bitcoin ( BTC ), which usually leads the pack in inflows, suffered outflows last week while certain altcoins enjoyed inflows.

“This has raised the question of whether we are entering an ‘altcoin season.’ While inconclusive, there are some signs: Solana and XRP attracted substantial inflows of US$311m and US$189m respectively, with SUI also seeing US$8m.

However, beyond these names, inflows tapered off quickly. Several altcoins saw outflows, including Litecoin (US$1.2m) and Bitcoin Cash (US$0.66m).”

Source: CoinShares

Source: CoinShares

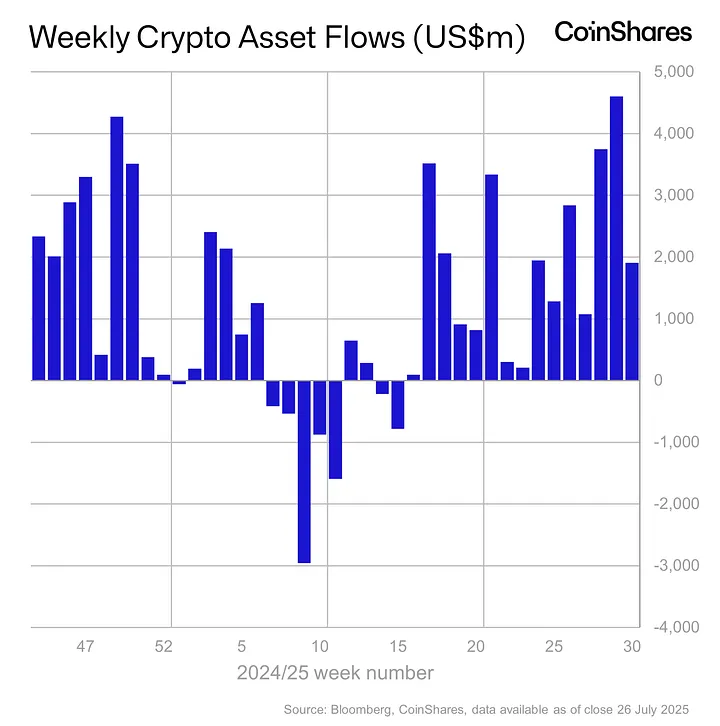

Overall, the digital assets investment products market saw $1.9 billion in inflows last week, the fifteenth week in a row of positive flows.

“This pushed month-to-date inflows to a record US$11.2bn, significantly surpassing the US$7.6bn seen in December 2024 following the US election.”

Regionally, the US led with $2 billion in inflows, followed by Germany at $70 million. These inflows were offset by outflows from Hong Kong, Canada and Brazil to the tune of $160 million, $84 million and $23 million, respectively.

Unusually, leading smart contract platform Ethereum ( ETH ) led all inflows last week with $1.59 billion.

“Year-to-date inflows into Ethereum have now reached US$7.79bn, surpassing the total for all of last year.”

Generated Image: Midjourney

Featured Image: Shutterstock/monkographic

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.